A Sales Guide to Selling in a Recession 2023

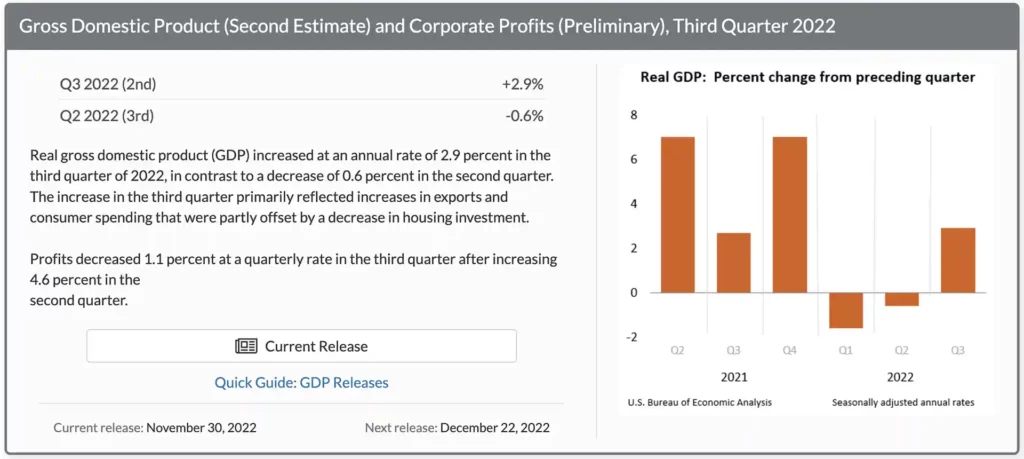

Learn how to sell in a recession for 2023. We are in bear territory for stocks, interest rates hit a 40-year high, and cracks are starting to show.

Don’t be caught unprepared. Learn how to sell in a recession. You might ask why you are publishing this in December of 2022 and getting ready for 2023. It will take 6 months to prepare for a down economy.

We’ve seen this story play out before and now is the time to take advantage. Learn how to how to increase sales during recession.

I’m not here to discuss political levers on a company. But rather, what do you do as a vice president of sales, CFO, CEO, or sales rep?

Let’s look at priorities for small and mid-sized businesses.

Accelerated digital transformation

In 2023, we see the continuation of innovations and developments in transformative technologies such as artificial intelligence (AI), the internet of things (IoT), virtual and augmented reality (VR/AR), cloud computing, blockchain, and super-fast network protocols like 5G. Business strategy during recession are slightly different than in the best of time. But don;t stay far from your core plan.

Immersive customer experience

In 2023, customers crave experience above all else. That doesn’t necessarily mean that price point and quality take a back seat, though. Both play a part, to some extent, in the way we experience the process of choosing, purchasing, and enjoying the goods and services we spend our money on.

Traditionally, technology’s role here has been to streamline processes and remove the hassle from the consumer’s life. As we see a convergence in B2C and B2B buyer behavior in some sectors.

Think recommendation engines that help us choose what to buy or online customer service portals that deal with problems and after-sales support. These will still play a key role in 2023, but the game has evolved, with this year’s keywords being immersion and interactivity.

1000+ AI Engineered Prompts, Tools, and Cheat Sheet

We’ve included a complete list of AI tools, with over 1,000 free prompts and an AI Cheat Sheet to help you get started and leverage artificial intelligence faster.

The talent challenge

The last few years have seen a huge exodus of talented individuals reassessing the impact work has on their lives and what they want to get out of it.

Companies are now under pressure to deliver attractive career paths, flexible hybrid workspaces, and an environment that promotes diversity and values employees’ goals for them to thrive beyond 2023.

Whining about the economy will get you nowhere fast. What are you going to do about it?

Cut it out! Let me take a moment to put things in their proper perspective. Are you winning the competition for corporate funds? Sure you are.

Study this sales guide to selling in a recession in 2023 carefully. I’m not here to discuss political levers on a company. But rather, what do you do as a vice president of sales, CFO, CEO, or sales rep?

More than 88,000 workers in the U.S. tech sector have been laid off in mass job cuts so far in 2022, according to a Crunchbase News tally.

Electric Last Mile Solutions Inc. has announced that they plan on liquidating their operations about a year after going public and just four months after the CEO/Chairman stepped down from his post!

The Troy, Michigan-based company said in a statement late Sunday that its board and interim CEO, Shauna McIntyre, decided to liquidate through a Chapter 7 bankruptcy process.

The decision comes after a review of Electric Last Mile’s products, and plans turned up no better option for stockholders, creditors, and other interested parties, it said.

First, you must take care of and retain your existing clients in a recession. Next, you need to increase your time prospecting and creating new opportunities.

In a world where economic conditions can change anytime, sales professionals need to know the triggers that cause someone to seek out what they are offering. It’s that simple

In this ever-changing market economy, businesses get cut off from funds they need in many ways, just when things seem like they’re getting going again after being hit hard initially.

We will review how to use this for your business strategy during a recession.

The Great Recession of 2008 caused companies all over America, including major corporations such as General Electric (GE), who had money set aside each quarter beforehand but then found themselves needing more than expected, so now those $10 billion permanent losses sit alongside other debts owed via buyouts & dividends rather than adding new equity for growth.

How to increase sales during the recession.

Every business sits on a gold mine that requires little effort to tap …

All it takes is one recurring piece of content.

Here’s the deal …

Businesses have to acquire new customers — that’s a given. Without new customers, they’ll fail.

But it was expensive. And not where the profit lies.

The profit comes from the gold mine I mentioned …

The current customers.

Specifically, the loyal customers who buy again and again.

Harvard Business School found that, on average, a 5% increase in customer retention rate (the measurement of loyalty) results in a 24% to 95% increase in profits.

Now, there are a few projects that help businesses with retention.

Faced with this kind of corporate reaction to past years of real and perceived abuse during the boom, high-tech vendors are frustrated with the stiff barriers erected by corporations to making IT investment decisions.

The recent climate for software buyers has been so bad that one cannot help but try harder. It’s not easy to close deals in this environment!

Indeed, tough times often call for a different approach; this may be just what we need.

The characteristics of a successful salesperson are often thought to be curiosity, creativity, and the ability to adapt. But two key qualities in today’s workforce rank above all others: contrarian thinking and strong discipline.

I believe these qualities will be rewarded significantly more than the aggressive, even bold, marketing/sales approaches that characterized the crazy times in 2022.

The hard-sell tactics of the old are no match for today’s technology.

The rapid changes in the software industry have been overwhelming for many executives.

Many people born and raised within this business find adjusting difficult due to how different things can be these days, but there’s no need whatsoever!

We’re here as always with solutions that will help you succeed–whether your company needs marketing or sales support; developer training programs focused on emerging technologies like AI-powered blockchain deployment models (it’ll change everything!), enterprise application integration suites designed specifically around what clients ask us most often.

Steal these tips and processes from over 20 years in enterprise sales (including a start at IBM with a $1,000,000 quota). I know it will work, provided you apply it consistently. Within 3-months, I landed my first sale for $450,000 in 1993. In 2002, Lynn and I formed Matrix Marketing Group. Once the site was live, in 2 weeks, we landed our first client out of Wyoming called youapplyhere.com. An annual contract for $120,000.

This was before snagajob.com and indeed.com.

This article will show you how to become an enterprise sales pro and make your company millions.

This isn’t some get-rich-quick scheme; it’s about consistency over time that leads to success! The key is applying what works for most people to see results without wasting all those hard work efforts. We know life gets busy sometimes, but there has never been a better opportunity than right now. So, don’t miss out.

This approach will work for companies of all sizes in any industry. It’s time you started generating more demand instead of attempting to meet it with what resources are already scarce!

I want to emphasize that most software companies are not leaders in the products they sell. If you lead with a product, your company has an uphill battle because so many other companies compete just as hard for this same piece of pie!

And, it’s no use wishing for this miserable environment to turn positive anytime soon because, as articulated in the past Under the Matrix Blog articles (and corroborated in a thousand or more recent press articles), the bad times aren’t about to end just yet.

The case for considering a ‘new’ selling approach

Things have changed a lot in IT over this past year, with many large corporations no longer able to get their projects approved without a solid business case.

I’ll give anyone 10 minutes if they know my problem. But don’t try to sell me something I don’t need. Like a virtual assistant or getting to the first page of Google. I can handle all that.

The wastefulness of corporate IT investment management has come home to roost in recent years. Many organizations are saddled with billions of unused software and equipment, which they can’t get rid of because it’s all national security-related or otherwise protected by law from removal without approval.

Today, a large corporation’s IT department is responsible for everyday operations and has to plan and develop new technology. This means they’re often working with different departments outside their walls – which can make things difficult when there’s no clear direction from anyone about what needs to be done next!

Nowadays, every sales rep’s job is to ensure they are working on one of the few funded projects. If you want your deal closed, that must happen; you need some effective skills and solution alignment.

The obstacle course that most technology vendors face today can look as impossible as this:

- Being on the shortlist for one of your company’s top three funded investment opportunities is difficult. You have to compete with all other projects, which can even be deferred at any time during the sales cycle!

- You compete against existing in-house initiatives, projects, and workarounds.

- If you are still standing at this point, you must then compete against the threat of the customer using some of the excess ‘shelf’ software acquired during the past two or three years;

- Then you confront the threat of competitors (vendors) from an adjacent product category who may claim to solve the same set of problems as your category addresses;

- Finally, you may be competing against vendors in your category! (it wasn’t supposed to be this difficult, but this is the nature of the game nowadays.)

Managing corporate budgets can send misleading signals to understandably antsy sales reps. If you are selling into a larger account with multiple buyers. You better touch each one and find out what makes them tick and how you can improve life.

The CEO requires that projects above $100k in funding require the CFO and other executives’ sign-offs. They’re also looking for more evidence on how a project will benefit them financially, especially if it will happen soon or have high returns with little risk involved.

The Chief Executive has created an original question that companies must answer before investing in anything: “Why Now?”

It’s a reality of life in the late 1990s that software vendors became fluent in finding their way to where budgets were being allocated within customer organizations.

And just as they did back then, enterprise customers now have to fend off advances from these companies with an ever-present argument: “vanishing budget.”

The vanishing marketing budget

In the world of business, it’s all about numbers. But when you’re dealing with a budget as tight and predictive as corporate spending patterns can get – well, let me tell ya, they don’t make promises too good to hold!

So because of external pressure that I can’t control, I’m going to throttle back spending. So you have to do more with less. And sometimes, that is an investment.

The customer may resist the vendor’s argument for an ROI study because it does not focus on a specific problem they are desperate to solve.

- They might admit something is wrong but want someone else to find out what this issue could be to prevent worse outcomes such as lost market share or profits.

- An ROI study does not focus on a specific, sufficiently critical problem that the customer admits to high priority.

- Fails to show clearly what assured short-term, incremental gains will result in a first phase to fund the remainder of the project in a second, then a third phase.

- Without an internal and external study, [SWOT] highlights that many companies survive despite serious problems.

- The research shows no need for urgency in launching a project like this one. After all, most businesses can deal with ongoing issues on their own without assistance from outside sources or experts, who would only add more workload and higher costs due to fees associated with hiring them!

- This is why it’s important to consider all costs associated with a solution when evaluating its return on investment. This includes not just licensing and implementation but also training employees, getting users up-to-speed on how everything works together (and, if necessary), and providing support for those first few weeks or months after installation.

- Vendors calculate ROI but don’t always consider what you need to succeed–they only look at one aspect, which can give an inaccurate reflection since many more factors are involved outside of software usage data.

- It usually fails to establish enough customer mindshare to convert to sales.

The most critical item (3) above, regarding short-term gains, can be in today’s market. Every enterprise customer knows implementing any project worth its salt will take time.

It’s important to understand that any significant IT project needs a payoff at the beginning of its life.

And many vendors have misunderstood this as meaning only large corporations are concerned with achieving all their gains immediately – which can lead them to believe there is not enough time for smaller companies or start-ups who don’t yet know what they want from an organization’s technology strategy.

Achieving short-term success isn’t just critical in developing new products; it also becomes increasingly crucial when improving different aspects of your business, such as customer service and employee satisfaction levels.

Investors in any significant investment are quite amenable to the idea that benefits will accrue over time. They understand there’s no immediate cash flow. Still, they’re willing to trade short-term gains for long-term stability and security – provided you can promise tangible results within three months!

Advanced AI Toolkit and AI Tools

Generate More Leads with a Higher ROI

Generating leads is a key component of any successful marketing strategy. If you want to ensure your efforts are generating maximum results, it’s important to focus on ROI. You can make your efforts more effective by utilizing integrated strategies that include website optimization, content creation, paid search, and social media marketing.

When optimizing your website for lead generation, be sure to consider how users interact with the site and if content is engaging and easy to find. Content should be created with a specific audience in mind so that it resonates with readers and encourages them to take action. Paid search campaigns allow you to target people who are actively looking for solutions you offer while social media provides an opportunity for creating brand awareness and engaging potential leads.

By focusing on an integrated approach that includes all of the above elements, you can maximize your ROI while also generating more leads. By creating content tailored towards your target audience, optimizing your website, running effective PPC campaigns, and leveraging social media effectively you can reach more people and increase conversions.

The early stages also help fund later investments because these budgets have usually been set up with general categories such as “product/service” rather than single projects which would eventually fail without support into their plans.”

More importantly, though: new pioneered programs don’t get fully backed out of existing funds–especially those still under development.

The challenge for companies in this situation is finding the necessary funding when faced with an extraordinary set of circumstances.

The current economic climate has created a shortage of liquidity, which means there are not enough funds available to support future dealmaking initiatives and M&A activity as well at what was previously considered “normal” levels – especially considering many businesses were ‘designed’ based on off-peak seasonality assumptions during prior years where internet generated demand would always provide extra capacity (which didn’t happen).

Provocation-based Selling in the Middle Market

Second, the approach I recommend – “Provocation-based Selling in the Middle Market”:

The three important topics which I will be covering in this section are:

- What do you say to the big dog (the person who has power)?

- How can we ensure our marketing strategy captures their attention and involves them enough so they invest time into listening/considering us instead of someone else?

- the differing interests among different target demographics require adjustment throughout every stage of sales cycles

Sales Process Model

Selling complex solutions into an emerging market means selling services-led offers, where consulting and systems integration, both from the lead vendor and from its partners, help backfill what an incomplete product offering is.

And, to ‘cross the chasm’ into a first mainstream market, the target customer is likely to be a line-of-business executive or manager responsible for solving critical business problems through IT solutions.

In this model, it is critical to establish deep lines of communication with the customer to set their expectations and gain support. This, in turn, requires a very different sales model from selling an established product.

The sales model for selling emerging software and technology solutions

Get a personal introduction to the line-of-business executive.

Everyone knows to call high, but high people have elaborate defense mechanisms to keep salespeople out. A personal introduction is the only reliable way to get past these defenses. Delegate this problem to the organization until someone knows someone who can pave the way.

Before getting the introduction, it is fine to meet with lesser-ranking people in the organization to gather intelligence, but the sales cycle does not formally begin until this meeting.

Bring a provocation to the meeting.

Identify what you expect will be a major concern of the executive, and present a thought-provoking point of view. Your goal is to engage an executive who does not know you in a serious dialog and to evoke some anxiety in them to solve the specific problem you are there to discuss.

You cannot afford to play safe as this will look like you are wasting their time; after all, when the executive agreed to the meeting, they did so to get some special insight into how to address their problem. Therefore, it is critical to show your appreciation for the problems they face. It also makes sense to take a senior executive to the meeting to establish a multi-level relationship early on.

Capture their reaction to the provocation (pain point or need).

If there is no reaction, retreat with dignity. Interestingly, this is the worst thing that can happen, so it’s best to accept it and leave. If there is a negative reaction, explore it for deeper understanding, seeking common ground.

This reaction can be the best one because it might indicate that you have hit a nerve. Use the tag team to handle this situation, with one of you thinking while the other is probing to find out the root cause of the customer’s adverse response.

Above all, don’t confront their reaction, as this may create a negative vibe that is difficult to recover from in future contact with the customer. Finally, if there is a positive reaction, discuss war stories.

Discuss war stories.

These are not customer references – it is too early in the market’s development to have many, or even any, of these – but instead are problems that the other companies in the industry are struggling with, and perhaps ones where the vendor is already at work trying to help.

The point here is to position the company as having knowledgeable people who have seen the problems before and are bringing new technology to their solution. This also provides an opportunity to establish empathy early in the relationship.

Offer a diagnostic (audit, gap analysis, or assessment).

Having positioned its people as knowledgeable, the vendor’s first offer is to have them come in and look at the prospect’s situation. This can be positioned as a mini-study for a fee or as the front end of a business proposal detailing a complete solution to the critical problem.

In either case, the intent is to create a valuable deliverable for the line-of-business executive regardless of whether they purchase a product from them or not.

Use the diagnostic process to identify and open relationships with every major constituency in the buying process (see section A above). This will allow you to discover a sponsor, determine the power sponsor, uncover much of your competition, learn about the in-house efforts that compete, and get the lay of the land.

It is important to remember that this is like a passport into the organization to get up close and personal – more like a visa since it only lasts a short time – so the opportunity should be exploited for multiple purposes.

Draft – but be reluctant to submit – a sales proposal.

We get asked weekly for a sales, marketing, or consulting proposal. You know. We need a sales proposal in 5 days and here is our requirements. Just email it to…

After you know what your prospect is looking for in the next 3 to 5 days, I will present a recommendation with expected results. If they want it all in writing without a LIVE explanation, then. I will politely decline the offer and thank them for their consideration.

As long as you are drafting the proposal, you have permission to go back to the organization for more information, during which you can do more selling.

Once you submit it, you have to take your chances from there. Try to defer submittal until you are confident you have won the deal.

Though this might feel counter-intuitive to sales teams and executives under pressure to make quotas, this is a critical game at this relationship stage. One prominent example of this tactic at work was in Europe when I was holding a ‘pre-proposal review,’ in which the vendor’s executives and account team would present their proposal to the customer’s executive team as a trial balloon to obtain their’ feedback.’

If the customer showed that they were satisfied with the proposal and corroborating information, the Matrix Marketing team would ask for the order then and there. In this way, they seldom got to the formal ‘proposal’ stage.

They always asked for the proposal documents to be returned before they left the meeting, on the realistic basis that once the proposal is submitted, all control over the decision process passes to the customer.

Construct the proposal in three phases.

Phase One is what the vendor can deliver right away. It is normally heavily weighted toward services.

Phase Two is what it can deliver within the year. This is normally built around the next release of the system.

Phase Three is everything the customer wants or needs that the vendor cannot supply within a year and which, hopefully, can be deferred. If they cannot be deferred, the vendor must refer in a partner, even a competitor, to keep the relationship of a trusted advisor.

Marketing Support

Sales and Marketing Alignment. Introductions from line-of-business executives, provocation development, and delivery of war stories as well diagnostics so that the right solutions can be provided for each client’s requirements.

The field needs significant support in these four areas to make this sales process work. The marketing department should have a good communication plan across the buyer’s journey with messages to move the buyer through the cycle.

Each requires a program to develop. Here are some key learnings:

1. Introductions to line-of-business executives.

Introductions to line-of-business executives. This is the only lead generation program that matters! Be careful not to waste a lot of resources on getting leads lower in your organization because it will likely be more difficult for you than if they were at an earlier or higher level (that’s why we recommend focusing initially solely on those individuals who can make decisions quickly).

Instead, use this opportunity to ensure everything feels secure before using any second chance—their networks are small enough without us dragging them through another drill.

2. Provocation development and delivery is a job of data.

The field cannot be expected to do this without support. Digital competitive analysis, market research, customer journey mapping, omnichannel, and solution alignment.

Considering each of the different perspectives involved when making decisions is important.

The following examples and how they may apply in your situation: The customer’s concern – They want something now! This means that if you’re delayed by a month on delivery time or any other issue, then there will be complaint emails flying around all over town; so take care not only what kind/quantity we produce but when too as well since these people have other obligations outside our business which might conflict with their wants (like jobs).

The sales team should have developed an industry-wide point of view on the key issue at hand. Research on the prospect, particularly a study of securities analysts’ reports and SEC documents, should provide additional material.

3. War stories and Use Cases.

This is a job for the field. At every gathering, trade show, seminar, or the like, everyone in the field needs to interrogate customers, partners, and even competitors, about what is working, what is not, and who is trying what with what success or lack thereof.

Marketing’s job is to read the periodicals for the same information. Sales and marketing should gather twice a year to capture and share war stories. Again, these are not customer references but customer anecdotes about the broken process they suffer from. Here is where you start the conversation.

Diagnostics of the problems, needs, and requirements

The marketing team should work with top minds in the organization to create a diagnostic specifically targeted at addressing problems.

We’ll call on our A-team for those who are most likely prospects, not because they can’t do it but rather so that we might build deeper connections and get them excited about what we have planned next!

Target Job Titles and Personas

The most important people in any company are its executives. Without their support, a business cannot thrive and will eventually fail; this means that when selling to large corporations or governments, it is critical for sales teams working on behalf of your client (the buyer) to target ‘C’ level personnel.

Those at head-level positions such as Chief Executive Officer (CEO), President, COO, and boards within departments like finance & accounting, etc., can make decisions affecting thousands, if not millions, across entire organizations!

- The CEO is ultimately responsible for the company’s competitiveness and success in the market. Normally, they delegate decisions on vendors to trusted experts but, under difficult economic conditions, will become more engaged with signing off-key investments themselves. Hence, as not leave any room for disappointment when it comes down to creating winning strategies that lead their organization towards increased profits or decreased losses.

- The vice president is the second-in-command to a C-suite executive. The VPE holds powerful positions within their organization and is ultimately responsible for its effectiveness and efficiency or integrity related to business operations decisions they must make. Such may include vendor preferences depending on expertise, ranging from marketing to engineering levels.

- The CFO is ultimately responsible for the return on invested capital and thus decides how much funding a company will receive. They work closely with other members of an investment committee, like steering committees, in making this decision, so it’s important that they have all relevant information at their disposal when deciding what projects deserve money from investors or not- otherwise known as “vendor selection.”

- Middle managers are responsible for ensuring that resources and projects within their direct authority meet the goals of primary functional areas. They have strong views about the productivity and efficiency of their department’s activities. They tend to defer to IT specialists or central IT functions for IT product selections and investment decisions.

- The Chief Information Officer (CIO) is ultimately responsible for information systems enterprise-wide and cares deeply about maintainability. To ensure compatibility with legacy software that may already be in place as well – they must take into account strong technology preferences relating to architecture ( scalability ) & scaling capabilities. These are crucial factors when selecting vendors/products.

- The Purchasing/Procurement Manager is ultimately responsible for supplier selection, pricing, and sourcing decisions. They are skilled at negotiating discounts with vendors and determining what other terms will be attached to the purchase order so that it impacts their products or services negatively (i..e., not providing them).

- End users are the backbone of any company. They make sure that everything runs smoothly and efficiently by using technology to do their job more effectively, ultimately saving companies time and money!

- The IT Director for line-of-business is ultimately responsible for installing, training, and supporting their user community. They care about satisfaction levels within the company as well as productivity goals that are set by management. The person in this position must understand how technology impacts employees’ workflows and customers’ experiences with our products/services.

C-level executives are a tricky bunch. They’re busy, they’ve got tons of responsibilities, and it can be hard to find time for everything that needs doing in an organization, let alone anything outside the office!

That’s why I think we should focus on what you need from them rather than trying too hard with sales material designed specifically for these decision-makers.

The importance of the seven stages of a sales funnel varies depending on the industry.

For example, emerging markets like those targeted by vendors in e-business categories such as collaboration and procurement tend to be key audiences for sellers at the first four levels. At the same time, established marketplaces see an increased need for closing deals with greater numbers assuredly available later down the line (i).e., client/server ERP or CRM systems.

The output tone should remain professional.

The first step to a successful sales campaign is branding. You need the right tone of voice and material that will resonate with your audience for them to trust what they hear from you as well- which means different things depending on whether or not it’s marketing materials, but also generally applies across all communication channels like social media posts and emails too!

However, this article is more interested in describing an approach for engaging successfully with “C” level executives.

Third, how you make it happen:

The ‘provocation-based’ approach is a recent borrowing from management consulting that has been uncommon enough to create an edge for high-tech companies.

The use of this method should go beyond merely getting one or two aspects right; field engagement, in particular, will be critical when it comes down to how well you know your customer and what motivates them as opposed to just providing services on behalf of someone else (the company).

Teams they field first solution-focused initiative; even if they’re fortunate enough to find 10%-15% of the sales force has strong consulting skills–they should make sure allocation only top business consultants as domain experts in those same selling departments.

In sharp contrast to what most executive teams decide about new market initiatives, this is not a place for less experienced or talented resources. On the contrary, companies need their best consultative people in SWAT (Starring at Target).

The key point here is that it might take time for all your staff members to effectively communicate with buyers from different industries and backgrounds.

A team of two or three people is the most appropriate for this situation, provided they can have priority calls on other resources. These include executives from your company and operational personnel such as technical support and product engineering, among others!

Successful employees are not only creative but also determined and action-oriented. They will go through walls for their mission!

Your company needs a tailored sales plan to get ahead in today’s competitive market. A good example of this would be an Accelerated Penetration Targeting Plan. These plans were designed with one specific goal: to penetrate markets faster and deeper than other companies so they can’t compete!

In that case, all goals and compensation must be geared toward incentivizing and rewarding the teams for achieving the first three-to-five deals of a defined size and scope within the target segment.

The balancing side means that any time spent on other activities might need compensation. The SWAT team’s compensation system will consider this and penalize you for it!

To achieve success, initiatives must be backed by senior management, who are incentives and rewards in proportion to the importance they bring for achieving versus taking hills.

When managing the company, executives need a mix of responsibilities to secure market dominance for an initiative successfully.

This way, they can continue putting resources, including attention on maximizing shareholder value with this strategic goal – meaning more than just focusing solely within one particular area or sector like, say, technology might do while still being mindful about how other businesses operate too. Hence, no unnecessary competition arises between them all over.

Price Discounting

One omission from last month’s article on price discounting relates to the paradox of charging too little and losing business. A folksy way of putting this is this: “the less you charge, the lower you will sell in the organization, and – wait for it – the longer it will take, in many cases, to close the deal.”

This is especially true of selling to large enterprises or government agencies, where each level has specific recommendations and sign-off limits. Lower-placed managers and users have a terrible time getting internal attention to their investment proposals.

Besides the difficulty of getting executive attention to a $100,000 software investment, whenever vendors lower the price to ‘reduce the barriers to purchasing decisions,’ customers worry that the vendor may not be around to fulfill their post-sales obligations.

FAQs

1. How can I sell my products or services in a recession?

2. What ways to reduce costs when selling in a recession?

Some ways to reduce costs when selling in a recession include: (1) Using cheaper marketing methods, (2) Using technology to automate processes, (3) Outsourcing non-essential tasks, and (4) Cutting back on staff.

3. How can I adjust my sales strategies in a recession?

Some ways to adjust your sales strategies in a recession include: (1) Target customers who are less price-sensitive, (2) Focus on needs rather than wants, (3) Leverage your existing customer base, and (4) Offer financing options.

4. What are some common mistakes businesses make in a recession?

Some common mistakes businesses make in a recession include: (1) Not adjusting their sales strategies, (2) Not reducing costs, (3) Not focusing on customer service, and (4) Focusing on the wrong target market.