Exploring the Untapped Potential and Future Opportunities in Vermont’s Emerging AI Sector

Venturing into the Green Mountain State. Vermont, known for its picturesque landscapes, charming small towns, and vibrant culture, has long been a haven for those seeking an escape from the hustle and bustle of urban life. However, beneath the surface of this idyllic setting lies a troubling reality: Vermont’s industry is stagnant.

While other states have experienced growth and diversification in their industrial sectors, Vermont has struggled to keep pace. This blog explores the factors contributing to Vermont’s industry stagnation and the state’s challenges in revitalizing its economic engine.

It might surprise many Venture Capital Investors, but the state of Vermont is shaping up as a burgeoning hotbed for Artificial Intelligence investments.

Renowned for its pristine nature – the winding ski trails, sugar maple trees, and picturesque autumn landscapes, this quaint New England state is now emerging as a promising destination of a different kind. Keep your gaze fixed on this hidden gem for those linked with VC investment, particularly in the AI sector.

A Flourishing Tech Ecosystem

Vermont is not traditionally viewed as a technological powerhouse.

The Silicon Valley giants and Boston’s innovation corridor often steal the limelight regarding AI development and breakthroughs. However, this Green Mountain State is not a novice in the tech game.

The state has a well-established tech ecosystem that’s been gradually growing for years. With a rich and diverse pool of tech companies and startups, Vermont provides an inspiring and nurturing environment for emerging AI endeavors.

MatrixLabX Products Intro.

Three groundbreaking AI agents from MatrixLabX are shaking up the marketing industry: AI ProdPad, AI BrandPad, and AI ContentPad.

These innovative platforms are transforming the way businesses approach marketing. AI ProdPad streamlines product strategy with data-driven precision, AI BrandPad elevates brand identity with cutting-edge AI-driven insights, and AI ContentPad revolutionizes content creation, delivering tailored advertising solutions faster than ever.

Together, these AI agents are redefining the future of marketing, making MatrixLabX a name to watch in this rapidly evolving landscape.

Academic Excellence Fuels Growth

The University of Vermont has been a cornerstone in transforming the state into a potential AI hub. Its Complex Systems Center is producing valuable research on AI, machine learning, and data science, bringing together teams of interdisciplinary researchers and building partnerships with tech businesses.

The institution’s commitment to these areas of study and research fuels growth, providing an impressive talent pool passionate about AI innovations.

Academic Excellence Fuels the Growth: A Reporter’s Perspective

As a reporter, I’ve witnessed the transformative power of academic excellence in driving individual and societal growth. It’s not just about acquiring knowledge or achieving top grades; it’s about cultivating a mindset of critical thinking, innovation, and resilience. It’s about empowering individuals to contribute to their communities and the world.

The Foundation for Success

A strong academic foundation gives individuals the tools to navigate an increasingly complex and competitive world. It equips them with the ability to analyze information, solve problems creatively, and communicate effectively. These skills are valuable in the workforce and essential for making informed decisions about personal and civic life.

Driving Innovation

Academic excellence fosters a culture of curiosity and exploration, nurturing the next generation of innovators and problem solvers. When individuals are encouraged to question, challenge assumptions, and seek out new knowledge, they lay the groundwork for breakthroughs in science, technology, and other fields that drive societal progress.

Economic Prosperity

A well-educated workforce is a key driver of economic growth. Academic excellence attracts and retains talent, leading to a more productive and innovative workforce. This, in turn, fuels economic development, creating new opportunities for individuals and businesses alike.

Social Mobility

Education is a powerful tool for social mobility, providing individuals with the skills and knowledge to break the cycle of poverty and improve their quality of life. Academic excellence ensures that access to opportunities is not limited by socioeconomic background, promoting a more just and equitable society.

Global Competitiveness

In today’s interconnected world, academic excellence is not just a personal advantage; it’s a national imperative. Nations with a strong education system are better equipped to compete in the global economy and contribute to advancing knowledge and innovation.

Investing in the Future

Investing in academic excellence is an investment in the future. It’s an investment in the potential of individuals, societies’ prosperity, and human civilization’s advancement. It’s a commitment to building a brighter future for all.

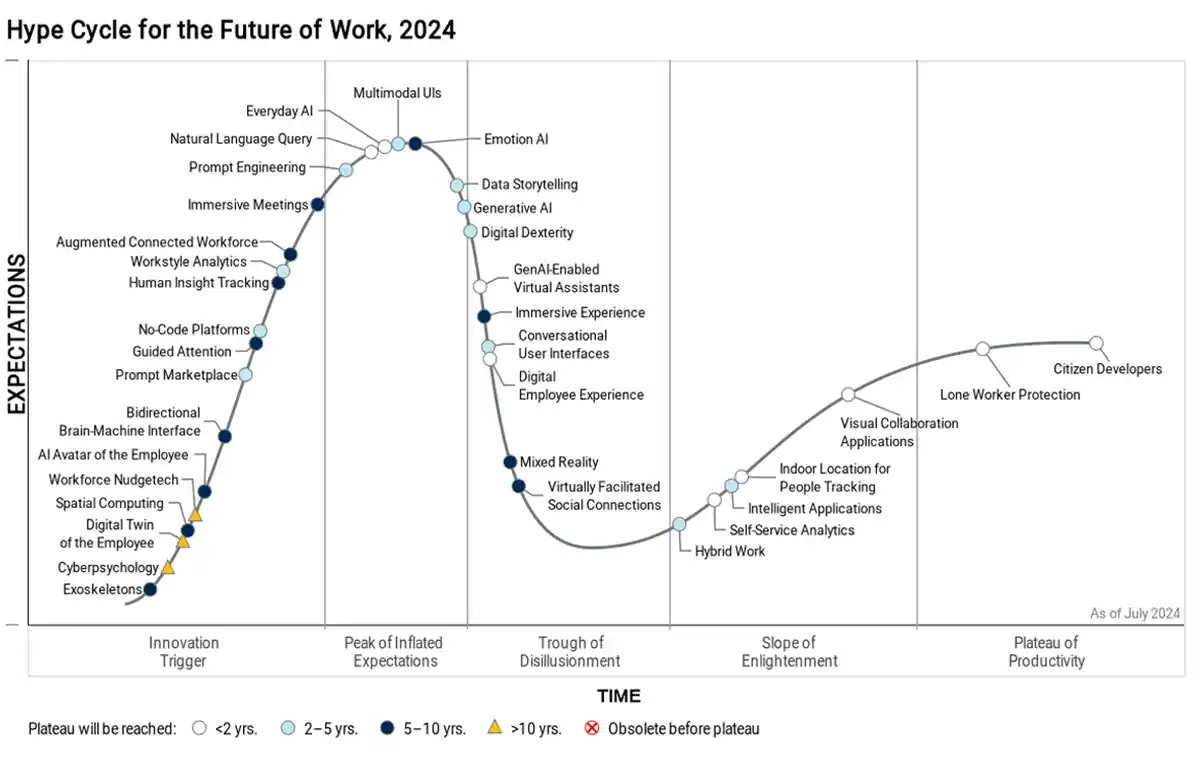

As a reporter, I’m committed to highlighting the stories of individuals and communities transforming their lives and world through academic excellence. Education is the most powerful force for positive change, and I’m proud to participate in the movement to make academic excellence accessible to all. Below is the future of work.

Financial Incentives and Government Support

The state government and local organizations offer many benefits and incentives to attract innovation in AI. These range from the Vermont Employment Growth Incentive (VEGI) to subsidizing workforce training programs, which offer capital investment to qualifying projects.

Programs like the Vermont Seed Capital Fund provide critical financing to local early-stage companies. This strong commitment has set a solid foundation for AI businesses to flourish.

Livability Quotient

Vermont is renowned for its high livability quotient. Apart from the idyllic surroundings, it offers an exceptional quality of life with its potentially lower cost of living, reduced commute times, impressive health services, and excellent education system.

This lifestyle attracts skilled professionals, creators, and innovators, providing businesses with a steady flow of competent talent.

Early Success Stories

Several tech first-movers in Vermont have tasted success, further strengthening the state’s appeal to investors. Companies like MatrixLabX, which specializes in AI automation platforms, and Faraday, an AI-driven consumer predictions platform, have put Vermont on the global tech map.

Success stories like these cement investor confidence and portray Vermont as a promising ground for AI investments.

Champlain: The Vermont Valley

Dubbed ‘Vermont’s Silicon Valley’ (okay, that’s silly–Utah’s got it), the area surrounding Lake Champlain is home to numerous thriving tech companies and startups. This region has become a promising tech hub, driving the state’s innovation engine.

With high-growth startups, supportive incubators, and an active VC ecosystem, Champlain is poised for significant tech and AI advancements.

In conclusion, while Vermont may not have the vast scale of Silicon Valley or the traditional clout of Boston, it has all the ingredients necessary to foster a compelling and vibrant AI sector.

The state creates a harmonious blend of academic excellence, governmental support, and a high livability quotient – a recipe for AI success. For venture capital investors in AI, it’s time to consider Vermont a viable investment destination. It might be a hidden gem, but with its undeniable potential, it won’t remain hidden for long.

Vermont Funding Resources

Investment Capital

Investments are needed at many stages of a business’s growth. These investments can take different forms, starting with “friends and family” and moving to more institutional investors. The following are links to some of the many resources available in Vermont. Capital sources from outside Vermont and foreign sources are also active in Vermont.

Vermont Employee Ownership Center (VEOC) The VEOC supports business owners considering an exit to broad-based employee ownership via an Employee Stock Ownership Plan (ESOP), worker co-op, or similar model. The non-profit offers free pre-feasibility consulting, presents seminars, organizes an annual conference, and maintains a revolving loan fund to support the financing of such deals.

“Angel” Investors Angel investments are generally made for funding requirements between $100,000 to $1 million, with individual investors contributing between $10,000 and $100,000 each. These amounts are too small for venture capital firms. Angel investors usually focus on companies that have already developed a basic concept and business strategy and are in the seed stage of investment.

An emphasis is placed on business enterprises with the potential for rapid growth. In addition to offering significant capital to launch business entities, many “angels” also offer their business expertise and actively participate in the business’s management, operation, and marketing.

North Country Angels (NCA) brings together over 40 successful and experienced entrepreneurs who are active in making early-stage and seed investments in companies located in the northeastern United States. Every month, they gather information to review business plans from prospective companies. Members of the NCA make individual decisions about investments. Many are interested in actively developing a venture, from management and board activities to helping structure financially sound investment placements. For more information, contact North Country Angels.

Venture Capital firms are generally privately owned. In most cases, these firms seek to generate a high rate of return by investing in rapidly growing businesses in all stages of development. Most venture capital firms will prioritize investments where a high rate of return – often 10:1 or higher – may occur to maintain an annual portfolio return rate of at least 30%. Since most new ventures fail, these high rates of return are required to offset the risk the venture capitalist assumes.

Fresh Tracks Capital L.P. combines $25 million in venture capital with the strategic resources entrepreneurs need to build thriving businesses throughout Vermont. Vermont’s intellectual capital and Fresh Tracks’ investment experience are winningly combined.

Fresh Tracks makes equity investments in companies demonstrating a compelling and defensible competitive advantage. Linked to the national Village Ventures network of professional and financial resources, Fresh Tracks’ local roots and network support the growth of innovative businesses through multiple financing rounds.

For more information, contact:

Fresh Tracks Capital, L.P.,

29 Harbor Road, Suite 200, Shelburne, VT 05482

802-923-1500; FAX: 802-923-1506

info1@freshtrackscap.com

http://www.freshtrackscap.com/

Worth Mountain Capital Partners is a Vermont-based corporate finance firm that advises and invests in established companies in northern New England. Grounded in values that speak to a sense of place and of a time when transactions were crafted on the strength of enduring relationships, their work is based on bedrock principles that fueled the industriousness of New England’s heritage. Worth Mountain’s approach recalls an era when the Yankee spirit of ingenuity and frugality made it possible to be both conservative and forward-thinking at once.

For more information, contact:

Worth Mountain Capital Partners,

68 Court Street, Middlebury, VT 05753

802-398-8111

info@worthmountainconsulting.com

http://www.worthmountainconsulting.com

The Vermont Seed Capital Fund, LP is looking for select investment opportunities in early-stage, high-opportunity, technology-based companies in Vermont. The objectives are to impact next-generation jobs and wealth creation in Vermont by providing companies and entrepreneurs access to early-stage risk capital. The fund is a revolving, “evergreen” equity fund with $5 million of initial capitalization from the State of Vermont and U.S. Senator Patrick J. Leahy. The Vermont Economic Development Authority (VEDA) is a strategic partner for this fund.

This professionally managed venture capital fund invests exclusively in Vermont start-ups. Growing firms are determined to offer high growth potential, financial return commensurate with risk, and public benefit for Vermonters. Portfolio firms also have access to substantive programs, facilities, partners, and value-adding services offered via a strategic relationship with the non-profit VCET incubator.

Investment transactions range from $50,000 to $250,000. The fund can act as a lead investor or as part of an investment syndicate.

For more information, contact:

Vermont Center for Emerging Technologies

210 Colchester Avenue

Burlington VT 05401

http://vermonttechnologies.com

Borealis Ventures partners with exceptional entrepreneurs to build great companies from the earliest stages. We’re based in New Hampshire, but our portfolio companies have a global impact as they redefine application software, deliver new Internet and mobile services, and commercialize life-changing technologies.

For more information, contact:

10 Allen St., Upper Level

Hanover, NH 03755

phone: 603.643.1500

http://www.borealisventures.com

Vermont EPSCoR (Experimental Program to Stimulate Competitive Research) has supported research in Vermont’s colleges and universities with funds from the National Science Foundation and local sources since 1986. The impact of the EPSCoR program includes the private sector — particularly small, technology-based businesses. Vermont EPSCoR allows Vermont small businesses to compete for grants to foster research and development projects, which will lead to application to the federal Small Business Innovation Research (SBIR) programs.

For more information, contact:

Vermont EPSCoR

Cook Physical Science Bldg.

82 University Place

University of Vermont

Burlington, VT 05405

Phone: (802) 656-7931

Fax: (802) 656-2950

Email: epscor@uvm.edu

Are Your Marketing Efforts a Shot in the Dark? Let’s Turn on the Spotlight!

Imagine having the clarity of seeing your marketing strategy from a bird’ s-eye view and understanding every nuance of your campaigns. Our comprehensive audit delves into the core of your marketing DNA, dissecting each campaign with surgical precision to identify the powerhouse strategies and weed out the underperformers.