Navigating the Evolving Landscape: Top 7 Challenges for Banking Services

Navigating the Evolving Landscape: Top 7 Challenges for Banking Services

The banking industry is undergoing rapid transformation, driven by technological advancements, changing customer expectations, and increased competition. This article will discuss the top 7 challenges facing banks today and offer insights on how to overcome them.

Setting the Scene: The Transformative Age of Banking

The banking industry is undergoing unprecedented transformation, driven by technological advancements, evolving customer expectations, and a complex regulatory landscape. As banks navigate this ever-changing environment, they face many challenges that demand strategic and innovative solutions.

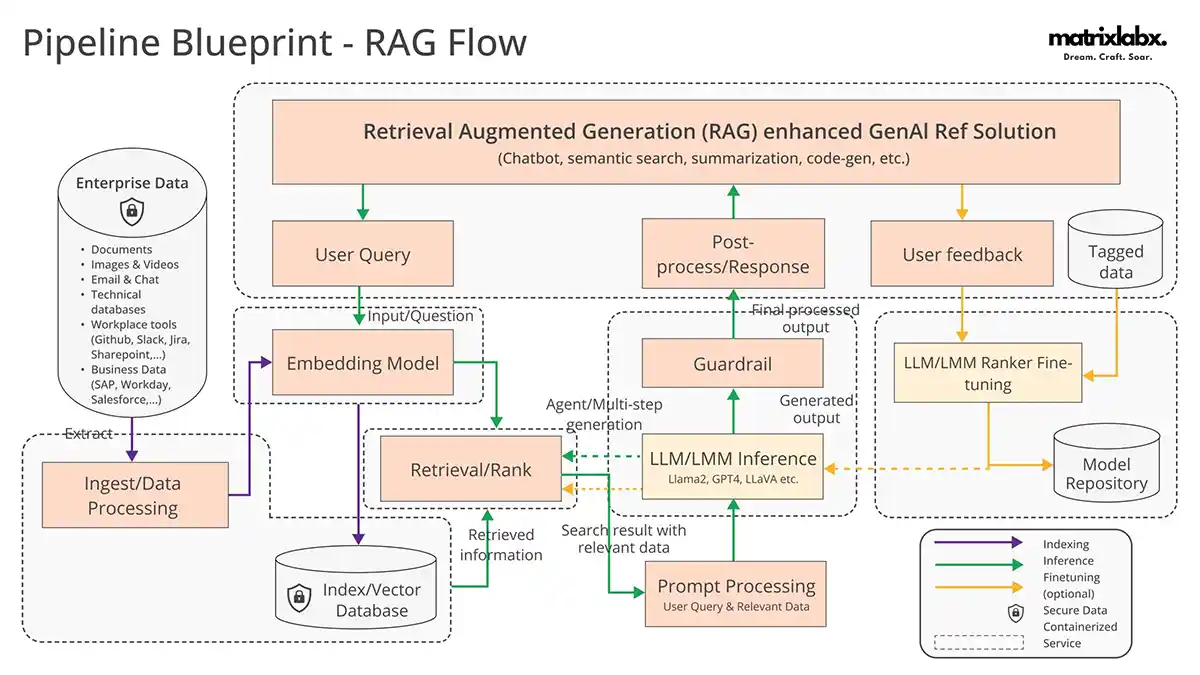

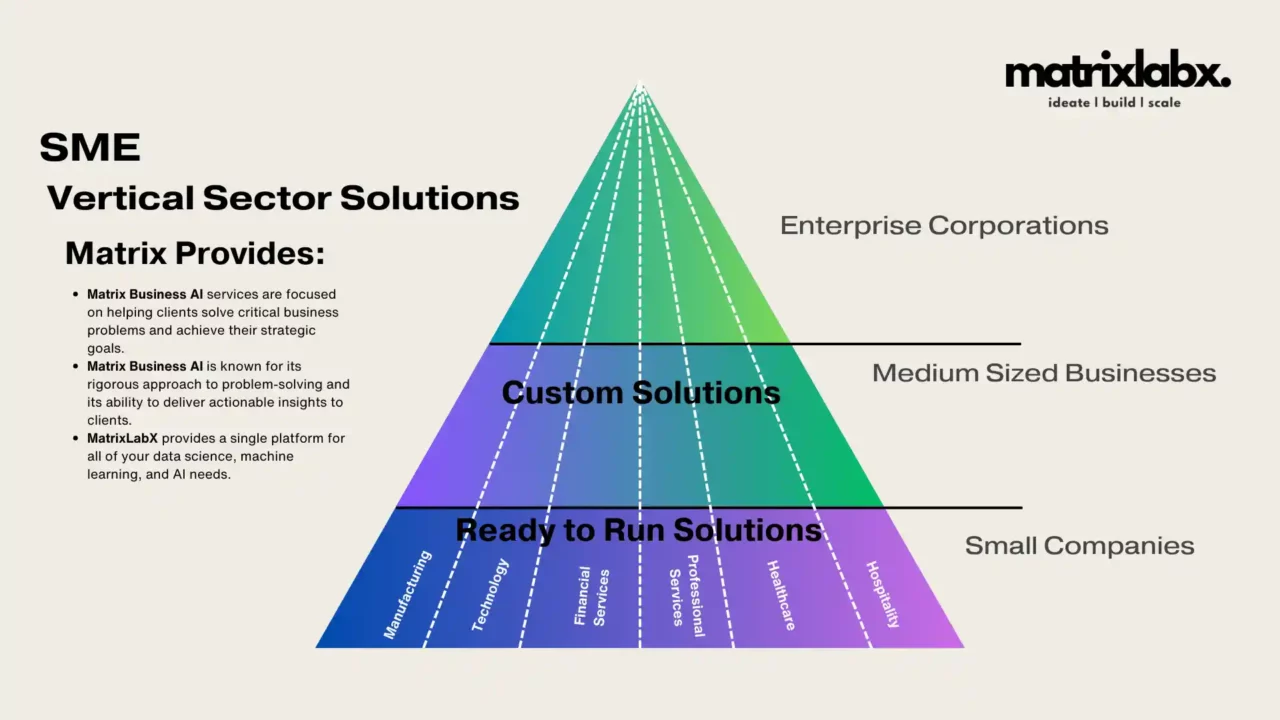

AI agentic systems, exemplified by platforms like OrchestraAI, represent a paradigm shift in financial services marketing. These systems offer a powerful solution for firms seeking to navigate a challenging landscape defined by stringent regulations, diverse customer demands, and fierce competition.

By adopting AI agentic systems, financial services firms can unlock unprecedented efficiencies, enhance personalization, and ensure compliance without compromising creativity or innovation. The journey toward AI-driven marketing excellence begins with bold leadership, strategic investment, and a commitment to redefining industry norms.

The future of financial services marketing is here, powered by AI. Firms ready to embrace this transformative technology will gain a competitive edge and set new standards for innovation and customer engagement in the industry.

For more insights and to explore the potential of OrchestraAI, visit MatrixLabX.

Overview of Current Challenges in the Banking Sector

The banking sector is grappling with several critical challenges that threaten to hinder its growth and competitiveness. These challenges stem from a confluence of factors, including:

- The rapid pace of technological innovation: The rise of digital technologies, such as artificial intelligence (AI), blockchain, and mobile banking, is redefining the customer experience and creating new opportunities for disruption. Banks must adapt to these changes to remain relevant and competitive.

- Evolving customer expectations: Today’s customers are increasingly tech-savvy and demand personalized, seamless, and convenient banking experiences. Traditional brick-and-mortar models are no longer sufficient to meet these expectations, and banks must embrace digital channels to stay ahead of the curve.

- A complex regulatory environment: The financial industry is subject to many regulations to protect consumers and ensure financial stability. While these regulations are essential, they can also create compliance burdens and stifle innovation. Banks must find ways to navigate this regulatory maze while still maintaining a focus on growth and innovation.

Challenge 1: Digital Transformation

AI-Agentic System for Content Marketing

AI-Agentic systems like OrchestraAI for content marketing are advanced, autonomous technologies designed to execute content strategies with minimal human intervention.

Embracing the Digital Revolution: Why It’s a Must

Digital transformation is no longer an option for banks; it is necessary. Banks that adopt digital technologies will need help to compete with more agile and innovative players. Digital transformation offers a range of benefits for banks, including:

- Improved customer experience: Digital channels provide customers with 24/7 access to their accounts and a more personalized banking experience.

- Reduced costs: Digital solutions can automate many manual processes, leading to significant cost savings.

- Enhanced risk management: Digital technologies can help banks identify and mitigate fraud and other financial risks.

The Obstacles of Going Digital: Security, Investment, and Culture

While the benefits of digital transformation are clear, banks face several obstacles in their journey to becoming digital-first organizations. These obstacles include:

- Cybersecurity: Banks must invest heavily in cybersecurity measures to protect their customers’ data and systems from cyberattacks.

- Investment: Digital transformation requires significant upfront investment in technology, infrastructure, and training.

- Cultural change: Banks must overcome cultural resistance to change and adopt a more agile and innovative mindset.

Challenge 2: Regulatory Compliance

Navigating the Maze of Financial Regulations

The financial industry is subject to a complex and ever-evolving regulatory landscape. Banks must comply with a wide range of regulations, including:

- Anti-money laundering (AML) regulations aim to prevent using the financial system for money laundering and other illicit activities.

- Capital adequacy regulations: These regulations set minimum capital requirements for banks to ensure financial stability.

- Data privacy regulations protect consumers’ data and restrict how banks can use and share this data.

Balancing Compliance and Innovation

Compliance with financial regulations is essential, but it can also stifle innovation. Banks must find ways to balance compliance with innovation to remain competitive. Some strategies for balancing compliance and innovation include:

- Adopting a risk-based approach to compliance focuses on identifying and mitigating the highest-risk areas of compliance.

- Using technology to streamline compliance processes: Technology can automate many manual compliance tasks, freeing up time and resources for innovation.

- Building a culture of compliance: Banks must create a culture where compliance is seen as a core business value, not an afterthought.

The banking industry is facing a period of unprecedented change. Banks that can successfully navigate the challenges of digital transformation and regulatory compliance will be well-positioned for long-term success. By embracing technology, adapting to customer expectations, and finding innovative ways to comply with regulations, banks can continue to play a vital role in the global economy.

Challenge 3: Cybersecurity Threats

The Rising Tide of Cyber Attacks in Banking

The banking industry is a prime target for cyberattacks due to the vast amount of sensitive financial data it holds. Cybercriminals constantly evolve their tactics, techniques, and procedures (TTPs) to exploit vulnerabilities in banks’ systems and networks. As a result, banks must be vigilant in their cybersecurity efforts to protect their customers’ data and prevent financial losses.

Common cybersecurity threats faced by banks include:

- Phishing attacks: Phishing attacks involve sending emails or text messages that appear to be from legitimate sources, such as banks, to trick recipients into revealing sensitive information.

- Malware attacks: Malware is malicious software that can be installed on a computer system without the user’s knowledge or consent. Malware can steal data, encrypt files, or disrupt operations.

- DDoS attacks: Distributed denial-of-service (DDoS) attacks are designed to overwhelm a website or network with traffic, making it unavailable to legitimate users.

Implementing Robust Security Measures: A Non-Negotiable Necessity

To protect against cyberattacks, banks must implement a comprehensive cybersecurity program that includes:

- Strong access controls: Banks should use strong passwords, multi-factor authentication, and other security measures to control access to their systems and networks.

- Vulnerability scanning and patching: Banks should regularly scan their systems for vulnerabilities and patch them promptly.

- Employee training: Banks should train their employees to recognize and report suspicious activity.

- Incident response plans: Banks should have plans to respond to cyberattacks quickly and effectively.

In addition to these measures, banks should consider adopting new cybersecurity technologies, such as AI-powered threat detection and behavioral analytics. By taking a proactive approach to cybersecurity, banks can minimize the risk of cyberattacks and protect their customers’ data.

Challenge 4: Changing Customer Expectations

OrchestraAI Marketing Platform – WATCH

OrchestraAI utilizes a compound AI agent architecture as an AI Agentic Platform. This architecture seamlessly integrates multiple specialized AI agents into a cohesive system, enabling it to tackle complex, multifaceted marketing tasks.

Understanding the New Age Banking Customer

Today’s banking customers are increasingly tech-savvy and demand personalized, seamless, and convenient banking experiences. They are accustomed to using their smartphones and other digital devices to access information and conduct transactions, and they expect the same level of convenience from their banks.

Key characteristics of the new age banking customer:

- Digital native: They are comfortable using digital technology and prefer to interact with their banks through online and mobile channels.

- Demanding: They expect personalized and convenient banking experiences that meet their needs.

- Price-sensitive: They shop around for the best deals and are willing to switch banks if they can find better rates or services.

Personalization and Convenience: Meeting the Demands of Digital-Savvy Users

To meet the demands of the new-age banking customer, banks must:

- Personalize customer experiences: Use data analytics to understand customer preferences and offer personalized products, services, and recommendations.

- Provide seamless omnichannel experiences: Enable customers to start a transaction on one channel and complete it on another.

- Offer innovative digital products and services: Develop mobile apps, online banking platforms, and other digital tools that meet the needs of tech-savvy customers.

Banks that can successfully adapt to the changing expectations of their customers will be well-positioned to attract and retain new customers in the coming years.

2025 ALERTS: The Chatbot Era has Ended

Our recent market research shows that 85% of marketing agencies need more in-house expertise to manage and deploy multi-AI agent systems effectively.

Challenge 5: Fintech Competition

The Fintech Revolution: Friend or Foe?

The rise of fintech has disrupted the traditional banking industry, challenging established players and creating new opportunities for innovation. While some banks view fintech as a threat, others recognize the potential for collaboration and mutual growth.

Fintech companies are challenging traditional banks in several areas, including:

- Payments: Fintech companies have developed innovative payment solutions that are more convenient and cost-effective than traditional payment methods.

- Lending: Fintech companies use data analytics and machine learning to offer more personalized and affordable lending products.

- Wealth management: Fintech companies provide low-cost investment and wealth management solutions accessible to a wider audience.

Collaborating with Fintech: Strategies for Mutual Growth

Banks can benefit from collaborating with fintech companies in several ways:

- Gain access to new technologies and expertise: Fintech companies are at the forefront of innovation, and banks can leverage their expertise to develop new products and services.

- Expand into new markets: Fintech companies often understand customer needs in underserved markets, and banks can partner with them to expand their reach.

- Reduce costs: Fintech companies can help banks automate manual processes and reduce operational costs.

Examples of successful collaborations between banks and fintech companies:

- Barclays partnered with TransferWise to offer international money transfers at a lower cost.

- JP Morgan Chase partnered with OnDeck to offer small business loans through a digital platform.

- Santander partnered with Ripple to develop a blockchain-based payments solution.

How to do it:

- Identify potential partners: Banks should identify fintech companies developing innovative solutions that complement their business strategy.

- Establish clear goals: Banks and fintech companies should clearly define their objectives for collaboration and agree on metrics to measure success.

- Develop a strong governance structure: Banks and fintech companies should establish a clear governance structure to ensure the collaboration is managed effectively.

By collaborating with fintech companies, banks can gain access to new technologies, expand into new markets, and reduce costs. This can help them to remain competitive and meet the evolving needs of their customers.

Challenge 6: Data Management and Analytics

The Goldmine of Data: Harnessing its True Potential

Banks are sitting on a goldmine of data, but many are not effectively harnessing its potential. Data analytics can help banks make better decisions about everything from customer acquisition and retention to risk management and fraud prevention.

How to do it:

- Collect and store data effectively: Banks need systems to collect, store, and manage their data effectively.

- Cleanse and prepare data: Data needs to be cleaned and prepared before it can be analyzed. This involves removing errors and inconsistencies.

- Analyze data: Banks can use various data analytics tools to analyze their data. These tools can help to identify patterns, trends, and insights.

- Act on insights: Banks need to act on the insights they gain from data analytics. This could involve developing new products and services, improving customer service, or reducing risk.

Overcoming the Hurdles in Data Analytics and Interpretation

Banks often face challenges in data analytics and interpretation, including:

- Lack of data quality: Banks may have incomplete, inaccurate, or inconsistent data.

- Lack of expertise: Banks may need more expertise to analyze their data effectively.

- Lack of integration: Banks may have siloed data systems that make analyzing data from different sources difficult.

Strategies for overcoming these hurdles:

- Invest in data quality: Banks should invest in initiatives to improve the quality of their data.

- Hire data scientists: Banks should hire data scientists with the skills and expertise to analyze their data.

- Integrate data systems: Banks should integrate their data systems to make analyzing data from different sources easier.

Banks can gain a competitive advantage and improve their bottom line by effectively managing and analyzing their data.

Challenge 7: Sustainability and Social Responsibility

Banking on a Better Future: The Role of Sustainability

The banking industry plays a crucial role in shaping the global economy, and its actions significantly impact the environment and society. In recent years, there has been a growing recognition of the need for banks to adopt sustainable practices and integrate social responsibility into their business models.

Sustainability in banking:

- Environmental sustainability: Banks can contribute to environmental sustainability by financing renewable energy projects, promoting energy efficiency, and supporting sustainable lending practices.

- Social sustainability: Banks can promote social sustainability by providing financial services to underserved communities, investing in education and healthcare initiatives, and supporting financial inclusion.

Examples of sustainable banking practices:

- Rabobank: Rabobank is a Dutch bank that has pioneered sustainable banking. The bank has committed to financing 100% sustainable agriculture by 2025.

- UBS: UBS is a Swiss bank with a strong ESG (environmental, social, and governance) investing track record. The bank has committed to reducing its carbon emissions by 50% by 2030.

Integrating sustainability into business models:

- Establish sustainability goals: Banks should set and integrate clear sustainability goals into their overall business strategy.

- Measure and track progress: Banks should regularly measure and track their progress toward their sustainability goals.

- Engage with stakeholders: Banks should engage with their stakeholders, including customers, employees, and investors, on sustainability issues.

Social Responsibility in Banking: More Than Just a Buzzword

Social responsibility is not just a buzzword in the banking industry; it is a critical component of long-term success. Banks that demonstrate a commitment to social responsibility can attract and retain customers, build brand reputation, and enhance their competitive advantage.

Examples of socially responsible banking initiatives:

- Citigroup: Citigroup has a long history of supporting financial inclusion. The bank has partnered with several organizations to provide financial services to underserved communities.

- Banco Santander: Banco Santander is a Spanish bank that is strongly committed to education. The bank has donated millions of dollars to support education programs worldwide.

Social responsibility strategies for banks:

- Identify social responsibility priorities: Banks should identify the social issues that are most important to their stakeholders and focus their efforts on those areas.

- Develop and implement social responsibility programs: Banks should develop and implement social responsibility programs that align with their priorities.

- Measure and report on social responsibility performance: Banks should measure and report their performance to stakeholders.

Cross-Cutting Issues in Banking Challenges

The banking industry’s challenges are often interconnected, and banks need to take a holistic approach to address them effectively. For instance, digital transformation, regulatory compliance, and cybersecurity issues are interrelated and can impact each other.

The Interconnection of Digital, Regulatory, and Cybersecurity Issues

- Digital transformation: Digital transformation requires banks to adopt new technologies and processes, which can create new security vulnerabilities.

- Regulatory compliance: Regulatory compliance can impose additional costs and complexity on banks, making it more difficult to invest in digital transformation.

- Cybersecurity: Cybersecurity threats constantly evolve, and banks must invest in new security measures to protect their systems and data.

A Holistic Approach to Banking Challenges

To effectively address their interconnected challenges, banks need to adopt a holistic approach that considers the interplay between digital, regulatory, and cybersecurity issues. This approach should include:

- A clear understanding of the interconnectedness of challenges: Banks must understand how different challenges are comprehensively interrelated.

- A cross-functional approach to problem-solving: Banks need to bring together experts from different departments to solve problems holistically.

- A focus on risk management: Banks must develop a strong risk management framework to identify and mitigate potential risks.

By adopting a holistic approach, banks can better navigate their complex challenges and ensure their long-term success.

As the Chief Executive Officer (CEO) of a leading bank, I am acutely aware of the transformative impact of technology on the financial industry. Technological innovations are not just disrupting how we do business; they are creating new opportunities for growth and innovation.

Leveraging AI and Machine Learning in Banking Services

Artificial intelligence (AI) and machine learning (ML) are revolutionizing banking services by automating tasks, providing personalized experiences, and enhancing risk management.

- AI-powered chatbots: These virtual assistants can answer customer questions, provide account information, and even process transactions, reducing the burden on human customer service representatives.

- Personalized recommendations: AI algorithms can analyze customer data to identify patterns and preferences, enabling banks to offer personalized product and service recommendations.

- Fraud detection: ML models can analyze transaction patterns to detect anomalies and flag potential fraudulent activity, protecting banks and customers.

Blockchain and Banking: A Match Made in Tech Heaven

Blockchain technology is poised to revolutionize the banking industry by enhancing security, transparency, and efficiency.

- Secure transactions: Blockchain’s distributed ledger technology provides a tamper-proof record of transactions, reducing the risk of fraud and errors.

- Transparent payments: Blockchain transactions are traceable and verifiable, promoting transparency and accountability in the financial system.

- Cross-border payments: Blockchain can facilitate faster and cheaper cross-border payments, reducing reliance on traditional correspondent banking networks.

Adapting to Regulatory Changes

The banking industry is subject to a complex and ever-evolving regulatory landscape. Banks must adapt to these changes to ensure compliance and maintain their reputation.

- Proactive regulatory monitoring: Banks should establish a team dedicated to monitoring regulatory changes and assessing their impact on the business.

- Regular compliance audits: Banks should conduct regular compliance audits to identify and address gaps in their compliance practices.

- Collaboration with regulators: Banks should engage with regulators proactively to stay informed about upcoming changes and seek clarification on specific requirements.

Building a Compliance-First Culture in Banking

A strong compliance culture is essential for banks to navigate the regulatory landscape effectively and avoid costly penalties.

- Embed compliance into the decision-making process: Compliance should be integrated into all aspects of business decision-making, from product development to customer onboarding.

- Train and educate employees: Banks should regularly train and educate employees on compliance-related topics, ensuring that everyone understands their responsibilities.

- Foster a culture of open communication: Banks should encourage employees to report compliance concerns without fear of reprisal, creating an environment of transparency and accountability.

By embracing technological innovations and adapting to regulatory changes, banks can position themselves for long-term success in the dynamic financial landscape.

Conclusion

As a top executive at a leading bank, I am acutely aware of technology’s transformative impact on the financial industry. The traditional banking model faces unprecedented challenges from digital disruptors, evolving customer expectations, and a complex regulatory environment. To navigate these challenges and thrive in this ever-changing landscape, banks must embrace innovation and adapt to the needs of the modern customer.

Summarizing the Banking Landscape and its Challenges

The banking industry is undergoing a period of rapid transformation driven by several key factors:

- Digital Disruption: Fintech companies are challenging traditional banks with innovative digital solutions that offer greater convenience, personalization, and cost-effectiveness.

- Changing Customer Expectations: Today’s customers are tech-savvy and demand seamless, personalized experiences across all channels. They expect banks to provide real-time access to their accounts, proactive financial advice, and tailored product recommendations.

- Regulatory Complexity: The banking industry is subject to a complex and ever-evolving regulatory framework to protect consumers and ensure financial stability. While these regulations are essential, they can also create compliance burdens and stifle innovation.

The Path Forward: Embracing Change and Innovation in Banking Services

Banks must embrace change and innovation to stay ahead of the curve and meet the demands of the modern customer. This includes:

- Adopting Digital Technologies: Banks must invest in digital technologies, such as artificial intelligence (AI), machine learning (ML), and blockchain, to enhance customer experiences, automate processes, and improve risk management.

- Personalizing Customer Interactions: Banks must leverage data analytics to gain deeper insights into customer behavior and preferences. This will enable them to offer personalized product recommendations, tailored financial advice, and proactive fraud prevention measures.

- Navigating Regulatory Compliance: Banks must develop a robust compliance infrastructure and adopt a risk-based approach to regulatory compliance to ensure they meet all requirements without stifling innovation.

How Banks Can Rise to These Challenges

To rise to the challenges facing the banking industry, banks must focus on the following key strategies:

- Foster a Culture of Innovation: Banks must cultivate a culture that embraces innovation and encourages employees to experiment with new ideas and technologies.

- Collaborate with Fintech Companies: Banks should explore partnerships and collaborations with fintech companies to gain access to cutting-edge technologies and expertise.

- Invest in Employee Training and Development: Banks must invest in training and development programs to equip their employees with the skills and knowledge to navigate the digital transformation and adapt to changing customer expectations.

- Maintain a Customer-Centric Approach: Banks must place their customers at the heart of their decision-making processes and continuously strive to improve their products, services, and overall customer experience.

The banking industry is at a crossroads, and the path forward will require a concerted effort from banks, regulators, and customers. I invite readers to share their thoughts and perspectives on the banking industry’s challenges and opportunities. Your insights can help shape the future of banking and ensure that financial institutions continue to play a vital role in the global economy.