Can these sources of ideas for new products for mid-market businesses

Unlock Innovative Product Ideas: Strategies for Mid-Market Business Growth. Learn how these origins of ideas for new products for mid-market businesses can drive innovation and new sales products.

Creating new product ideas can seem daunting, but it’s not as hard as you think. New product ideas that don’t exist or ideas for new products to invent.

Story: The Origins of Innovation – Sources of Ideas for New Products

In a fast-paced tech company, Sarah, a seasoned product manager, sat at her desk staring at a blank whiteboard. The team’s quarterly review had just ended with a clear mandate: they needed to develop ideas for new products that could push the company ahead in a competitive market. But where would these ideas come from? How could her team uncover the next breakthrough?

As Sarah tapped her pen, she remembered the various sources that had fueled product innovation throughout her career. One by one, the stories of past products began to unfold in her mind.

1. Customer Feedback: The Voice of the User

Sarah’s team launched a project management tool a few years ago that gained a loyal customer base. But after a few months, complaints about the tool’s limited mobile functionality began to pour in. At first, the team resisted change—the product was performing well, so why rock the boat?

Then, one day, Sarah received an email from a long-time customer explaining how the lack of a mobile-friendly feature impacted their team’s productivity in the field. The email was heartfelt and detailed, and Sarah could see the customer’s frustration.

That email sparked a shift. Her team quickly pivoted to develop a mobile version of the tool, integrating customer feedback into their design. The result? Not only did they retain their existing customers, but they attracted a whole new segment of users who needed flexibility.

“Never underestimate the power of listening,” Sarah thought. Sometimes, the best product ideas come directly from those who use them.

2. Market Research: Spotting Gaps and Trends

Next, Sarah recalled when she and her team were trying to enter a new industry. The team wasn’t sure what product would resonate in the crowded market. So, they turned to detailed market research. They scoured industry reports, tracked competitor products, and closely examined emerging trends.

During this deep dive, they noticed a small but growing segment of businesses shifting toward automation. The competitors hadn’t fully embraced this movement yet, which left an opening for Sarah’s company. With this insight, they developed an automation-focused feature that met a growing demand, putting them ahead of the curve.

“Research doesn’t just show you where things are—it can show you where they’re going,” Sarah mused. By understanding trends and gaps, product managers could seize opportunities before competitors saw them.

3. Internal Innovation: Tapping the Expertise of the Team

One of the most memorable products Sarah had worked on wasn’t inspired by customers or research—it came from within her team.

There was a developer named Mike, a quiet guy who often worked behind the scenes but was always tinkering with new technologies. One afternoon during a brainstorming session, Mike mentioned a side project he’d been working on a machine learning algorithm that could predict customer churn. At first, Sarah didn’t see how it could be incorporated into their product line, but Mike’s enthusiasm was contagious.

Sarah gave Mike the green light to prototype his idea. To her surprise, the algorithm turned out to be a game-changer. It helped their clients retain more customers and improve customer engagement based on data-driven insights. This feature became one of their product’s major selling points.

“Sometimes, the best ideas come from within,” Sarah realized. Innovation doesn’t always have to start from outside sources—it can come from empowering your team to think creatively and follow their passions.

4. Competitor Analysis: Learning from Others

There was also the time when Sarah’s company was trailing behind a major competitor in the ecommerce space. The competitor had launched a sleek, user-friendly checkout experience that dramatically increased their conversion rates.

At first, competing with such a well-executed feature seemed daunting. But rather than feeling defeated, Sarah’s team dug into what made the competitor’s product so effective. They conducted a detailed competitor analysis, breaking down every user interface element and identifying opportunities to innovate even further.

By improving the competitor’s foundation and adding unique customization options, Sarah’s team developed an enhanced checkout experience that ultimately stole the show.

“You don’t have to reinvent the wheel—sometimes you just need to make it roll faster,” Sarah grinned.

5. Industry Disruption: Keeping an Eye on Game-Changing Technology

Finally, Sarah reflected on a lesson learned early in her career during rapid technological change. At the time, mobile apps were starting to dominate the market. One of her colleagues had urged the team to explore creating a mobile-first product, but the company’s leadership was hesitant. After all, they were doing well with their desktop-based products, and change felt risky.

But the shift to mobile was inevitable. A competitor jumped on the trend first, releasing a mobile app that instantly attracted millions of users. Sarah’s company was forced to play catch-up, scrambling to build a mobile version of their product to stay relevant.

The lesson stuck with her ever since: don’t ignore disruptive technology. It can feel risky to bet on something new, but ignoring it can be even riskier.

“Keep your ear to the ground, and don’t be afraid to embrace change,” Sarah reminded herself.

6. Partnerships and Collaborations: Broadening Horizons

One of the most successful products Sarah’s team had ever launched came from an unexpected place—a partnership. Sarah’s company had collaborated with a smaller firm specializing in AI. While her company had the market reach, the smaller firm had niche expertise.

Together, they co-developed a predictive analytics tool no company could have built alone. The partnership was a win-win, bringing new capabilities to both companies and creating a more innovative product than anything they could have created in-house.

“Sometimes, the key to innovation is realizing you don’t have to go it alone,” Sarah reflected.

As Sarah stood up from her desk and looked at the whiteboard again, she no longer felt overwhelmed by the pressure to develop new ideas. The stories from her past experiences reminded her that innovation comes from many sources—listening to customers, staying ahead of trends, fostering internal creativity, learning from competitors, embracing disruption, and collaborating with others.

“Good ideas are all around us,” Sarah thought. “We just have to be ready to see them.”

With that in mind, she grabbed her marker and wrote the words at the top of the board: “Inspiration comes from everywhere.” It was time to start gathering her team and letting the ideas flow.

94% of CEOs want to maintain or accelerate pandemic-driven digital transformation (Gartner).

We know what it’s like at the ideation phase in the ensuing chaos. But that’s not necessarily a bad thing. But could the process be improved? With AI embedded in the product development process, you’ll see a 50% decrease in time to market.

Generative AI is just starting; we’ve been playing with it since 2011. We’ve built mini apps, super apps, engineering platforms, applied observability, and adaptive AI. And we love doing that. But we believe the meta-verse will eventually evolve. We’re designing AI industry cloud platforms using what used to be object-oriented technology. If you haven’t seen Google PaLM2, look at it.

As a product guy with over 30 years of experience in market research, ideation validation, product spec testing invalidation, product requirements documents, market requirements documents, and all the other necessary content to generate a go-to-market plan, I can do it in a matter of days instead of weeks or months. Amazing.

There are many different sources of inspiration; all you need is creativity and imagination. So don’t be afraid to try something new – here are 10 sources for new product ideas to get your creative juices flowing. But wait. What about AI and AIBrandPad or AIProdPad? We save that for the end. Take your time to read the top 10 before jumping into AI. That way, you will have a sound foundation to use AI.

Are you looking for ideas for new products? We can help. Our creative professionals have decades of combined experience in product development and design. We specialize in creating innovative solutions that maximize value for our clients. Let us know your needs, and we will work with you to develop a concept that works for you. Contact us today, and let’s get started!

Check out this article for 10 sources of inspiration to help get your creative juices flowing. You’ll find everything from classic products that have been revamped to new and innovative ideas that are sure to wow consumers.

AI-Driven Product Development and Launch

So what are you waiting for? Start brainstorming today! With so many great options, you’re sure to find something that will inspire you to create a new product that will revolutionize the industry.

Finding promising new product ideas is the starting point in the idea generation’s new product development process. Ideas for new products trigger planning for new services and products.

New product ideas are evaluated as the process progresses, and new product planning expenses accumulate. Even the most commoditized product can be wrapped up in a new digital experience. We did it with coal transportation. You can do it with your business.

There are various internal and external sources of new product ideas. Ideas can be generated by information search, marketing research, research and development, incentives, and acquisition.

I’ll discuss the screening, evaluation, and business analysis to help determine if a new product concept is sufficiently attractive to justify proceeding with development.

Seeds of Ideas for New Products for Small and Mid-Market Businesses

Limiting the search for new product ideas to internal research and development activities is far too narrow an approach. Both solicited and spontaneous ideas may emerge from sources.

Here’s a pro tip. It’d be better if you could chat GTP for $20 a month. Spin up some ideas in the application. For example, if I was going to launch a product, let’s see a micro app in product development. No micro app or mini app is typically developed for the individual level. We all know about Google alerts and all the research tools, but I will show you something. The marketing requirements document is below. Not bad for less than 45 seconds.

Market Requirement Document for ERP Systems in the Microbrewing Industry

This document presents the requirements for an Enterprise Resource Planning (ERP) system designed to cater to the specific needs of the microbrewing industry in the United States, specifically targeting companies with sales revenue of $3 million or less.

Feature Function List

- Inventory Management: Automatically track raw materials, brewing supplies, finished goods, and promotional materials.

- Production Planning and Scheduling: Streamline the planning of brewing batches based on inventory levels and demand forecast.

- Sales and Distribution Management: Handle all sales and distribution activities, including order processing, delivery schedule, and invoice generation.

- Financial Management: Integrate all financial transactions and processes, including accounts payable, accounts receivable, general ledger, and budgeting.

- Quality Control & Compliance: Enforce quality standards for raw materials, in-process items, and finished goods. Manage compliance with federal and state brewing regulations.

- Customer Relationship Management (CRM): Maintain customer records, manage marketing campaigns, track customer interactions, and analyze sales trends.

- Business Intelligence & Reporting: Analyze key performance indicators (KPIs) and generate real-time reports for strategic decision-making.

Benefits

- Efficiency: Streamline business processes, reducing time spent on administrative tasks and freeing up resources for growth.

- Visibility: Real-time inventory, sales, and financial tracking provide full visibility into operations.

- Compliance: Simplify adherence to industry regulations through integrated compliance tools.

- Data-Driven Decision-Making: Use advanced reporting tools to make informed, strategic decisions.

- Improved Customer Service: CRM tools enable better understanding and customer servicing.

Unique Value Proposition

A value proposition is a statement that summarizes the unique value that a product or service offers to its customers. For a microbrewery, the value proposition can be based on the following factors:

- The quality of the beer: Microbreweries typically focus on producing high-quality beer made with fresh, local ingredients. This can be a major selling point for consumers looking for a more authentic and flavorful beer experience.

- The variety of beers offered: Microbreweries often offer various beers, from traditional styles to more experimental brews. This can appeal to a wider range of consumers and help the brewery stand out.

- The brewing process: Microbreweries often use traditional brewing methods, which can give their beers a unique flavor profile. This can be a selling point for consumers looking for a more artisanal beer experience.

- The brewery’s location: Microbreweries are often located in areas popular with tourists and beer enthusiasts. This can help to attract new customers and increase sales.

- The brewery’s marketing and branding: Microbreweries need a strong marketing and branding strategy to reach their target audience and increase sales. This can include creating a unique brand identity, developing a social media presence, and hosting events and tastings.

By focusing on these factors, microbreweries can create a value proposition that will help them to increase their sales volume.

Here are some specific examples of how microbreweries can use their value proposition to increase sales:

- A microbrewery that produces high-quality beer can partner with restaurants and bars known for their food and drink selection. This will help to expose the brewery’s beers to a new audience and increase sales.

- A microbrewery that offers various beers can host tasting events and classes. This will allow consumers to try different beers and learn more about brewing, which can help build brand awareness and increase sales.

- A microbrewery that uses traditional brewing methods can emphasize the authenticity of its beers in its marketing materials, appealing to consumers looking for a more artisanal beer experience.

- A microbrewery located in a popular tourist destination can offer a brewery tour or tasting experience. This will allow tourists to learn more about the brewery and its beers, which can help increase sales and boost the brewery’s visibility.

By understanding the factors that influence a microbrewery’s value proposition, brewers can create a strategy to increase sales and grow their business.

Our ERP solution provides comprehensive, industry-specific features to microbreweries, enabling them to streamline operations, comply with regulations, and make data-driven decisions. Unlike generic ERP systems, our solution is built to handle the unique challenges of the microbrewing industry, and its cost-effective pricing makes it ideal for businesses with $3 million or less in revenue.

Ditch the Pixel Dungeon: Forge Your Perfect Headless Website

Forget clunky templates and pixelated walls. Build a website that dances with AI that breathes personalization, and leaves your visitors screaming (in a good way). Headless development unleashes endless possibilities. Join us and craft your digital masterpiece. Dare to break the internet? Contact us today!

We understand that microbreweries need to focus on what they do best—creating amazing beer—so our ERP solution is designed to take care of the rest. With a simple setup process, detailed guides and tutorials, plus 24/7 customer support, you can start optimizing your business operations quickly. Try MatrixERP today and see how much easier it can make running a microbrewery!

Matrix ERP is microbreweries’ leading enterprise resource planning (ERP) solution. Our cloud-based software offers brewery-specific features to streamline operations, comply with regulations, and make data-driven decisions. With our ERP system, you can create real-time reports on your inventory, sales, and financials for better visibility into your business’ performance. Plus, you can open new distribution channels with a few clicks, allowing you to expand your customer base and increase revenue.

Our ERP system is incredibly cost-effective—perfect for microbreweries that don’t have tens of thousands of dollars to spend on software. We also provide comprehensive customer support and access to our knowledgeable team of experts dedicated to helping you get the most out of Matrix ERP.

Experience the power of Matrix ERP today and see how it can revolutionize your microbrewery operations! Contact us for a free demo today.

Key Competitors

- Orchestrated BEER: An all-in-one business management software designed specifically for the craft brewing industry.

- Ekos Brewmaster: An ERP system focused on managing the day-to-day operations of brewing companies.

- VicinityBrew: A software solution built for the specific needs of the brewing industry.

- BrewNinja: A system that covers all aspects of a brewery’s operation, from grain to glass.

Sure, here is an explanation of how a chief marketing officer (CMO) can use BARD AI to scan key competitors:

Key Competitor Scanning with BARD AI

As a chief marketing officer (CMO), staying ahead of the competition and understanding their strategies is crucial. BARD AI can be a valuable tool for scanning key competitors and gathering insights into their marketing efforts.

BARD AI can access and process vast amounts of information from the internet, including competitor websites, social media profiles, and news articles. This information can be used to:

- Identify key competitors: BARD AI can help you identify your direct and indirect competitors, even if they are not well-established or visible in your market.

- Analyze competitor marketing campaigns: BARD AI can analyze competitor marketing campaigns to understand their target audience, messaging, and channels.

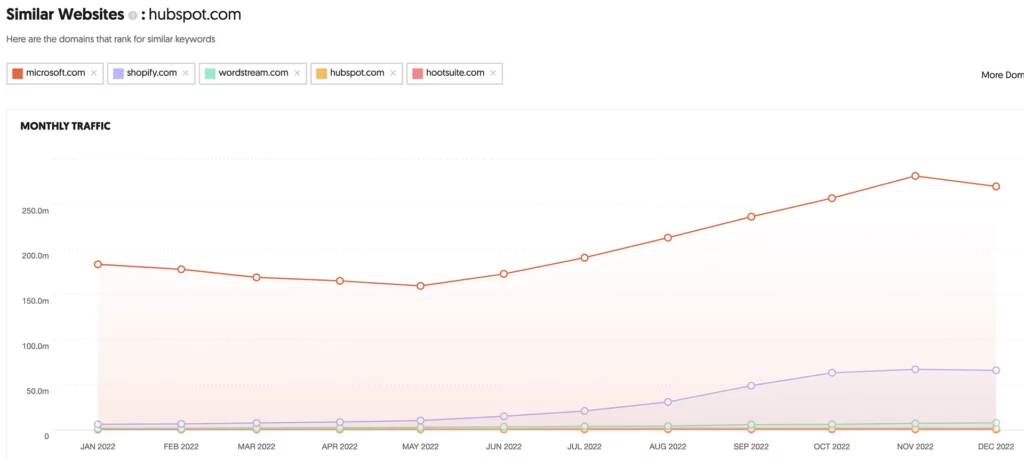

- Track competitor performance: BARD AI can track competitor performance metrics, such as website traffic, social media engagement, and brand sentiment.

Ways that CMOs can use BARD AI to scan key competitors:

- Create competitor profiles: Use BARD AI to create detailed profiles of your key competitors, including their target audience, value proposition, marketing channels, and key strengths and weaknesses.

- Monitor competitor activity: Set up BARD AI to monitor competitor activity, such as new product launches, marketing campaigns, and media mentions.

- Identify competitive threats: Use BARD AI to identify potential threats, such as new entrants to the market or emerging technologies.

Benefits of Using BARD AI for Competitor Scanning

There are several benefits to using BARD AI for competitor scanning:

- Improved efficiency: BARD AI can automate many tasks in competitor scanning, freeing up your time to focus on other strategic initiatives.

- Enhanced accuracy: BARD AI can process vast amounts of data and identify patterns that may not be obvious to humans.

- Unbiased insights: BARD AI is not biased by personal opinions or experiences, which can lead to more objective insights.

Overall, BARD AI is a powerful tool that can help CMOs stay ahead of the competition and make informed marketing decisions.

Additional tips for scanning key competitors with BARD AI:

- Use BARD AI to identify and track competitors’ website traffic and social media engagement.

- Use BARD AI to analyze competitors’ keyword usage and search engine rankings.

- Use BARD AI to identify and track competitors’ customer reviews and sentiment.

By following these tips, you can use BARD AI to gain a comprehensive understanding of your competitors’ marketing strategies and make informed decisions about your marketing efforts.

Top States with the Highest Density of Microbreweries

- California: Known for its craft beer culture, California has the highest microbreweries.

- Washington: The state’s breweries range from large, globally recognized brands to small, community-based microbreweries.

- Colorado: Home to many renowned microbreweries and craft beer festivals. New Belgium.

- Oregon: The state is recognized for its vibrant craft beer scene with many microbreweries.

- Michigan: Michigan’s craft beer industry has been growing rapidly, with a high density of microbreweries nationwide.

Here’s a proposal for you to generate a market requirement document for an ERP system in the microbrewing industry targeting companies with 3 million in sales revenue or less. Provide a feature function list, benefits, unique value proposition, and key competitors in the industry in the states with the highest density of microbreweries in companies.

Company employees, customers, competitors, outside inventors, acquisitions, and channel members are sources of new product ideas.

Procter & Gamble’s Ivory soap was the result of an accident. The manufacturing process overmixed the ingredients, creating air bubbles in the soap that caused it to float. Customers love it!

The essential issue management must face is establishing a program for generating and evaluating ideas that will meet the company’s needs.

Several questions must be answered in developing such an idea for a new products program:

- Should idea searches be targeted or open-ended?

- Should the search for new product ideas be restricted to those corresponding to the mission, target market, and company strategy?

- How extensive and aggressive should the company’s idea search activities be?

- Should search be an active or passive function within the firm?

- Where will the responsibilities for the search for new product ideas be placed?

- How will new product planning activities be directed and coordinated?

My research findings indicate that financial performance is higher for high-technology companies with proven product competence.

Companies that focus on their product strategy perform much better over a long period than those that do not. These findings came from a study of 246 products across 26 small and medium-sized companies.

The idea search program should be aligned with most companies’ corporate mission and objectives. While some far-out new product ideas may change a company’s future, open-ended ideas often search for disparate resources and misdirect efforts.

Generalizing the other three questions is impossible since they depend on many factors, including the size and type of company, technologies involved, new product needs, resources, management preferences, and corporate capabilities. Top management should develop a plan for idea generation to satisfy the company’s requirements.

Many new product ideas start with customers, particularly ideas for industrial products. Both industrial and consumer buyers are useful sources of new product ideas. A lead user analysis offers promising potential for developing new industrial products.

Lead users are those companies whose current needs and requirements anticipate marketplace needs.

The approach is to identify these market leaders and analyze their needs to improve the productivity of new product development and rapidly change product markets. The objective is to satisfy the lead users’ needs, thus accelerating new product planning.

Methods of Generating Ideas

Several alternatives for generating ideas are investigated. Typically, a company uses more than one of these options.

Search.

Systematic monitoring of various information sources may help identify new product ideas. Companies that wish to sell or license ideas they do not want to commercialize can publish new product ideas publications and use online sources.

Computerized search services provide information about new technologies. New sources may also yield information about competitors’ new product activities.

Many trade publications contain new product announcements. Kickstarter and Indiegogo are good places to look for new ideas. Marketing management must identify the relevant search areas and assign responsibility for a search to an individual or group.

AI-driven Marketing Research for ideas for new products with ChatGTP commands.

Getting early ideas & market research

Generate app ideas and concepts. ChatGPT can be a good starting point for ideation and a brainstorming tool for generating ideas or design concepts.

- Prompt: Generate three ideas for using AI in a pedometer app.

Conduct market and competitor research. If you’re unfamiliar with a market and want a better idea, ask ChatGPT.

- Command: Compare and contrast the features of the top 5 ERP platforms in the market.

(Note: ChatGPT is trained on data before 2021, so the answer may not be up-to-date. But it can give you a general idea of the market and important competitors.) We use a real-time data model.

A Survey of product end-users can be useful in identifying needs that new products can satisfy. One useful technique for identifying and evaluating a new product concept is the focus group, which can be used for consumer and industrial products.

A small group of 8 to 12 people is invited to meet with an experienced moderator to discuss new product ideas. Idea generation might start with discussing product requirements for some product use. Subsequent focus group sessions can evaluate product concepts formulated to satisfy the needs identified in the initial session.

At each stage, more than one focus group can be used. Focus groups may include channel members, company personnel, and customers.

Another consumer research technique is the advisory panel. It’s selected to represent a target market. For example, a producer of computer accessories would include computer users on the panel. Companies are using customer advisory groups. These groups provide insight and evaluate new products.

Internal and External Department.

Research and development generate many new product ideas, which may also originate from development efforts outside the company. Sources include inventors, private laboratories, research universities, and small high-tech firms.

Other Idea Generation Methods.

Incentives may be useful for gleaning new product ideas from employees, marketing intermediaries, and customers. The incentive amount should be high enough to encourage submission.

The company should also guard against employees leaving and developing promising ideas elsewhere. For this reason, many companies require employees to sign a nondisclosure agreement. These don’t have many teeth; get a patent.

Consumer product funds are interesting for generating new products, developing them, and moving their ideas to commercialization.

While the objective of consumer product funds is to provide a return to investors, corporate participants may gain access to new products without the high cost of internal development.

However, critics of the funds argue that small venture firms lack the experience to successfully plan and introduce new products. Two or more corporate investors may also try to compete for a good new product or perhaps the entire company.

Finally, acquiring other firms offers a way to obtain new product ideas. This strategy may be more cost-effective than internal development and substantially reduce the lead time required for new product planning.

Idea generation identifies one or more product concepts to be screened and evaluated. An idea for a new product must be transformed into a defined product concept.

The complete product concept is a statement about selected anticipated product attributes that show how they will yield selected benefits relative to other existing products or problem solutions. For example, the pump toothpaste dispenser (attribute) offers a simple and quick alternative (benefit) tube.

SCREENING, EVALUATING, AND BUSINESS ANALYSIS

Evaluating new ideas is essential for new product planning. Assume that a successful new product specifies criteria for commercial success (e.g., sales, profit contribution, and market share).

While keeping the risk or rejection of good ideas at an acceptable level. If the risk of rejecting an idea is set too low, then too many ideas will be developed that must be rejected later.

Moving too many ideas too far into development and testing is an expensive mistake. Management must establish a screening and evaluation procedure that will kill unpromising ideas immediately.

Expenditures buildup from the idea stage to the commercialization stage, or the risk of developing an alarming new product, declines as more and more information is obtained about the product and the market. Thus, the best screening procedure is one that is not too tight.

The objective is to eliminate the least promising ideas before investing too much time and money. The tighter the screening procedure, the higher the risk of rejecting a good idea. Based on the specific factors involved, management should have established a risk appropriate for the situation.

A new product idea should be evaluated regularly through the new product planning stages. The evaluation techniques appropriate to each stage in the planning process are matched to the evaluation task.

Ideas may be rejected at any stage, even though the objective is to eliminate the poor risk relatively early in the planning phase before major product development expenditures occur.

Screening

An idea for a new product should receive an initial screening to determine that strategic fit in the company. Two important dimensions should be evaluated:

- The strategic capability of the idea

- The commercial feasibility of the venture

Several specific factors in each category are shown in Exhibit 2.

The screening aims to eliminate ideas that are not compatible or feasible for the company. These assignments are somewhat subjective since management must establish how narrow or wide the screening boundary should be.

For example, managing two otherwise similar companies might have different missions and objectives.

Thus, an idea involving a new product market area could be strategically compatible with one company but not another. Dimension management evaluates ideas, concepts, and products, including all key management areas.

Some firms develop screening procedures using scoring and rating techniques. The result is a score for each idea being screened. Management can set ranges for passing and rejecting. The methods are effective only if managers agree on the relative importance of the screening factors.

Evaluation

The boundaries between idea screening, evaluation, and business analysis are not drawn. Some firms combine two evaluation stages. Nevertheless, the distinction seems appropriate.

After the initial screening, the surviving ideas are subject to a more comprehensive evaluation. Several factors shown in Exhibit 2 may be evaluated in greater depth, including the buyer’s reaction to the proposed concept. Concept tests are useful in evaluating and refining new product ideas.

Concept testing

Concept testing aims to obtain a reaction to the new market concept from a sample of potential buyers before the product is developed.

The product concepts are presented to the test participants in various forms, such as a written description, a drawing, a model, or a package.

Typically, a statement of a concept is part of the testing procedure. The statement should be brief, consisting of one or two paragraphs, and bias must be avoided in its wording.

When designed and implemented, the concept test offers a useful way of evaluating a product idea very early on. Given the information obtained, the cost of concept testing is reasonable.

There are some important cautions. The test, at best, is a very rough gauge of commercial success. The test is somewhat artificial since the actual product and a commercial setting are absent.

The concept test is useful in signaling favorable or unfavorable product concepts. It also offers a basis for comparing two or more concepts. A requirement for concept testing is that the product can be expressed as a concept. Moreover, the participants have the experience and capability to evaluate it.

Concept selection

Completing the evaluation stage should yield one or more concepts for business analysis. In general, consumer products firms spend more on screening and evaluating ideas than industrial product firms.

The time devoted to developing the new product is greater for industrial goods companies than consumer goods companies.

Business analysis

Business analysis is normally accomplished at several stages in the new product planning process. It estimates the proposed product’s commercial performance. The quality of the revenue and cost forecast depends on obtaining an accurate financial projection.

The first assessment is conducted before the product concept is developed. Financial projections are refined at later stages.

Revenue forecasting

The product’s newness, market size, and competing products influence the accuracy of revenue projections. For SaaS computer software, estimates of total market size can usually be obtained from industry information.

Several industry associations publish the industry forecast. Industry and financial analysts like Gartner, IDC, and Forrester provide great information. Estimating the feasible market share for a new product entry is the more difficult.

Sales of new-to-the-world products are very difficult to forecast. One approach is to identify the potential size of the target market and then estimate the new product’s market penetration rate.

For example, sales forecasts for electric cars could be based on the penetration percentage in the conventional gas-driven car market over a specified time.

Cost estimation

Several types of costs are encountered in planning and commercializing new products. Estimating the cost for each stage in the new planning process is one way to categorize them. The cost increases rapidly as the product concept moves through the process.

The cost for each planning stage can be further divided into functional categories (e.g., marketing, research and development, and manufacturing). The executive’s experience in new product planning should be able to generate reasonable cost estimates.

Profit projections

Several profit projections can gauge a new product’s financial performance. Those appropriate for new product business analysis include hurdle rate computation, cash flow, return on investment, and profit contribution.

Break-even analysis is useful to show how many units of a new product must be sold before it makes a profit. Management can use the break-even level to estimate the project’s feasibility.

Senior management must determine the appropriate time frame for projecting sales, costs, and profits. Policy guidelines may be specified.

For example, the product may be required to recoup all costs within a certain period. Business analysis estimates should consider the estimated flow of revenues and costs over the time used. Typically, new products incur a higher cost before generating revenues.

Other considerations

Several issues must be considered in the business analysis of a proposed product concept. First, management should formulate guidelines for the financial performance of new products. These can be used to accept, reject, or further analyze the product concept.

Another issue involves assessing the amount of risk. New products substituted for existing products often cannibalize sales. This factor should be included in financial projections or additional consideration beyond the financial estimates.

EXAMPLES OF NEW PRODUCT IDEAS

- Ring Video Doorbell

- Car Vending Machines

- A Solar-Powered Camping Tent

- The Biolite Camping Stove

- Ultra-Ever Dry Waterproof Coating

- PaperKarma: The Junk Mail-Eliminating App

- Senz: The Stormproof Umbrella

- Justick: An Electro-Adhesive Bulletin Board

Wrap Up on ideas for new products

The new product development process starts with a search for new ideas. The search should not be casual. Senior management should define the products and markets to emphasize.

It should state the new product objectives, whether cash flow, market share domination, or other objectives. It should state how much effort should be devoted to developing original products, modifying existing products, and copying competitors’ products.

The purpose of idea generation is to generate several ideas and then reduce the number of ideas to an attractive, practicable few.

Download the marketing requirements document and product requirements document.

Organizations recognize the necessity and advantages of developing new products and services. Newer products must replace their more mature and declining products.

The key to successful innovation lies in developing better organizational processes for handling new product ideas and developing sound research and decision procedures at each stage of the new product development process.

New products, however, can fail. The risk of innovation is as great as the rewards.

General FAQs for ideas for new products

How can I come up with ideas for new products?

Coming up with ideas for new products can be a challenging task. You can use a few methods to generate ideas, such as market research, competitive benchmarking, brainstorming sessions, and customer feedback. Market research involves an in-depth look at your competitors and what their customers prefer. Competitive benchmarking is a strategic method of evaluating the performance of your company in comparison to other firms in the same industry. Content Marketing Financial Firms

Where do most product ideas come from?

Most product ideas come from market research, competitive benchmarking, brainstorming sessions, and customer feedback. Market research involves gathering data about the competition and what customers prefer.

What are some creative ways to generate new product ideas?

Some creative ways to generate new product ideas include talking to customers and industry experts, brainstorming with a team or colleagues, leveraging existing technology (e.g., artificial intelligence), and exploring current trends in the industry. Additionally, you can look to other industries for inspiration or use resources such as design sprints or hackathons to develop fresh ideas.

How do I know if my product idea is any good?

You can determine if your product idea is good by conducting market research, getting customer feedback, analyzing the competition, and testing it with a focus group. To ensure the success of your product, you should also develop an effective marketing plan and create a business model to show potential investors or customers that your idea is worth pursuing.