Compound Agent Systems for Marketing Financial Services Firms

Learn About Compound Agent Systems for Marketing Financial Services Firms.

Unleashing the Power of Compound Agent Systems in Financial Services Marketing

In today’s fast-paced financial services landscape, where customer expectations are ever-evolving, 79% of marketing executives agree that leveraging advanced technology is crucial to staying competitive.

Compound Agent Systems, a sophisticated blend of AI-driven technology and human expertise, revolutionizes how financial services firms approach marketing.

However, with innovation comes hesitation. Let’s explore how these systems can be trusted allies for Chief Marketing Officers (CMOs) looking to enhance their strategic efforts.

The Skill Gap: Why 85% of Marketers Are Not Ready

The Skill Gap: Why 85% of Marketers Are Not Ready highlights the urgent need for upskilling in a rapidly evolving digital landscape. Advanced technologies like AI, data analytics, and automation are outpacing traditional marketing expertise, leaving most professionals unprepared to adapt and compete effectively.

Addressing the Concerns: Transparency and Trust

These systems operate on transparency, offering clear insights into how data is used and ensuring compliance with stringent financial regulations. Compound Agent Systems prioritize data security by employing state-of-the-art encryption and anonymization techniques, addressing privacy concerns upfront.

Moreover, seamless integration capabilities ensure these systems work harmoniously with existing marketing technologies, minimizing disruptions and maximizing efficiency.

AI-Agentic System for Content Marketing

AI-Agentic systems like OrchestraAI for content marketing are advanced, autonomous technologies designed to execute content strategies with minimal human intervention.

Evidence-Based Recommendations for Success

Financial services firms should focus on a few key strategies to harness the full potential of Compound Agent Systems.

First, invest in training teams to work alongside these systems, ensuring AI insights amplify human creativity and strategic thinking.

Second, regularly evaluate system performance using clear metrics to ensure marketing goals are met.

Studies have shown that firms adopting these systems report a 30% increase in customer engagement and a 25% boost in lead conversion rates.

By embracing Compound Agent Systems, CMOs can confidently drive innovation and achieve measurable marketing success.

The Future of Financial Services Marketing

Integrating Compound Agent Systems for financial service companies represents a pivotal step forward as the industry evolves.

By addressing concerns head-on and providing transparent, evidence-based strategies, CMOs can build trust in these systems and unlock new levels of marketing effectiveness.

The future of financial services marketing is here, and it’s time to seize the opportunities that Compound Agent Systems offer.

Compound Agent Systems in Financial Services Marketing

Unlocking Complex Interactions for Strategic Growth

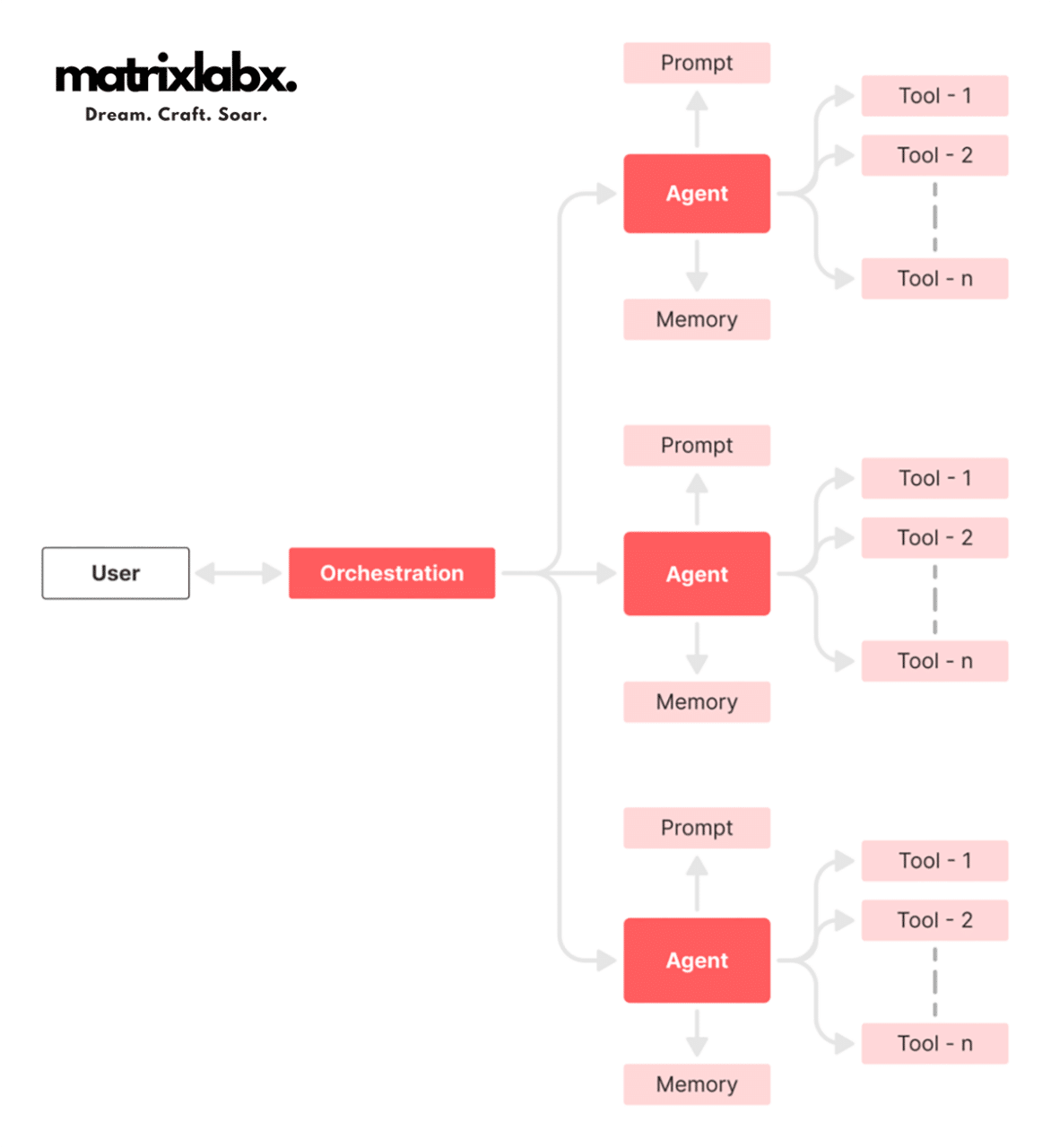

Compound Agent Systems represent a fusion of multi-agent systems and advanced algorithms tailored to revolutionize marketing strategies for financial services firms.

These systems utilize autonomous software agents collaborating, competing, and communicating efficiently to analyze large data sets, predict market trends, and personalize customer experiences.

These agents perform complex tasks through machine learning and artificial intelligence integration, making marketing campaigns adaptable and highly responsive.

Why Compound Agent Systems?

Staying ahead in the fast-paced financial sector depends on swiftly adapting to consumer behavior and market shifts.

Compound Agent Systems empower Chief Marketing Officers (CMOs) to achieve these objectives. By deploying intelligent agents that operate semi-independently, CMOs can gain deeper insights into customer preferences, streamline marketing efforts, and optimize resource allocation.

This technology enhances precision in targeting and substantially improves ROI by automating repetitive tasks, allowing teams to focus on strategic initiatives.

Where to Implement These Systems

Implementing Compound Agent Systems within financial services firms can significantly improve customer engagement and profitability. Ideal deployment areas include customer relationship management, personalized marketing strategies, and real-time data analytics.

These systems can be embedded into existing marketing platforms or operate as standalone solutions, providing versatility in application.

By embracing this cutting-edge technology, firms position themselves as innovators, setting new industry standards.

Adopting these systems offers CMOs a competitive edge and aligns marketing tactics with the ever-evolving digital landscape, sparking curiosity and fostering brand loyalty.

OrchestraAI Marketing Platform – WATCH

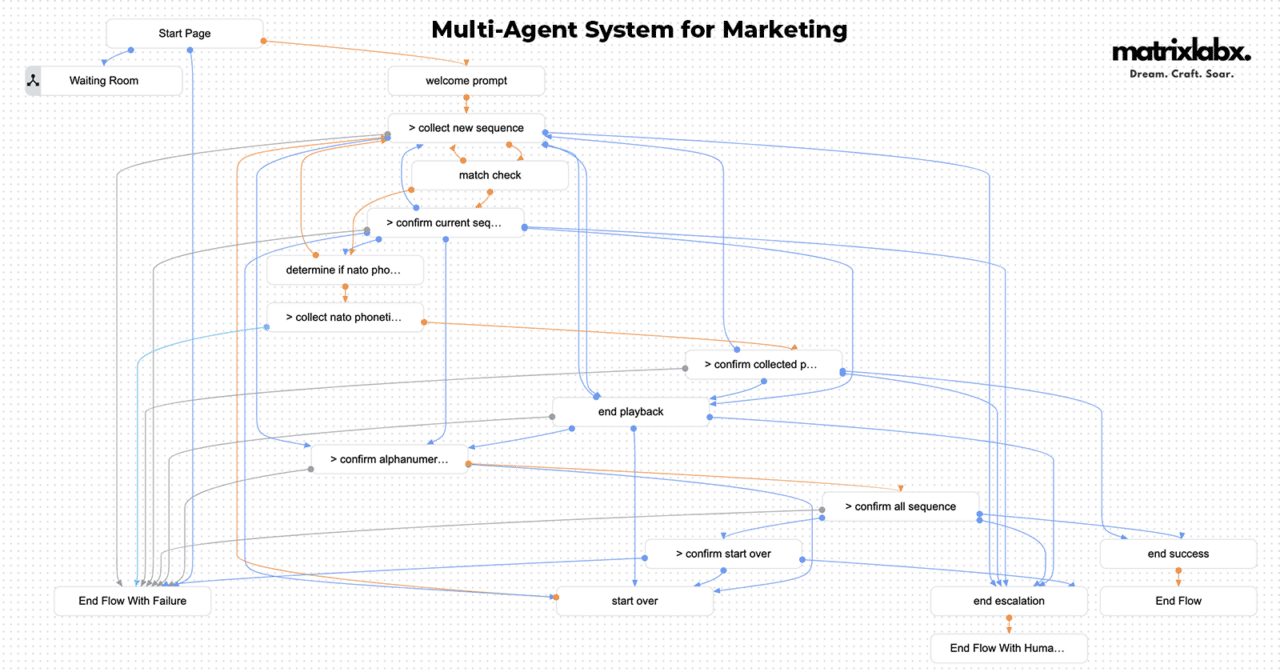

OrchestraAI utilizes a compound AI agent architecture as an AI Agentic Platform. This architecture seamlessly integrates multiple specialized AI agents into a cohesive system, enabling it to tackle complex, multifaceted marketing tasks.

The AI Experience Gap: A CMO’s Greatest Challenge

In today’s rapidly evolving digital arena, Chief Marketing Officers (CMOs) face a critical knowledge gap: a lack of hands-on AI experience.

As businesses race to harness the power of artificial intelligence, CMOs grapple with understanding and integrating these technologies efficiently. This gap impinges on their ability to make informed decisions, optimize marketing strategies, and achieve higher ROI.

The pressure to stay ahead of the tech curve is unrelenting, and the consequences of falling behind can be dire. This can lead to lost opportunities and diminishing brand relevancy.

The High Stakes of Staying Behind

The inability to fully leverage AI tools in marketing puts CMOs at a significant disadvantage.

With a deep understanding of AI, CMOs can avoid making misguided strategic decisions, relying on outdated methodologies, and failing to tap into AI’s predictive and personalized capabilities.

This disconnect hampers the marketing department’s efficiency and limits campaign effectiveness, leading to increased costs and decreased competitive edge. The fear of being outpaced by tech-savvy competitors looms, and the stakes have never been higher.

Our Solution: Master AI with Expert Guidance

Enter our cutting-edge AI marketing solutions designed specifically to bridge this critical gap. We empower CMOs by providing user-friendly tools and comprehensive training that transform AI from a daunting challenge into an accessible asset.

Our intuitive platforms enable you to harness AI for data-driven insights, predictive analytics, and personalized customer experiences. Our support allows CMOs to transform their marketing strategies, enhance customer engagement, and drive significant growth.

Get ready to be intrigued by how seamlessly AI can integrate into your existing workflows, sparking a revolution in your marketing efficiency and effectiveness.

Don’t let the AI learning curve hold you back.

Embrace our tailored solutions and watch your strategies evolve, ensuring you remain at the forefront of digital marketing innovation. Discover the full potential of AI and embark on a journey towards smarter, more impactful marketing.

2025 ALERTS: The Chatbot Era has Ended

Our recent market research shows that 85% of marketing agencies need more in-house expertise to manage and deploy multi-AI agent systems effectively.

Harnessing Innovation with Compound Agent Systems

Revolutionizing Financial Strategies

“Compound Agent Systems has been a game-changer in financial services,” says a leading fintech consultant, Mark Henderson. By leveraging these intelligent systems, financial firms can process data and make adaptive decisions that were once only possible with large teams of analysts.

Henderson emphasizes, “The agility and precision of these systems allow for rapid identification of market opportunities and risks. Imagine having a network of virtual experts working in tandem around the clock—that’s the power we’re harnessing.”

Personalization: The Key to Customer Loyalty

Jane Rogers, CMO at Global Banking Solutions, believes that Compound Agent Systems’ most intriguing aspect is its ability to provide personalized marketing strategies. “In today’s market, personalization is no longer a luxury—it’s a necessity.

Compound Agent Systems analyze customer behavior on an unparalleled scale, enabling firms to tailor communications and offers that resonate with individual needs and preferences,” Rogers points out.

“This approach not only boosts customer satisfaction but significantly enhances brand loyalty.”

Transforming Data into Insights

According to Dr. Michael Liu, a prominent data scientist, the true magic of Compound Agent Systems lies in their ability to transform raw data into actionable insights within seconds.

“These systems synthesize vast amounts of data in real-time, allowing marketing teams to identify trends that would otherwise remain hidden.

It’s like turning the chaos of big data into a symphony of insights,” Liu explains. He continues, “For CMOs, this capability is invaluable in crafting not only reactive but anticipatory strategies.”

Compound Agent Systems’ forward-thinking nature ensures financial service firms remain competitive, agile, and insightful. Thus, they represent the future of intelligent financial marketing strategies.

Unveiling Compound Agent Systems in Financial Services Marketing

In the evolving world of financial services, leveraging cutting-edge technology is imperative for staying competitive.

Compound agent systems utilize multiple interconnected artificial intelligence agents and offer a dynamic solution for optimizing marketing strategies.

These systems are adept at analyzing data, predicting consumer behavior, and customizing outreach efforts in a scalable way.

Breaking Tradition: The Power of Collaboration

The synergy achieved through compound agent systems allows for comprehensive data analysis and enhanced customer interaction.

By integrating factors such as real-time analytics, customer segmentation, and behavioral insights, financial firms can tailor their marketing strategies to meet diverse client needs.

Smaller, lesser-known brands have harnessed these advantages remarkably well.

Innovation in Action: Case Studies

NoviWave is a fintech breakout innovator that efficiently employs compound agent systems to revolutionize how they approach personalized marketing by deploying multiple AI agents to understand customer preferences.

NoviWave crafts individualized financial recommendations, ensuring heightened customer satisfaction and retention.

Another emerging brand, Quercus Capital, utilizes compound agent systems to create a dynamic customer journey.

Their system effectively identifies potential cross-selling opportunities by interpreting user interactions, resulting in increased revenue and client loyalty without overextending organizational resources.

Monarch Finance stands out by integrating these systems to improve market segmentation. They employ agents to gather granular data, enabling highly targeted campaigns that resonate deeply with distinct audience segments, thus maximizing engagement and conversion rates.

In conclusion, while bigger financial firms often dominate the headlines, innovative smaller brands provide inspirational blueprints for leveraging compound agent systems. By utilizing interconnected AI agents, companies can transform their marketing efforts and deliver personalized and effective financial solutions to their clients.

Orchestrate interactions that provide specific forms of help across the full customer journey autonomously. With three sets: New Neldentifyeds, Aid Self-Learning, and Foster Connection. Learn More.

Unleashing the Power of the OrchestraAI for Financial Marketing

In an era of paramount digital transformation, financial services firms constantly seek innovative ways to enhance their marketing strategies.

Enter OrchestraAI is a collaborative communication platform designed to revolutionize how compound agent systems operate in marketing.

This next-gen tool propels marketing strategies into new dimensions by facilitating seamless integration and real-time data exchange among diverse marketing agents, from AI-driven algorithms to human strategists.

Understanding OrchestraAI in Financial Marketing

OrchestraAI represents a turning point for financial services marketing, providing unparalleled connectivity and agility.

Imagine a real-time network where AI agents can discuss trends, analyze consumer behavior, and exchange insights with marketing professionals. This dynamic interplay between machine learning models and human creativity leads to more personalized and impactful marketing campaigns.

Financial firms can leverage OrchestraAI to enhance customer engagement by providing tailored offerings that resonate with each individual’s financial journey.

Implementing OrchestraAI: A Step-by-Step Guide

To begin using OrchestraAI, financial services firms should identify key marketing objectives and the compound agents needed to achieve them.

Next, OrchestraAI will be introduced as the central communication hub by integrating existing systems using Matrix-compatible APIs.

Conduct training sessions for staff and ensure that AI models and human agents can effectively collaborate within this environment.

The final step involves refining strategies based on the insights gathered through Matrix-facilitated interactions, ensuring the marketing approach remains agile and responsive.

OrchestraAI offers a bold new avenue for financial marketing, poised to transform how firms engage with their audience.

By embracing this approach, firms can stay ahead of the curve, offering unprecedented value and attracting the next generation of tech-savvy consumers.

Unlocking Potential with Compound Agent Systems

Innovative marketing strategies are essential in the competitive financial services arena. Compound agent systems are at the forefront, offering transformative potential.

These systems integrate advanced algorithms with artificial intelligence, enabling firms to automate and optimize their marketing strategies.

The result? Hyper-personalized customer experiences that are efficient and effective in driving conversions.

Empowering Financial Services with Automation

Compound agent systems function by simulating human decision-making processes. They analyze vast amounts of data to predict customer needs and preferences, allowing financial firms to anticipate and cater to their clients precisely.

Gone are the days of generic marketing approaches; these systems provide insights that can be translated into tailored marketing campaigns–building loyalty and trust.

Achieving Precision and Efficiency

The beauty of compound agent systems lies in their efficiency. By automating repetitive tasks and streamlining marketing workflows, financial service firms can allocate more time and resources to strategic initiatives.

This approach reduces operational costs and increases the return on investment. Moreover, these systems’ real-time adaptability means firms are always aligned with market trends, maintaining a competitive edge.

Incorporating compound agent systems is not just about staying current; it’s about leading the charge in a digital-first world.

As the financial sector evolves, those leveraging this sophisticated marketing tool will find themselves at the pinnacle of customer engagement and satisfaction.

Ultimately, the chatbot era is ending because it represents a transitional phase in the evolution of AI, one that prioritizes accessibility over capability.

The emergence of agentic AI systems signals the next stage in technological innovation, which focuses on interaction and meaningful, actionable outcomes.

As businesses and consumers demand more from their AI tools, chatbots’ static nature is being replaced by agentic systems’ fluid, intelligent adaptability.

The era of the chatbot, while instrumental in paving the way for AI adoption, is now giving way to a more transformative era of agentic intelligence.

The digital worker is here. There is no time off. 85% of agencies need help understanding AGI and compound agents. It’s a new world, and with prices dropping up to 50%, many agencies can’t sell.