Enterprise Software Companies Realignment: Closing Leaky Sales Pipelines

The realignment of enterprise software businesses happens daily from leaky sales pipelines and poor forecasting. As a global consulting firm, you are doing a realignment enterprise software vendors project.

You must do the SWOT analysis, digital footprint research, and global external factors to shore up waste and cost containment often ignored.

I get about 5 – 7 emails daily about someone with a better widget. APIs abound while we try to bring in best-of-breed solutions. But these all have an overhead that a lot can reduce. Lesson do not jump on the bandwagon of the latest NEW technologies.

Here is some very lazy marketing. A stranger sends me an email from nowhere. Does even know what I do, need, or care about. SPAM!

Does my point go beyond inbound marketing and poor copy we send you right into SPAM? That’s where I find 20 – 30 per day. The 5 – 7 sneak by into my inbox.

The digital side of Matrix Marketing Group has a lab where new technologies are alpha and beta tested before any offer is made. The overhead mentioned before is the maintenance of any best-of-breed solution. Why? Multi-vendor solutions.

Sales reps are finding it difficult to sell their products or services in the current economy. This has led to a rise in the number of companies who are looking for realignment enterprise software vendors.

These vendors can help close sales pipelines by providing accurate data and advanced features that help organizations stay ahead of their competition.

Are you struggling to keep your sales pipeline closed?

Many enterprise software vendors find it difficult to close their sales pipelines. This is due to the current economy and the ever-changing market conditions. However, by working with a realignment enterprise software vendor, you can overcome these challenges and stay ahead of your competition. The enterprise software companies list is short.

At realignment, we understand the challenges that you’re facing. We provide accurate data and advanced features to help you close your sales pipeline and stay ahead of your competition. Contact us today to learn more about our services.

Two case studies that demonstrate the benefits of working with a realignment enterprise software vendor are as follows:

Case Study 1: A leading pharmaceutical company was looking to realign its enterprise software vendors to improve sales pipeline closure rates. After working with a realignment vendor, the company saw an increase in sales of 3% and a decrease in the time it took to close sales by 20%.

They are assessing the digital human equivalent.

Case Study 2: A global telecommunications company was looking to improve customer satisfaction rates. After working with a realignment vendor, the company saw an increase in customer satisfaction of 5% and a decrease in the time it took to close deals by 15%.

Both of these case studies demonstrate the benefits of working with a realignment enterprise software by a global consulting firm like Matrix Marketing Group. The top revenues in both cases increased.

Companies looking to improve their sales pipeline closure rates should consider working with such a vendor.

It is happening in enterprise real estate companies, and enterprise software companies’ realignment is necessary.

The organizational structure matters, and what each need

Your objective as the CEO should get the following:

- Train or hire marketers with strong business acumen.

- Link your link brand equity back to results.

- Do a risk assessment, so you don’t fall prey to the latest trends and can’t show how they will create more business.

- Marketers don’t think enough like businesspeople.

- Understand mapping complex buyer’s journey and content alignment

- Aligns marketing with sales as a partner

The CFO wants [enterprise software companies realignment]:

- Our sales and marketing expense is just too high for the revenue we’re generating; I know we can’t cut our way to revenue growth, but we’ve got to improve the return on our current investment before spending any more.

- We need to increase our revenue per employee, particularly our revenue per salesperson; We need more sales productivity.

The VP of Sales wants [enterprise software companies realignment]:

- I’m on the hook to hit an aggressive sales target, but hiring more salespeople is not an option right now; How can I improve our sales productivity?

- We’re not closing enough deals, and the ones we are closing are taking too long. How can I shorten our sales cycle and improve our conversion rate throughout the sales pipeline?

- How do I improve the ability of my reps to engage in more meaningful conversations with our prospects?

The CMO wants [enterprise software companies realignment]:

- I am spending a lot of time training sales, yet they still rely on my resources to close business; How can I make salespeople more self-sufficient when it comes to telling our story?

- We have developed reams of marketing brochures and other related content which sit in HubSpot’s SQL status untouched by sales, then they turn around and complain we don’t give them what they need to close business!

- My budget keeps getting cut because I can’t show a measurable ROI; How can I make the value of what my organization does tangible and quantifiable?

Realigning mid-market enterprise software companies for today’s economic climate is accelerating.

Marketing issues today:

- Business growth

- Marketing investment has not shown results

- Marketing isn’t based on a well-defined strategy

- Our sales are flat or declining

- New competitors are emerging

- Pricing pressures

- What marketing problem

- Executing marketing programs

- The customer experience needs improvement

- Internal marketing is not getting results and costs are too high

Take a look at these two lists, first the one on What’s OUT in terms of key vectors driving the goals and design of businesses throughout the naughty nineties, then the What’s IN list, describing the key parameters in place today, at the beginning of the ‘nasty naughts’ (00’s):

| WHAT’S OUT | WHAT’S IN |

|---|---|

| Sailing with the wind | Sailing into the wind |

| Time is the enemy | Waste is the enemy |

| First mover advantage | First prover advantage |

| Growth at all costs | Cash-flow positive at all costs |

| Early markets and tornadoes | Bowling alleys and main street |

| Catching the next wave | Fixing the leaky sales pipes |

| Horizontal markets (breadth) | Vertical markets (depth) |

| Vendor-centric messaging | Customer-centric messaging |

| Transaction-oriented selling | Consultation-based selling |

Suppose your company, along with virtually every other funded startup and IPO graduate of the past seven years, was designed for the conditions on the left in the table above. In that case, you will probably have drawn some conclusions by now about the reasons why your organization is struggling to adapt to the new conditions on the right.

Furthermore, since we are all exactly two and a half years older and wiser after the pandemic, I think most people have finally convinced themselves that the new conditions are not about to go away, so we need to adapt our organizations to the new rules.

Well, if everyone in the software business were so convinced of this new reality, I would have expected to see more enterprise software and systems companies reinvent themselves, not just by surface shuffling of functions and new messaging statements.

But by reexamining the most critical question of all – and one that businesses in more mature industries are accustomed to posing periodically to keep themselves focused on the right activities and priorities – which is, “What business are we really in?”

In the next few paragraphs, I would like to offer a simple and quick approach that any management team can use to jump-start the process of re-energizing their business. This can be especially valuable to those high-tech companies where management and employees may have lost the sense of what noble cause they are fighting for.

A word or two to describe what we mean by “Fixing the Leaky Sales Pipeline.”

OK, if we agree that catching the next wave and its corollary, vendor-centric messaging, are on the hot list of what’s Out, whereas fixing the leaky sales pipe and customer-centric messaging are on the list of What’s In, let me first explain what ‘leaky pipe’ we are supposed to try to fix, and what this has to do with our products and services.

This folksy term is merely a down-to-earth way of calling your customer’s attention to the holes in their operational processes that are leaking money (waste), as – in the case of a manufacturer, for example – they move through design, manufacturing, distribution, service, and warranty phases.

For instance, there might be individual leaks in sub-optimal product designs, excess component inventory, scrapped work, engineering changes, order cancellations, returned products, repeat service calls, or customer attrition.

Our rationale for addressing this set of concerns is simple: whereas in an up-economy, every company tends to focus more on increasing competitive advantage, market share, and revenues, thus often neglecting to see how wasteful their internal processes are, in a down-economy, companies start to look inside for ways to cut waste and thus costs, and they are less willing to invest in projects aimed at new market opportunities.

Thus, our advice to virtually every tech company trying to establish its new business, or sustain continued growth, is to focus on finding the chronic leaks in enterprise customers’ processes that their products and services (can) help to fix.

Answering the “What Business Are We Really In?” question

Taking this. Further, it makes logical sense if you want to connect with your target customers to align the goals of your business with their biggest concerns.

Thus, my simple proposition is this: instead of describing your business in terms of the products you make or the services you deliver, you reframe it in terms of the ‘$75M’ business problems your offerings help corporations solve.

Thus, if your business is currently defined in these terms, “we make a,b,c software products for mid-market or large enterprises in x,y,z markets” (and statements like these generally make software companies sound completely undifferentiated), do the following experiment: redefine your business in terms like these: “We are in the business of solving $75M.+ operational problems in d,e,f business processes for large enterprises in these main markets.”

Here’s an example, we sell electric cars. Rather than we sell clean transportation. The old feature/benefit content can appear old and stale.

Here is a quick list of electric car taglines (we found over 250 different taglines):

- All electric. No compromises.

- The future is electric, and it’s available now

- Let’s drive the future

- Switch to electric cars

- Redefining the way the world drives

- We boost the EV experience

- Safe, clean, affordable

- Get green and go electric

Provocation selling paired with great converting copy make lead generation work. It will drive more MQL and SQL that close.

Of course, you need to get specific about the sales pipeline leaks your technology is most suited to address and about which companies have benefited.

Encourage discussions throughout your organization based on a close look at your existing base of customers in most cases.

You will rapidly be able to construct a sentence or two that says more about the actual value you bring to the world than is apparent in your current, more product-centric messaging.

I’ve been talking about this for over 30 years now. And digital made it so easy to capture analytics, test, analyze, and adapt quickly.

The essential purpose of your business is to reassess

Besides being able to use this new view of the essential purpose of your business to reassess

- what your category really should be called (i.e., adopting more of a business application name than a technology-focused name), and

- What your best market penetration strategy should be going forward, you will see your existing customer base and your current pipeline in a new light. And, for organizations that have come through three, six, or as many as ten RIFs during the past thirty months or so and may be in a somewhat sad state, you will quickly see a positive effect, as people in every functional area, from developers to service consultants, start to feel new energy about the company’s mission. Keep an eye on your business and the economy in 2023 to strengthen your weakness.

First COVID, then lockdowns, then inflation at a 40-year high, and top it off in some sectors, labor shortages. So now, with labor at $15 or more, businesses are reducing product sizes and raising prices.

Over 80% of the people in the US and globally are cutting back on spending. The US economy is driven by consumer demand.

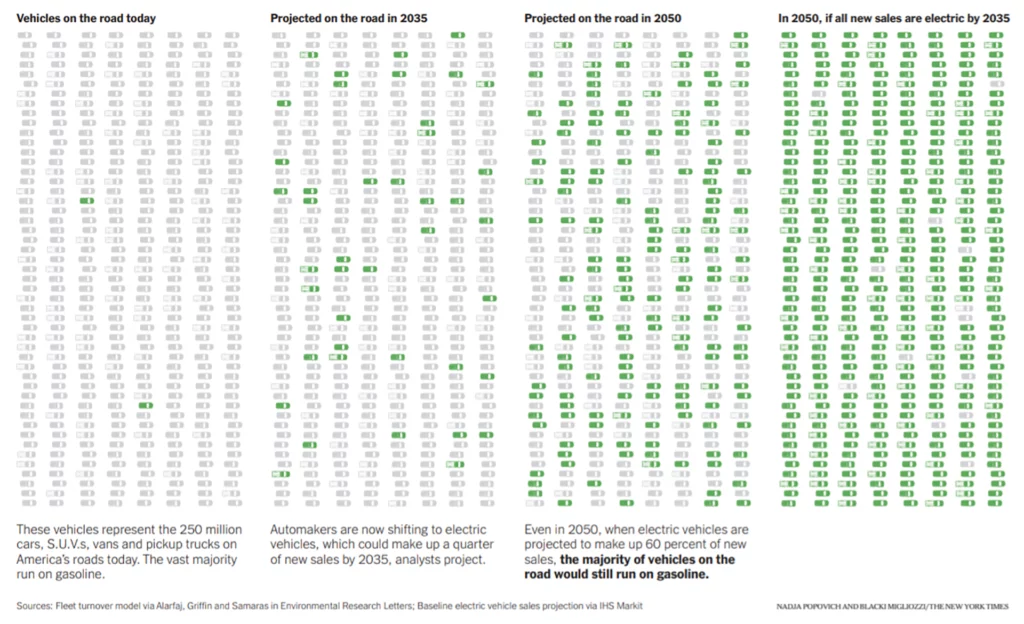

Even a small downturn in consumer spending damages the economy. As it drops off, economic growth slows. Prices drop, creating deflation. If slow consumer spending continues, the economy contracts to the road of a recession. The debate for clean energy goes on.

The US nor the global is ready for the practical implementation of clean energy. Ask yourself, is it worth all the pain and suffering for the middle class?

What if you are not in a powerful position to drive this debate?

I believe that anyone in the organization can spark the necessary debate. If you are a front-line employee, use every meeting opportunity to ask, “what $75M?+ corporate problems do our products and services help to solve?” If you are a middle manager, do the same.

Better still, if you have frequent contact with customers and prospects, take every opportunity to ask them what major leaky pipe problems they are addressing and even which of these they see your products addressing effectively. Then you can bring their testimonials into the discussion with your colleagues.

Alternatively, suppose you are currently between jobs and interviewing with new companies. In that case, one of the first due-diligence questions I suggest you ask your interviewer might be, “what major leaks in customer processes does your company’s technology help to solve?”

By the way, depending on the answer you get, you may decide that this company is too unrealistic to know what business value it could be delivered and thus has fewer chances of succeeding – or you may decide that this is an opportunity for you to show them how to look at their business in a new way.

Software companies realignment closing

What to do if you can’t find any major leaks to fix?

Ah, if this is true and you have turned up every possible rock without success, you may be forced to conclude that your business is not viable in today’s unforgiving corporate climate. Enterprise software companies’ realignment is inevitable.

At least, you could console yourself that it’s better to know this now than to keep investing energy and resources in something that may only serve as a feature in someone else’s critical problem-solving offering.

General FAQs about Enterprise Software Companies Realignment

What is the first step in re-aligning my organization?

The first step in re-aligning an organization is to create a clear vision for the future. This includes developing a strategy and setting goals that are achievable yet challenging. Once the goals have been established, it’s important to create a plan to achieve them and put the right team in place to make it happen.

Who should be involved in the re-alignment process?

The re-alignment process should involve the entire organization, from the executive team to the individual employees. This will ensure everyone is on board with the changes and working towards the same goal. It’s also important to have an external consultant who can help guide and advise the team throughout the process.

What are the benefits of re-aligning my organization?

There are many benefits to re-aligning an organization, including improved communication, increased efficiency, and better decision-making. By creating a clear vision and setting achievable goals, employees will be more motivated to achieve results. Additionally, involving everyone in the process will make employees feel more invested in the outcome and more likely to embrace the changes.

How long will it take to complete the re-alignment process?

The re-alignment process usually takes between 6 and 12 months to complete. However, the timeframe can vary depending on the size of the organization and the scope of the changes. It’s important to proceed slowly and ensure that all the necessary steps are taken to ensure a successful outcome.

What are some of the challenges that can arise during realignment?

Many challenges can arise during the realignment process, such as resistance to change, lack of communication, and poor decision-making. It’s important to be prepared for these challenges and have the plan to deal with them. Additionally, it’s important to have a strong executive team that can guide the organization through these difficult times.