Venture Capital in the USA: Capital Access

Learn about the Venture Capital in the USA: Capital Access.

I cut my teeth with Boulder, CO startup with a little startup called Biox Technology BTI. The Founder, CEO, and Chairman of the Board of Directors of Biox Technology, Inc. and friends Michel Hicky and Billy Moe.

Biox Technology was founded in 1979 by Michael Hickey, Scott Wilber, and Bill Moe. With Hickey as CEO, Wilber as the company’s Chief Engineer and Scientist, and Moe serving as the Executive Vice President, Enervest, a Denver venture fund, funded the company–and thus began the company’s ground-breaking achievements.

Wilber’s invention of the company’s technology and his development of the first oximeter patent proved significant, long-lasting innovations in pulse oximetry.

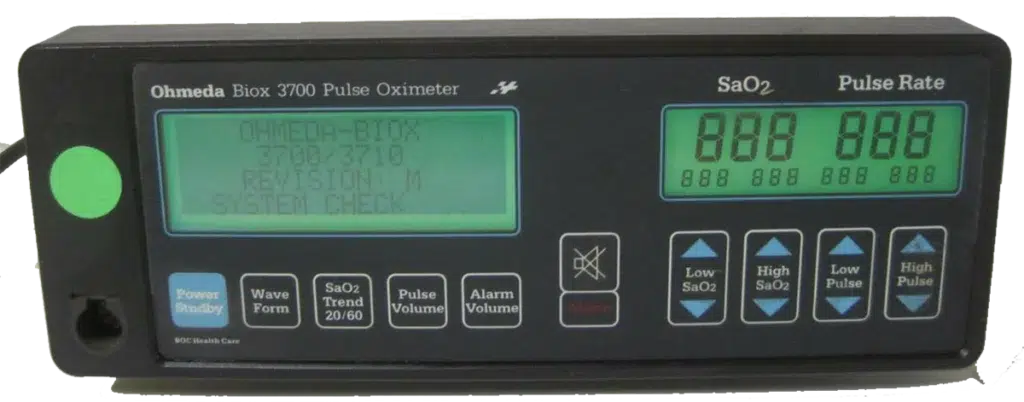

Wilber continued spearheading the company’s product development, masterminding pulse oximeter engineers to create the Biox II, Biox IIa, and Biox III product lines. His leadership led to the development of the widely-used Ohmeda Biox 3700 in the anesthesia market in the mid-1980s.

While Hewlett-Packard produced the first commercially available oximeters, their devices were large, cumbersome, and expensive–and of limited value, mainly geared for research in the respiratory care field.

Biox changed the game, introducing the first pulse oximeter to commercial distribution in 1980, and its marketing focused on the respiratory care market. Eventually, the company established a national, independent distribution network for respiratory care physicians.

Now you know the backstory of Biox Technology (sold to Ohmeda)–a team of visionaries that revolutionized the pulse oximetry industry and forever changed the medical field.

I have worked for and helped access funding for series A, B, C, and exits (rounds of funding) of small starters, M&A, to technology transfers. Sometimes seed funding works to keep the lights on equity financing and will take you to write a term sheet.

Are you looking for pre-money valuation or a post-money valuation through a due diligence process?

And most know the story in Boulder, CO, with TechStar and Foundry Group with Brad. But, enough.

Let’s get into this subject.

What Is The Definition Of Venture Capital

Venture capital is a form of private equity financing provided by specialized investment firms or individuals to early-stage, high-potential, growth-oriented startups and emerging companies.

The primary goal of venture wealth is to generate high returns for investors by funding businesses with the potential to grow rapidly and disrupt established markets.

In exchange for their investment, venture capitalists typically receive an equity stake in the company, allowing them to share in future profits and value appreciation.

Venture funds investments are considered high-risk due to the uncertain nature of the businesses they support. Still, successful investments can yield significant financial rewards for investors and the companies involved.

Brief History of Venture Capital in the USA

The history of venture capital (VC) in the USA can be traced back to the mid-20th century, with its origins rooted in the post-World War II era. Here’s a brief overview of the development of the VC industry in the United States:

- Early Beginnings (1940s-1950s): The first VC firms emerged in the late 1940s, with the establishment of American Research and Development Corporation (ARDC) by Georges Doriot in 1946 and J.H. Whitney & Company by John Hay Whitney in 1946. These firms funded innovative companies, laying the groundwork for the modern VC industry.

- Birth of Silicon Valley (1950s-1960s): The VC industry gained momentum in the 1950s and 1960s, particularly in the technology sector. In 1957, Arthur Rock and Tom Davis helped finance the formation of Fairchild Semiconductor, a pioneering technology company that played a crucial role in developing Silicon Valley. Other VC firms like Draper, Gaither & Anderson, and Venrock Associates were founded during this period, contributing to the industry’s growth.

- Expansion and Institutionalization (1970s-1980s): The 1970s witnessed an expansion in the VC industry, marked by the founding of prominent firms like Kleiner Perkins and Sequoia Capital. The industry started to mature with the National Venture Capital Association (NVCA) formation in 1973. In the 1980s, VC firms played a significant role in financing and fostering the growth of technology companies like Apple, Microsoft, and Cisco.

- Dot-com Boom and Bust (1990s-2000): The 1990s were characterized by the dot-com boom, as internet-related startups attracted significant VC investments. The industry experienced rapid growth, peaking in 2000 with over $100 billion in VC investments. However, the dot-com bubble burst in 2001, leading to a significant downturn in the VC industry. Oh, I remember it well…Sun Microsystem…ouch…

- Recovery and Growth (2000s-2010s): The VC industry gradually recovered from the dot-com bust and regained momentum in the mid-2000s, with a renewed focus on emerging technologies, including social media, mobile, and software as a Service (SaaS). The industry witnessed the rise of prominent companies like Facebook, Twitter, and Uber, which were backed by lender investments.

- Present-day (2010s-2021): In recent years, the VC industry has continued to evolve and expand, focusing on new sectors like artificial intelligence, biotechnology, and clean energy. VC has played a crucial role in financing and nurturing innovation in these industries, fostering economic growth and job creation in the USA.

Throughout its history, the venture capital industry in the USA has been instrumental in supporting and shaping the growth of innovative companies and technologies, making it a vital component of the American economy.

Importance of Venture Capital in the American Economy

Venture capital plays a significant role in the American economy by fostering innovation, promoting economic growth, and creating jobs.

Here are some key ways lenders contributes to the U.S. economy:

- Financing Innovation: Venture capital provides crucial funding to early-stage, high-potential startups that might not have access to traditional sources of capital, such as bank loans. This financial support enables these companies to develop innovative products and services, which can disrupt existing markets and create new ones.

- Encouraging Entrepreneurship: By providing financing and strategic support to entrepreneurs, venture capital helps create a favorable environment for business creation and innovation. This encourages more individuals to pursue entrepreneurial ventures, leading to the development of new technologies, business models, and industries.

- Job Creation: Startups and emerging companies funded by seed funding often experience rapid growth, creating new jobs in various sectors of the economy. Successful VC-backed companies, such as Apple, Google, and Amazon, have generated millions of jobs over the years, contributing to the overall employment growth in the U.S.

- Economic Growth: The growth of VC-backed companies contributes to the country’s overall economic growth. As these companies grow in size and value, they generate increased economic activity, which leads to higher GDP and increased tax revenues for the government.

- Strengthening Competitiveness: Investments in technology and innovation help the U.S. maintain its competitive edge in the global marketplace. By backing companies that develop cutting-edge technologies, venture team helps the country stay at the forefront of industries such as information technology, biotechnology, and renewable energy.

- Facilitating Mergers and Acquisitions: Startups often become attractive targets for acquisitions by larger companies. These acquisitions can create value for the acquiring company, the startup, and the overall economy by spurring growth, consolidation, and increased efficiency in various industries.

- Fostering Research and Development: Investments support research and development activities in various sectors, driving advancements in technology and knowledge. This, in turn, contributes to the overall growth and development of industries that depend on technological innovations.

Working capital is vital to the American economy by promoting innovation, entrepreneurship, and economic growth. The VC industry’s ability to identify, fund, and support high-potential startups has been instrumental in shaping the U.S. economy and maintaining its global competitiveness.

The insights into the trends and industries gaining traction in capital investments up to 2022. These trends are likely to continue into 2022 and beyond.

Up to 2023, venture capital investments were focused on industries like:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML have driven innovation across various sectors, including healthcare, finance, and transportation.

- Fintech: The financial technology sector has attracted significant investments, particularly in digital payments, alternative lending, and blockchain technologies.

- Healthtech: Digital health, telemedicine, and personalized medicine are transforming healthcare, making this sector a popular investment choice.

- Biotechnology and Life Sciences: Advances in genomics, gene editing, and drug discovery have drawn significant attention and investments in biotechnology and life sciences startups.

- Edtech: The education technology sector has been experiencing rapid growth, particularly due to the shift toward online learning and remote work during the COVID-19 pandemic.

- Cleantech and Sustainability: Cleantech and sustainable technology solutions have become a priority for VC investments with growing concerns about climate change and environmental issues.

- E-commerce and D2C: E-commerce platforms and direct-to-consumer (D2C) brands have gained traction as more people embrace online shopping.

- Cybersecurity: As cyber threats and data breaches become more common, the demand for innovative cybersecurity solutions has increased, attracting venture capital investments.

- Enterprise Software and SaaS: Software-as-a-Service (SaaS) and cloud-based enterprise software solutions are popular investment areas due to their scalability and recurring revenue models.

- Mobility and Transportation: The future of transportation, including electric vehicles (EVs), autonomous vehicles, and urban mobility solutions, has been a focus for venture capital investments.

NOTE: You should consult recent reports and data sources for the most up-to-date information.

Structure of the Venture Capital Ecosystem

The venture capital ecosystem consists of several interconnected components, each playing a crucial role in the financing, growth, and success of startups and emerging companies.

The primary elements of the venture capital ecosystem include venture capital firms, entrepreneurs and startups, limited partners and other investors, and advisors and service providers.

Venture Capital Firms:

- Types of Venture Capital Firms:

- Seed-stage investors: Focus on investing in startups during their earliest stages, providing initial capital for product development and market research.

- Early-stage investors: Invest in companies that have developed a product or service but require funding for scaling, marketing, and business development.

- Growth-stage investors: Provide capital to more mature startups that have demonstrated market traction and require funding to expand their businesses further.

- Major Venture Capital Firms in the USA: Some prominent VC firms in the United States include Sequoia Capital, Andreessen Horowitz, Kleiner Perkins, Accel Partners, and Benchmark Capital.

Entrepreneurs and Startups:

- Startup Life Cycle Stages: The stages in a startup’s life cycle include idea generation, development, market entry, growth, and maturity or exit.

- Selection Criteria for Venture Capital Funding: Venture capitalists look for startups with a strong management team, a scalable business model, a large addressable market, a competitive advantage, and a clear path to profitability.

Limited Partners and Other Investors:

- Roles of Limited Partners: Limited partners (LPs) are the primary source of capital for venture capital firms. They include pension funds, endowments, insurance companies, family offices, and high-net-worth individuals. LPs invest in VC funds expecting to receive a return on their investment.

- Types of Limited Partners: LPs include institutional investors (pension funds, endowments, insurance companies), family offices, government-backed entities, and high-net-worth individuals.

Advisors and Service Providers:

- Legal and Financial Advisors: These professionals provide startups and venture capital firms with legal, financial, and strategic advice, helping them navigate complex regulations, negotiate contracts, and manage financial matters.

- Incubators and Accelerators: These organizations support startups by providing mentorship, resources, office space, and sometimes funding in exchange for equity or other forms of compensation. They play a vital role in nurturing and developing startups, increasing their chances of success.

The venture capital ecosystem is a complex and dynamic network of entities that work together to identify, fund, and support promising startups and emerging companies. Each component is vital in fostering innovation, economic growth, and job creation in the United States and beyond.

Venture Capital Investment Process

The venture capital investment process consists of several stages, from identifying potential investment opportunities to exiting the investment once the startup has reached maturity or has been acquired. Here is an overview of the key stages of the venture capital investment process:

Deal Sourcing and Screening:

- Venture capitalists identify potential investment opportunities through various channels, such as referrals from other entrepreneurs, industry events, and networking.

- They screen these opportunities based on predefined investment criteria, which may include factors like the startup’s industry, stage of development, growth potential, and management team.

Due Diligence:

- Once a startup has been identified as a potential investment opportunity, the venture capital firm conducts a thorough due diligence process to assess the startup’s viability and risks.

- This process typically involves evaluating the startup’s management team, business model, market size, competitive landscape, intellectual property, and financial projections.

Investment Decision and Deal Structuring:

- If the due diligence process yields positive results, the venture capital firm decides whether to proceed with the investment.

- The deal is structured through negotiations between the venture capital firm and the startup. This may involve determining the investment amount, valuation, equity stake, and other terms and conditions, such as board representation and anti-dilution provisions.

Post-investment Monitoring and Support:

- After the investment, the venture capital firm closely monitors the startup’s progress and provides ongoing support.

- This support may include strategic guidance, financial planning, introductions to potential customers or partners, and recruiting key personnel.

Exit Strategies:

Venture capitalists ultimately aim to exit their investments and realize a return on their capital.

Several exit strategies can be employed, including:

- Initial Public Offering (IPO): The startup publishes its shares on a stock exchange.

- Merger or Acquisition (M&A): The startup is acquired by another company for cash or stock.

- Secondary Sale: The venture capital firm sells its stake in the startup to another investor or group of investors.

- Buyout: The startup’s management or another investor buys out the venture capital firm’s stake.

Each stage of the venture capital investment process involves careful evaluation, negotiation, and ongoing support to ensure the success of the startup and the venture capital firm’s investment. The end goal is to generate significant returns on investment while contributing to the growth and development of innovative companies.

Legal and Regulatory Framework

The legal and regulatory framework surrounding venture capital investments in the United States involves a combination of federal and state laws, regulations, and industry best practices that govern various aspects of the industry.

Key components of this framework include securities laws and regulations, tax implications for venture capital investments, and intellectual property protection.

Securities Laws and Regulations:

- The Securities Act of 1933 and the Securities Exchange Act of 1934 are the primary federal laws governing the issuance and trading of securities in the United States. They provide disclosure requirements, registration requirements, and antifraud provisions that apply to venture capital investments.

- The Investment Company Act of 1940 and the Investment Advisers Act of 1940 regulate the activities of investment companies and investment advisers, including venture capital firms.

- Venture capital firms may be exempt from certain registration requirements under the 2012 Jumpstart Our Business Startups (JOBS) Act, which introduced the concept of “venture capital funds” as a distinct category of investment funds.

- State-level “blue sky” laws also regulate the offering and sale of securities within their respective jurisdictions, adding another layer of regulation that venture capital firms must navigate.

Tax Implications for Venture Capital Investments:

- The Internal Revenue Code (IRC) provides various tax rules and incentives for venture capital investments, such as treating capital gains, losses, and pass-through taxation for certain investment structures.

- State-level tax laws and regulations may also influence the taxation of venture capital investments.

- Venture capital firms, limited partners, and startups need to consider the tax implications of their investments and structure their transactions accordingly to optimize tax efficiency.

Intellectual Property Protection:

- Intellectual property (IP) protection is crucial for many startups, as it secures their competitive advantage and enhances their value to investors.

- The U.S. legal and regulatory framework provides several avenues for IP protection, including patents, trademarks, copyrights, and trade secrets.

- Venture capital firms often require startups to have a robust IP strategy before committing to an investment. The value of a company’s IP assets can significantly impact its potential for success and growth.

The legal and regulatory framework for venture capital investments in the United States is a complex interplay of federal and state laws and regulations governing various industry aspects.

Both venture capital firms and startups must navigate this framework to ensure compliance, optimize tax efficiency, and protect their intellectual property assets.

Trends and Challenges in the Venture Capital Industry

The venture capital industry is constantly evolving, and as a result, it faces various trends and challenges that impact investors and startups.

Some key trends and challenges in the venture capital industry include

Increasing Competition:

- The venture capital industry has experienced significant growth over the past decades, leading to increased competition among VC firms to find and invest in promising startups.

- As a result, startups may face higher valuations and more investor interest, while venture capital firms need to work harder to identify and secure deals.

Globalization:

- Venture capital investments are becoming increasingly global, with VC firms seeking investment opportunities in emerging markets and technology hubs outside the United States.

- This trend presents opportunities and challenges as venture capitalists must navigate different legal, regulatory, and cultural landscapes while identifying and supporting startups in these new markets.

Focus on Diversity and Inclusion:

- The venture capital industry has historically been criticized for lack of diversity among its investors and the startups it supports.

- In response, there has been a growing emphasis on promoting diversity and inclusion within the industry by supporting underrepresented founders and increasing the diversity of VC firms’ investment teams.

Technological Disruptions:

- Rapid technological advancements, such as artificial intelligence, machine learning, blockchain, and biotechnology, are creating new investment opportunities and reshaping traditional industries.

- Venture capital firms must stay informed about these emerging technologies and be prepared to adapt their investment strategies accordingly.

Evolving Exit Strategies:

- The landscape of exit strategies for venture capital investments has changed over time, with a shift towards mergers and acquisitions (M&A) and a decrease in initial public offerings (IPOs).

- This trend requires venture capital firms to adapt their exit strategies and expectations, focusing on finding strategic acquirers or exploring alternative exit options, such as secondary sales or buyouts.

Regulatory Challenges:

- The regulatory environment for venture capital investments is complex and constantly evolving, with new rules and regulations introduced at both federal and state levels.

- Venture capital firms and startups must stay informed about these changes and ensure compliance to avoid potential legal and financial risks.

Impact Investing and ESG Considerations:

- There is a growing emphasis on environmental, social, and governance (ESG) factors (be careful here) and impact investing in the venture capital industry. Investors increasingly seek to support startups that align with these values.

- This trend presents opportunities and challenges as venture capital firms must balance their focus on financial returns with their commitment to social and environmental impact.

The venture capital industry faces various trends and challenges impacting how investors identify, support, and exit their investments.

By staying informed about these trends and adapting their strategies accordingly, venture capital firms can successfully navigate the evolving landscape and continue to support innovative startups.

Future Outlook and Opportunities for Venture Capital in the USA

The future of venture capital in the USA looks promising, as innovation drives economic growth and creates new investment opportunities.

Some key trends and areas of opportunity for venture capital in the United States include

Deep Tech and Emerging Technologies:

- The rapid advancements in deep tech sectors, such as artificial intelligence, machine learning, quantum computing, and biotechnology, present significant opportunities for venture capital investments.

- By investing in startups focused on these technologies, venture capital firms can support the development of transformative solutions that have the potential to disrupt traditional industries and create new markets.

Sustainability and Clean Technologies:

As concerns about climate change and resource scarcity grow, there is increasing demand for innovative solutions that address these challenges.

Startups focused on renewable energy, energy efficiency, waste reduction, and other clean technologies present attractive investment opportunities for venture capital firms looking to support sustainable growth and development.

Healthcare and Life Sciences:

- The healthcare and life sciences sectors continue to be a significant area of focus for venture capital investments, driven by the need for better diagnostics, treatments, and preventive measures.

- Opportunities like telemedicine, personalized medicine, genomics, and digital health offer promising growth potential for venture capital-backed startups.

Fintech and Digital Finance:

- The financial services industry is undergoing a digital transformation driven by technological advancements and changing consumer preferences.

- Fintech startups focused on blockchain, cryptocurrencies, digital payments, and alternative lending platforms present compelling investment opportunities for VC firms.

Edtech and the Future of Work:

- The education sector is experiencing significant disruption due to adopting new technologies and the changing nature of work.

- VC firms can invest in edtech startups focused on online learning, workforce development, and skill-building platforms to support the future of education and work.

Diversifying Investment Portfolios:

- As the VC industry focuses more on diversity and inclusion, there is a growing opportunity to invest in startups led by underrepresented founders, addressing untapped markets and customer segments.

- By diversifying their investment portfolios, VC firms can access broader innovation and growth potential.

Corporate Venture Capital (CVC):

- Corporate VC, where established companies invest in startups and emerging technologies, is becoming more prevalent as a way to access innovation and growth opportunities.

- This trend presents opportunities for collaboration between traditional VC firms and corporate investors, driving synergies and leveraging resources to support startups more effectively.

The future outlook for VCin the USA is optimistic, with numerous opportunities for investment in emerging technologies, sustainable solutions, and innovative sectors.

By staying informed about these trends and adapting their strategies accordingly, VC firms can continue to drive growth, innovation, and value creation in the United States and beyond.

How Is Matrix Marketing Group Help Venture Capital Firm Portfolio Launch And Drive Predictable Revenue Growth

Matrix Marketing Group is a digital marketing and sales enablement agency that helps businesses, including angel firms and their portfolio companies, drive predictable revenue growth by implementing effective marketing and sales strategies.

Here’s how Matrix Marketing Group can support VC firms and their portfolio startups:

Marketing Strategy Development:

- Matrix Marketing Group can work with VC firms and their portfolio companies to develop customized marketing strategies that align with their unique growth objectives and target markets.

- The agency helps identify the most effective marketing channels, tactics, and messaging to reach and engage the target audience, ensuring a higher return on marketing investments.

Digital Marketing and Lead Generation:

- Matrix Marketing Group can help implement various digital marketing tactics, including search engine optimization (SEO), pay-per-click (PPC) advertising, content marketing, email marketing, and social media marketing.

- These tactics aim to generate high-quality leads for the startup’s sales team, driving predictable revenue growth.

Sales Enablement and Support:

- The agency can support startups in enhancing their sales processes and infrastructure to improve efficiency and close deals more effectively.

- This includes implementing sales enablement tools, providing sales training and coaching, and optimizing sales workflows and pipelines.

Marketing Automation and CRM Integration:

- Matrix Marketing Group can help startups implement marketing automation platforms and customer relationship management (CRM) systems to streamline their marketing and sales efforts.

- By automating repetitive tasks and integrating marketing and sales data, startups can better understand their target audience, personalize communication, and make data-driven decisions.

Analytics and Performance Measurement:

- The agency provides ongoing monitoring, analysis, and reporting of marketing and sales performance, helping startups make informed decisions and optimize their strategies for continuous improvement.

- By tracking key performance indicators (KPIs) and setting benchmarks, Matrix Marketing Group ensures that the VC firms and portfolio companies achieve their desired growth targets.

Branding and Positioning:

- Matrix Marketing Group can work with startups to develop a strong brand identity, positioning, and messaging that differentiates them from competitors and resonates with their target audience.

- A strong brand helps build trust and credibility, essential for attracting and retaining customers, investors, and partners.

Matrix Marketing Group can help VC firms and their portfolio companies launch and drive predictable revenue growth by developing and implementing effective marketing and sales strategies. By leveraging the agency’s expertise in digital marketing, sales enablement, and analytics, startups can maximize their potential for success and growth.

List The Top 10 VC Firms In The USA For A.I. Startups

The top VC firms in the USA for AI startups might have changed. However, here is a list of well-known venture capital firms with a strong track record of investing in AI-focused startups:

- Sequoia Capital: With a long history of successful investments in technology companies, Sequoia Capital has backed several AI startups, including UiPath, Zoom, and Aurora.

- Accel: Accel has invested in various AI-driven companies, such as UiPath, Suki.AI, and H2O.ai, emphasizing their commitment to innovative technology.

- Andreessen Horowitz: This leading VC firm has a strong interest in AI and has invested in startups like OpenAI, Freenome, and Sift.

- NEA (New Enterprise Associates): NEA has a diverse portfolio, including investments in AI companies like Tamr, Datavisor, and Cognitiv.

- GV (formerly Google Ventures): GV has backed many AI-focused startups, including companies like DeepMind (acquired by Google), Cognitivescale, and Zymergen.

- Data Collective (DCVC): Data Collective is a VC firm specializing in deep tech and AI investments. Their portfolio includes companies like Vicarious, Sift, and Zymergen.

- Bessemer Venture Partners: With investments in several AI-driven companies, including Zapier, BigID, and Suki.AI, Bessemer actively supports the AI startup ecosystem.

- Khosla Ventures: Khosla Ventures is known for investing in groundbreaking technologies, including AI startups like Ayasdi, Sift, and Vicarious.

- Insight Partners: This global VC firm has invested in AI startups such as Qualtrics, Armis Security, and Darktrace.

- Battery Ventures: With a focus on technology-driven businesses, Battery Ventures has backed AI companies like Sisense, InfluxData, and Nutonomy.

It is essential to note that the VC landscape is constantly evolving, and the rankings and preferences of these firms may change over time. It is always a good idea to research the latest investments and focus areas of venture capital firms before approaching them for funding.

General FAQs

How does Matrix Marketing Group help venture capital firms and their portfolio companies with digital marketing strategies?

Matrix Marketing Group collaborates with venture capital firms and their portfolio companies to develop customized digital marketing strategies that align with their growth objectives and target markets. The agency helps identify the most effective marketing channels, tactics, and messaging to reach and engage the target audience, ensuring a higher return on marketing investments.

What specific digital marketing services does Matrix Marketing Group provide to venture capital clients and their portfolio companies?

Matrix Marketing Group offers a wide range of digital marketing services tailored to the needs of venture capital firms and their portfolio companies. These services include search engine optimization (SEO), pay-per-click (PPC) advertising, content marketing, email marketing, and social media marketing. By implementing these tactics, the agency aims to generate high-quality leads and drive predictable revenue growth for their clients.

How does Matrix Marketing Group support sales enablement and CRM integration for venture capital clients and their portfolio companies?

Matrix Marketing Group supports startups in enhancing their sales processes and infrastructure to improve efficiency and close deals more effectively. This includes implementing sales enablement tools, providing sales training and coaching, and optimizing sales workflows and pipelines. The agency also helps startups implement marketing automation platforms and customer relationship management (CRM) systems to streamline their marketing and sales efforts, enabling better understanding of the target audience, personalized communication, and data-driven decision-making.

How does Matrix Marketing Group measure the success of their digital marketing efforts for venture capital clients and their portfolio companies?

Matrix Marketing Group provides ongoing monitoring, analysis, and reporting of marketing and sales performance, helping startups make informed decisions and optimize their strategies for continuous improvement. By tracking key performance indicators (KPIs) and setting benchmarks, the agency ensures that the venture capital firms and their portfolio companies achieve their desired growth targets. This data-driven approach allows clients to measure the success of their digital marketing efforts and adjust strategies as needed.