Vertical AI Industry Models for Financial Service Firms

Learn About Vertical AI Industry Models for Financial Service Firms.

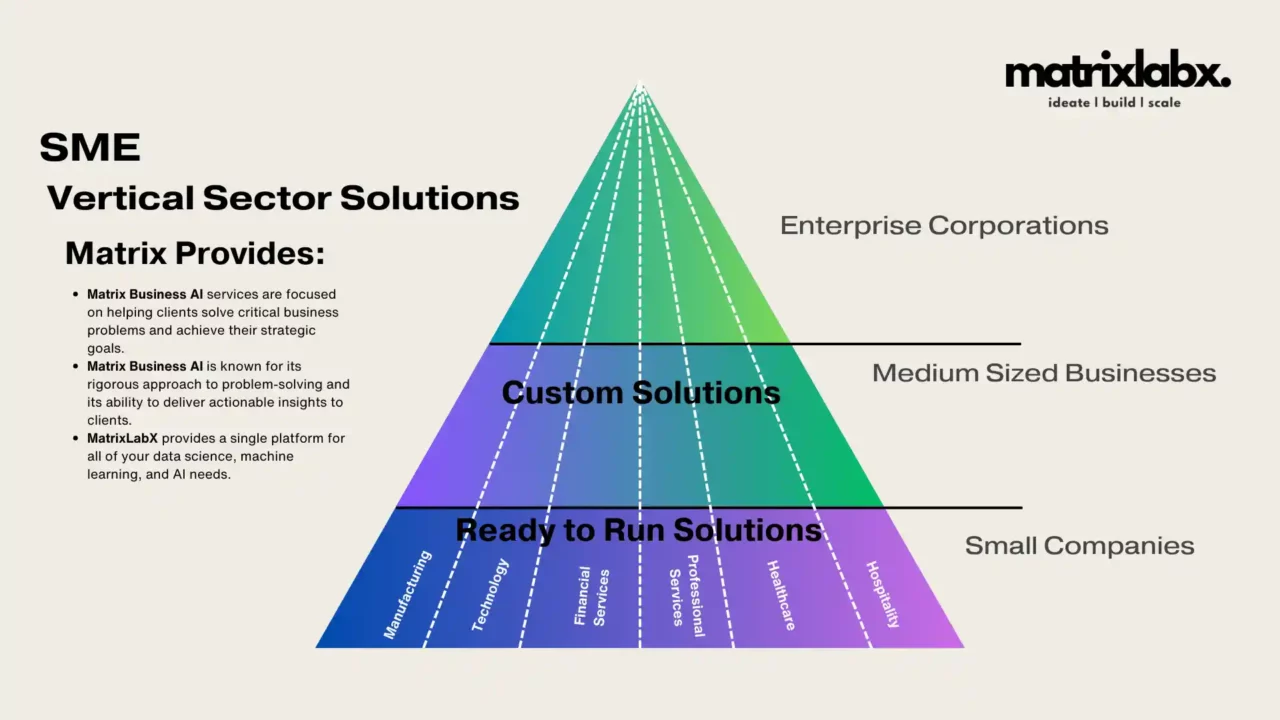

I. Introduction to MatrixLabX Vertical AI Industry Models

What are vertical AI industry models?

To implement vertical AI industry models in financial services for a firm of 50 people, you can follow these steps:

- Identify the specific business challenges that you want to address with vertical AI. What are your biggest pain points? What areas could AI help you improve?

- Assess your data readiness and infrastructure capabilities. Do you have the necessary data to train and deploy AI models? Do you have the necessary infrastructure in place?

- Research and evaluate different vertical AI industry models. There are many vertical AI industry models available, so it’s essential to research and select the one that best suits your specific needs.

- Pilot and implement a selected model. Once you’ve chosen a model, you must pilot it in a small, controlled environment to test its effectiveness. Once satisfied with the results, you can implement the model on a larger scale.

- Monitor and optimize the model’s performance. Once the model is in production, you must monitor its performance and adjust as needed. You should also regularly evaluate the model to ensure it continues to meet your needs.

Here are some specific tips for implementing vertical AI industry models in financial services for a firm of 50 people:

- Start small. Try to implement only a few AI models at a time. Choose one or two specific areas where AI can make the biggest impact.

- Use cloud computing. Cloud computing can make implementing and managing AI models easier and more affordable.

- Use pre-trained models. Numerous pre-trained AI models are available for specific tasks in financial services. This can save you time and resources.

- Get buy-in from your employees. It’s important to get your employees on board with AI. Explain how AI can help them do their jobs better and benefit the company.

- Provide training and support. Your employees must be trained to use AI models and interpret the results. You may also need to provide support to help them troubleshoot any problems they encounter.

By following these steps, you can implement vertical AI industry models in financial services for your firm of 50 people and reap the benefits of AI. AI Product Management: Why Software Product Managers Need to Understand AI and Machine Learning

Annual Marketing Budget Calculator

Key benefits of using vertical AI industry models in financial services

Top 3 Benefits of Using Vertical AI Industry Models in Financial Services

1. Improved decision-making

Vertical AI industry models can help financial service firms make better decisions by providing insights that are impossible to obtain with traditional methods.

For example, a vertical AI model for risk management could be used to identify emerging risks that would be difficult to spot with the naked eye. This information could mitigate those risks before they cause any damage. Agent as a Service: Faster, Cheaper, and Better Marketing

2. Increased efficiency and productivity

Vertical AI industry models can help financial service firms automate tasks and streamline workflows, significantly increasing efficiency and productivity.

For example, a vertical AI industry model for customer service could answer customer questions and resolve issues more quickly and efficiently than a human customer service representative could.

3. Enhanced customer experience

Vertical AI industry models can be used to develop more personalized and engaging customer experiences. For example, a vertical AI industry model for portfolio management could recommend investments to clients based on their individual risk tolerance and investment goals.

This information can help clients make more informed financial decisions and achieve their goals.

In addition to these top three benefits, vertical AI industry models can also help financial service firms to:

- Reduce costs

- Increase revenue

- Improve risk management

- Comply with regulations

- Gain a competitive advantage

Your FinServ Metrics

Enter your firm’s current 12-month averages to analyze your growth potential.

Financial Services Marketing Analysis

Marketing-Sourced Pipeline

Client Acquisition Cost (CAC)

Lead-to-Consultation Rate

High-Intent Prospect Identification

*Goal re-defined as ‘Anonymous Visitors to Identified Prospects’

Unlock Your Firm’s Growth Potential

Matrix Marketing Group uses AI to turn analytics into assets. Get a tailored quote based on your firm’s specific needs.

Get Your Custom Price QuoteVertical AI industry models offer various benefits for financial service firms. By leveraging AI’s power, firms can improve their decision-making, increase efficiency and productivity, enhance the customer experience, and gain a competitive advantage.

MatrixLabX Vertical AI Industry Models are emerging as pivotal threads in the intricate tapestry of financial services. These models are not mere tools but bespoke digital artisans crafted to navigate the complexities of specific industry landscapes. AI Marketing Plan for Manufacturing Businesses

Particularly in financial services, these models harness the dual power of specialization and artificial intelligence, proffering tailored solutions that resonate with the sector’s unique demands.

Their importance cannot be overstated. In a realm where precision and foresight are as valuable as currency itself, vertical AI industry models offer a competitive edge.

They transform nebulous data into actionable intelligence, enabling financial service firms to make decisions with a prescience previously the province of speculation.

Adopting such models has manifold benefits. They enhance predictive analytics accuracy, elevate customer engagement strategies, and accelerate decision-making.

By integrating these vertical AI models, financial entities can achieve service personalization and operational efficiency that sets them apart in a congested marketplace. Agent as a Service: Faster, Cheaper, and Better Marketing

II. Common Use Cases for Vertical AI Industry Models in Financial Services

Each vertical AI use case in financial services is a cog in a larger innovation mechanism. AI’s capacity to identify patterns and anomalies with superhuman acuity has revolutionized risk management and fraud detection.

AI models process complex credit scoring and underwriting datasets to provide more nuanced assessments of creditworthiness.

Portfolio management and investment advice, once the bastions of human expertise, are now augmented by algorithms that can analyze market data with unparalleled depth and breadth.

Customer service has transcended the limitations of human beings, with AI providing a level of personalization that mirrors the attentiveness of a private banker. Moreover, regulatory compliance, a labyrinthine challenge, is now navigated with the assistance of AI that can dissect and apply regulations with surgical precision.

5 Use Cases for Vertical AI Industry Models in Financial Services

1. Risk management and fraud detection

Vertical AI models can be used to develop more accurate and timely risk assessments and fraud-detection systems. This can help financial service firms to reduce their risk exposure and protect their customers from fraud.

For example, a vertical AI model for risk management could be used to identify customers at risk of loan default. This information could provide additional support to those customers or restrict their access to credit. AI Digital Marketing Trends and Future for Matrix Marketing Group [Interview]

2. Credit scoring and underwriting

Vertical AI models can be used to develop more accurate and fair credit-scoring and underwriting systems. This can help financial service firms make more informed lending decisions and reach a broader customer base.

For example, a vertical AI industry model for credit scoring could assess borrowers’ creditworthiness based on their circumstances. This information could enable borrowers to obtain more competitive interest rates and terms.

3. Portfolio management and investment advice

Vertical AI industry models can be used to develop more personalized and profitable portfolio management and investment advice solutions. This can help financial service firms improve their clients’ financial performance and increase their profits.

For example, a vertical AI industry model for portfolio management could recommend investments to clients based on their individual risk tolerance and investment goals. This information could then be used to help clients build more balanced and diversified portfolios.

4. Customer service and personalization

Vertical AI industry models can be used to develop more personalized and efficient customer service solutions. This can help financial service firms to improve the customer experience and to increase customer satisfaction.

For example, a vertical AI industry model for customer service could identify customers at risk of churning. This information could then be used to proactively reach out to those customers and offer them solutions to their problems.

5. Regulatory compliance

Vertical AI models can help financial services firms comply with complex, ever-changing regulatory requirements. This can help firms avoid costly fines and penalties and protect their reputations.

For example, a vertical AI industry model for regulatory compliance could identify and monitor transactions likely to violate regulations. This information could then be used to prevent those transactions from occurring or to take corrective action.

III. Key Considerations for Implementing Vertical AI Industry Models in Financial Services

To implement vertical AI industry models in financial services for a firm of 50 people, you can follow these steps:

- Identify the specific business challenges that you want to address with vertical AI. What are your biggest pain points? What areas could AI help you improve?

- Assess your data readiness and infrastructure capabilities. Do you have the necessary data to train and deploy AI models? Do you have the necessary infrastructure in place?

- Research and evaluate different vertical AI industry models. There are many vertical AI industry models available, so it’s essential to research and select the one that best suits your specific needs.

- Pilot and implement a selected model. Once you’ve chosen a model, you must pilot it in a small, controlled environment to test its effectiveness. Once satisfied with the results, you can implement the model on a larger scale.

- Monitor and optimize the model’s performance. Once the model is in production, you must monitor its performance and adjust as needed. You should also regularly evaluate the model to ensure it continues to meet your needs.

Here are some specific tips for implementing vertical AI industry models in financial services for a firm of 50 people:

- Start small. Try to implement only a few AI models at a time. Choose one or two specific areas where AI can make the biggest impact.

- Use cloud computing. Cloud computing can make implementing and managing AI models easier and more affordable. How to Use AI Digital Marketing to Transform Your Marketing Results

- Use pre-trained models. Several pre-trained AI models are available for specific tasks in financial services. This can save you time and resources.

- Get buy-in from your employees. It’s important to get your employees on board with AI. Explain how AI can help them do their jobs better and benefit the company.

- Provide training and support. Your employees must be trained to use AI models and interpret the results. You may also need to provide support to help them troubleshoot any problems they encounter.

By following these steps, you can implement vertical AI industry models in financial services for your firm of 50 people and reap the benefits of AI.

Implementing vertical AI has its intricacies. Paramount among these is the quality and quantity of data, for AI is only as rational as the information it digests. Model governance and risk management are also critical pillars, ensuring that AI operates within the defined ethical and regulatory parameters.

Change management and employee adoption also play a crucial role. The human element in the digitization journey must be nurtured, for the confluence of human and artificial intelligence will define the zenith of this technological epoch.

Marketing Waste ROI Calculator

Results

Estimated Waste Budget: $0

Revenue Potential with Optimization: $0

ROI Boost Opportunity: 0X

IV. Case Studies

The landscape is dotted with financial service firms that have successfully integrated vertical AI models, embracing and thriving in the process. These case studies serve as beacons, illuminating the path for others to follow.

They showcase the tangible benefits of AI implementation, from dramatic efficiency gains to the crystalline clarity with which they can foresee market trends.

Certainly, here are three fictionalized case studies showcasing the integration of Google Cloud’s Vertex AI within the financial services sector:

Case Study 1: Predictive Loan Underwriting for NextGen Bank

Challenge:

NextGen Bank faced challenges in its loan underwriting process, which was labor-intensive and slow. This led to a backlog of loan applications and dissatisfied customers.

Solution:

By implementing Vertex AI, NextGen Bank leveraged machine learning models to analyze applicants’ financial data, credit history, and other relevant parameters. The AI provided predictive insights, enabling the bank to assess risk more accurately and make faster lending decisions.

Results:

The adoption of Vertex AI resulted in a 30% reduction in loan application processing time. Due to the improved accuracy in predicting creditworthiness, loan default rates dropped by 15%. Customer satisfaction scores also improved significantly as loan approvals were provided more rapidly.

Case Study 2: Fraud Detection Enhancement for SecureFinance Corp.

Challenge:

SecureFinance Corp. faced a sophisticated array of financial fraud attempts that traditional rule-based systems failed to detect in real time, undermining customer trust and financial security.

Solution:

SecureFinance Corp. integrated Vertex AI to develop and deploy a real-time fraud detection system. The system utilized machine learning models to identify complex fraudulent patterns and suspicious transactions across multiple channels.

Results:

Vertex AI’s advanced analytics capabilities increased fraud detection rates by 25%. The system’s real-time processing ability reduced the number of fraudulent transactions slipping through undetected, saving SecureFinance Corp. millions in potential losses. Additionally, the false-positive rate of fraud alerts decreased by 20%, improving operational efficiency and the customer experience.

Case Study 3: Personalized Investment Portfolios for WealthMax Advisors

Challenge: WealthMax Advisors required assistance in delivering personalized investment advice at scale. Their clients sought tailored investment strategies aligned with individual risk profiles and financial goals, a resource-intensive service.

Solution: WealthMax Advisors utilized Vertex AI to enhance its investment analysis and portfolio management capabilities. The AI algorithms analyzed market data, client profiles, and historical investment performance to craft personalized investment recommendations.

Results: With Google Cloud Vertex AI, WealthMax Advisors could offer bespoke investment portfolio options to 50% more clients without additional human advisors, due to more precise, data-driven investment strategies; client portfolio returns improved by an average of 10%. The firm also noted a 40% increase in client retention, driven by customer satisfaction with personalized services.

In these case studies, Matrix Business AI and Google Cloud have demonstrated their potential to revolutionize various facets of financial services, from loan underwriting and fraud detection to personalized investment advice.

Through machine learning, financial institutions can enhance efficiency, reduce risk, and improve customer satisfaction, thereby gaining a competitive edge in the fast-evolving financial landscape.

V. Conclusion

The trajectory of vertical AI in financial services is not merely upward but exponential.

As we advance, the symbiosis between financial expertise and AI will become increasingly intertwined, ushering in an era when firms’ augmented capabilities will no longer be an advantage but a necessity.

These intelligent systems are redrawing the frontier of financial services, and the future, ripe with potential, awaits those ready to transform these technological marvels into business realities.

Our Amazing Clients.

For nearly two decades, we have forged partnerships with companies that aspire to minimize waste, gain a competitive edge, and truly prioritize the well-being of their stakeholders.

AI Maturity Ladder Assessment

Discover your organization’s position in the AI landscape and get actionable steps to accelerate your journey.

The AI Skills Gap is the disparity between the advanced capabilities of modern Artificial Intelligence models (such as LLMs, LAMs, and Agentic Workflows) and the human capacity to deploy, manage, and leverage them effectively.