Inbound Marketing for Financial Firms: Generating More Business

Inbound Marketing for Financial Services Firms: Generating More Business

Traditional marketing tactics are becoming less effective in generating business in today’s competitive financial services market.

Financial services firms must embrace and implement alternative strategies to help them remain competitive and attract more clients.

Financial services marketing is emerging as an effective solution for firms looking to increase their online footprint and generate more leads, customers, and revenue.

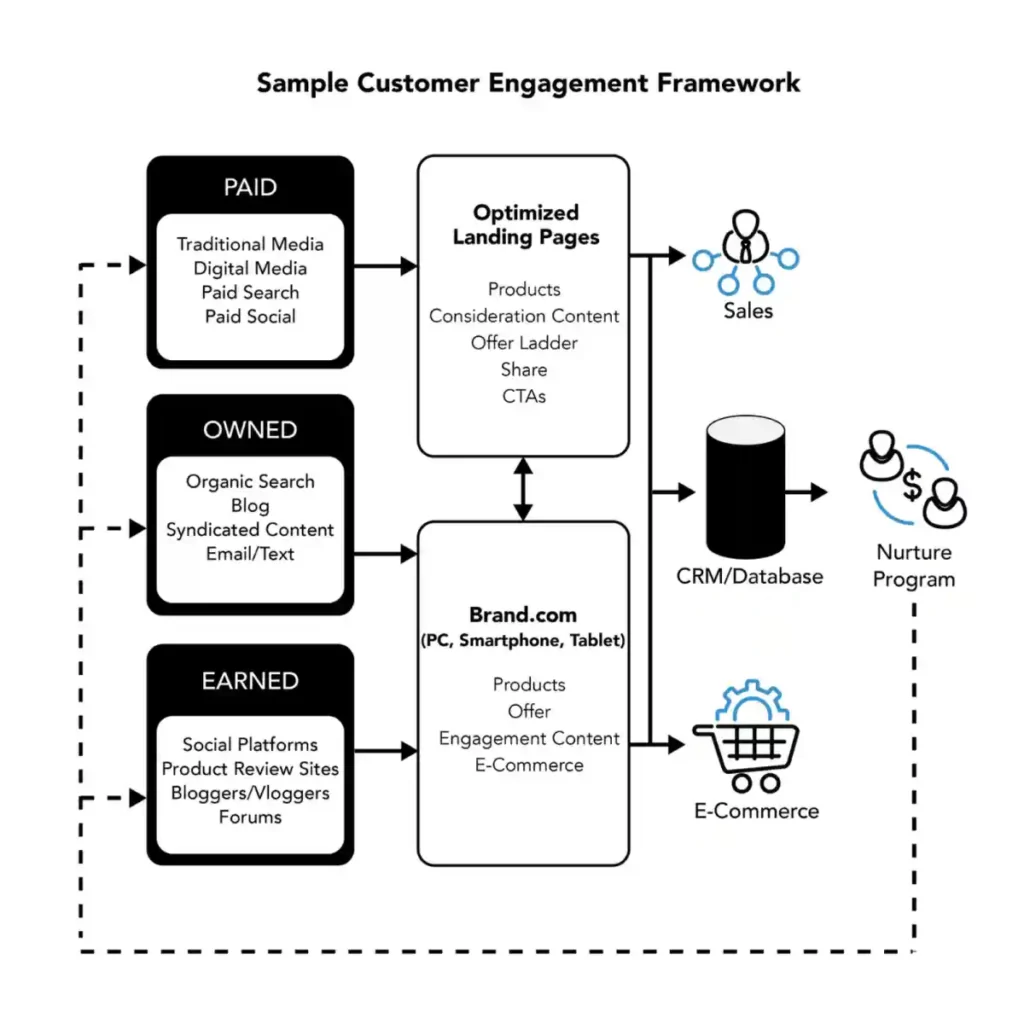

With proven tools such as content creation, search engine optimization (SEO), social media outreach, email campaigns, remarketing/retargeting efforts, automated nurturing sequences, and lead scoring capabilities, among many others, inbound marketing provides companies the opportunity to reach increasingly savvy clients with personalized messaging throughout their buyer’s journey.

Letting prospective customers find you instead of chasing them around is taking your position from the passive observer in a world ever-more dominated by those willing to invest time in the game — to control your destiny through efficient automation processes capable of identifying potential clients based on pre-set criteria while engaging meaningfully at scale.

All this data points towards one clear conclusion: leveraging modern digital tactics can transform businesses into fully optimized client blitz machines!

Inbound Marketing

With the rapidly evolving landscape of the financial services industry, businesses must adapt to meet the needs of their customers. Inbound marketing has quickly become a popular and effective strategy for attracting and retaining long-lasting customers.

By creating valuable content and engaging with prospective clients through various channels, businesses can establish themselves as thought leaders and build trust with their audience.

While traditional outbound marketing tactics may yield short-term results, inbound marketing focuses on creating lasting customer relationships, increasing loyalty, and higher customer lifetime value.

In today’s highly competitive market, implementing an inbound marketing plan is critical for financial services businesses looking to gain a competitive edge.

What are the Marketing Challenges for Financial Services Firms

Marketing for financial services firms poses unique challenges that require careful consideration. In today’s world, where the competition is intense, firms must differentiate themselves to remain relevant to their customers.

One of the significant challenges financial firms face is gaining their customers’ trust. With many instances of financial fraud, customers are becoming increasingly cautious and scrutinizing where they invest their money.

Another challenge is adapting to the increasingly digital world. Companies must now engage with their customers through social media and mobile devices while also ensuring their brand messaging is consistent across all platforms.

Financial firms also need to stay updated with regulations and compliance issues. Ultimately, creating a comprehensive marketing strategy that addresses these challenges requires a thorough understanding of the industry and the customer base.

What is Inbound Marketing

Inbound marketing is a methodology that has proven incredibly effective in today’s digital world. At the core of this approach lies the idea of attracting, engaging, and building relationships with potential customers by delivering valuable content and experiences that address their specific needs and interests.

By prioritizing the customer’s journey and leveraging various tactics such as search engine optimization, social media marketing, and content creation, inbound marketing allows brands to build trust and credibility with their target audience.

In contrast to traditional outbound marketing, which often relies on interruption-based techniques, inbound marketing strives to provide relevant and helpful information to prospects, ultimately turning them into loyal customers.

As such, inbound marketing has become crucial to any successful digital marketing strategy. It allows brands to connect with customers meaningfully and build long-term relationships based on mutual value and understanding.

Why Is Inbound Marketing for Financial Companies and Industries Important?

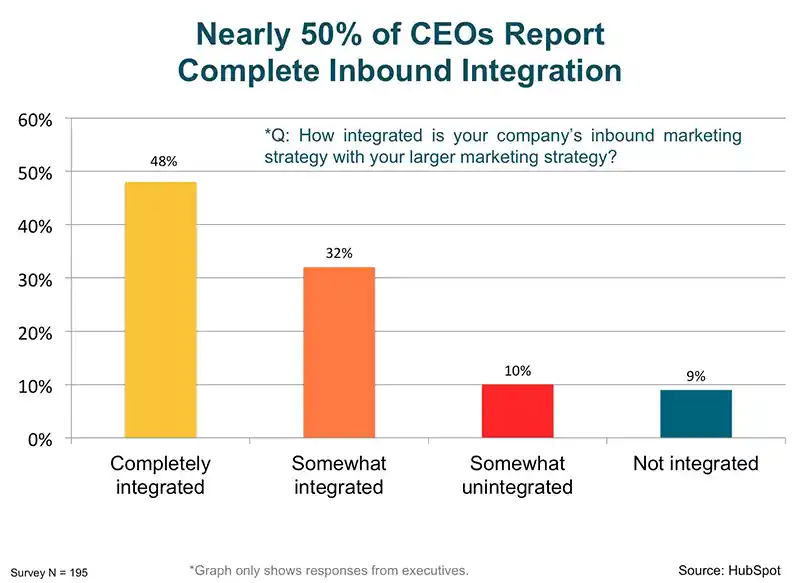

Inbound marketing has become a crucial strategy for financial services and industries recently.

This approach is about pulling potential customers towards your business rather than pushing your message onto them. You can establish trust and credibility by creating valuable content that resonates with your target audience.

Inbound marketing allows you to address your prospects’ needs and interests, which helps build meaningful relationships. In addition to enhancing customer engagement, inbound marketing can improve lead generation and conversion rates.

Overall, this method presents a more effective and cost-efficient way to attract and retain customers. It is particularly important for financial services and industries in this age of digital transformation.

How does it differ from traditional marketing tactics?

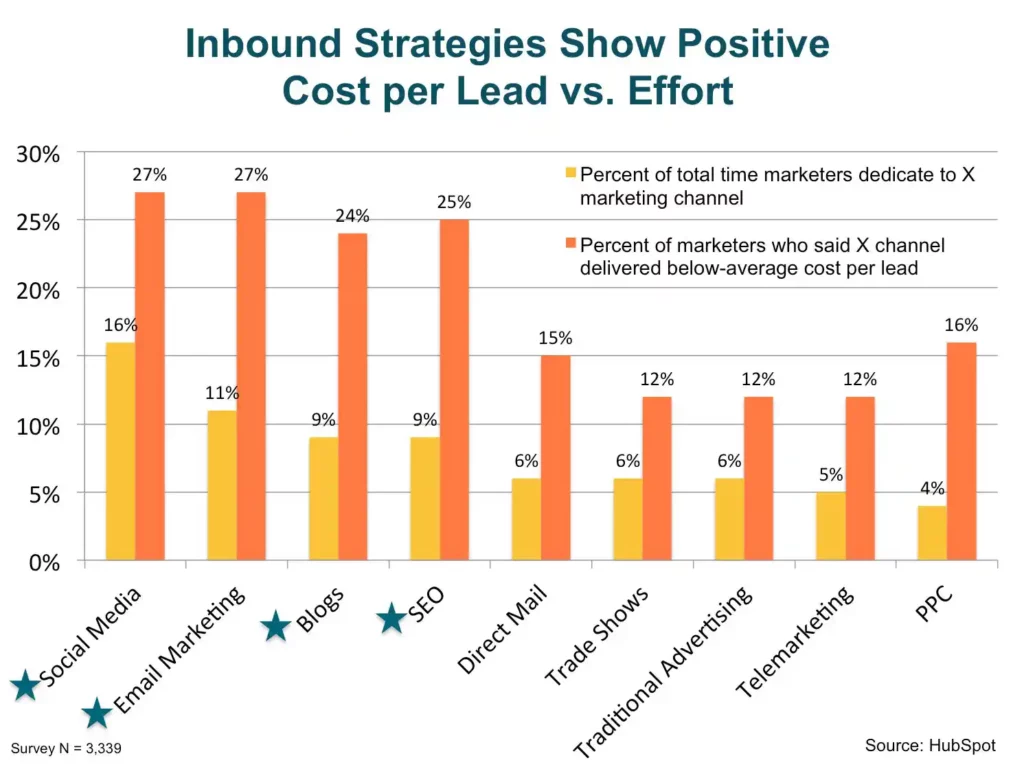

The marketing world has undergone a radical transformation in recent years, thanks to the rise of digital technology. Unlike traditional marketing tactics, which rely heavily on print and television advertising, today’s marketing strategies increasingly focus on leveraging the power of the internet and social media platforms.

Digital marketing offers many advantages over traditional marketing tactics, including reaching a wider audience, tracking and analyzing customer data, and delivering targeted campaigns more efficiently.

By utilizing various innovative tools and techniques, businesses can connect with consumers in new and effective ways, creating engaging content that resonates with audiences and drives conversions.

Whether you are a small business owner or a marketing professional, understanding the nuances of digital marketing is essential to staying ahead of the curve in today’s dynamic business landscape.

Why Financial Services Firms Should Look to Inbound Marketing for Generating More Business

Inbound marketing presents a powerful opportunity for financial services firms looking to generate more business.

Unlike traditional outbound marketing tactics that interrupt potential customers with unsolicited messages, inbound marketing focuses on creating valuable content and experiences that attract and engage potential clients.

Financial firms can cultivate relationships with prospects and position themselves as trusted experts by optimizing their websites, producing helpful blog posts and videos, and implementing effective social media strategies.

This approach not only results in more leads and conversions but also helps to build long-term loyalty, increasing the lifetime value of clients. In today’s digital landscape, embracing inbound marketing is essential for any financial services firm looking to succeed.

7 Proven Strategies for Generating More Traffic with Inbound Marketing

In today’s digital age, inbound marketing has emerged as a powerful tool for generating traffic to your website.

By providing valuable content your target audience is actively searching for, you can attract more visitors and convert them into customers. But how do you create an inbound marketing approach that truly works?

Here are 7 proven strategies that will help you boost your traffic and drive more leads through inbound marketing.

From optimizing your website for search engines to creating high-quality content, countless businesses have tested and proven these tactics. So, whether you’re just starting or looking to refine your existing strategy, these tips will help you achieve your inbound marketing goals.

- Optimize your website for search engines – By ensuring that your website is properly optimized for SEO, can help you increase the visibility of your content and attract more visitors to your site. This includes adding relevant keywords to your content and ensuring your titles and meta descriptions effectively summarize what a user will find on the page.

- Create content with a purpose – Writing blog posts and articles that are informative, interesting, and valuable to your target audience is essential for attracting more visitors. Make sure that you focus on creating optimized content for SEO, so it will have the greatest chance of being found in search engine results.

- Nurture leads with email marketing – Once you have attracted potential customers to your website, email marketing is a great way to nurture those leads and keep them engaged. Use automated emails to send personalized messages that provide helpful information, such as tips for selecting the right financial services provider or saving money on taxes.

- Leverage influencers – Connecting with relevant influencers can help you reach new audiences and get your content in front of potential customers. Look for influencers with highly engaged followers and create campaigns that resonate with their audience.

- Capitalize on social media – Social media provides an excellent platform for engaging with potential customers, sharing your content, and promoting your services. Choose a few major social media platforms your target audience frequents and create content tailored to each.

- Invest in pay-per-click advertising – Pay-per-click (PPC) ads are a great way to generate more traffic quickly. Utilize tools such as Google Ads, Microsoft Ads, and other platforms to reach your target audience with ads tailored to their interests.

- Track & analyze data – The key to improving your inbound marketing efforts is tracking the right metrics so you can make informed decisions about what works and what doesn’t. Analyzing website traffic, conversion rate, and search engine rankings will help refine your strategy and ensure you get the most out of your inbound marketing investments.

These strategies can effectively create an inbound marketing plan tailored to your financial services firm. By providing valuable content, optimizing for SEO, leveraging influencers, and tracking the right data, you’ll be able to attract more visitors, generate more leads, and convert them into customers.

How to Leverage Content for Quality Lead Generation

In today’s digital world, content is king. But more than simply creating content is required.

To truly leverage your content for quality lead generation, you need to have a strategic approach. It all starts with understanding your target audience and their pain points. From there, you can create content that addresses those pain points and provides value to your audience.

Consistency is also key; develop a content calendar and stick to it. Feel free to repurpose and share content across multiple channels, such as social media and email marketing.

By taking these strategic steps, you can turn your content into a powerful tool for generating high-quality leads for your business.

Best Practices for Integrating Social Media into Your Inbound Marketing Plan

In today’s digital age, social media has become a powerful tool for businesses to reach and engage with their target audience.

Integrating social media into your inbound marketing process can greatly enhance your brand’s online presence and potentially increase your customer base.

However, it’s important to understand the best practices for incorporating social media into your marketing mix. This means setting clear objectives, identifying your target audience, creating high-quality content, and being consistent in your approach.

By implementing these best practices, you can effectively leverage social media to attract, nurture, and convert leads into loyal customers.

Closing the Loop with Measurement and Analytics – Tracking Your Results from Inbound Marketing

In today’s digital age, measuring and analyzing the results of inbound marketing campaigns is crucial to the success of any business.

It allows for a deep understanding of what’s working and what’s not and enables data-driven decision-making to improve overall strategies.

Closing the loop with measurement and analytics means being able to track and evaluate the effectiveness of every aspect of your inbound marketing efforts. This includes analyzing website traffic and engagement, monitoring social media platforms, and measuring email marketing success.

Businesses can make informed marketing decisions by consistently tracking results and adjusting their approach to achieve the best possible outcomes. So pay attention to the importance of measurement and analytics in your inbound marketing strategy – it’s the key to unlocking growth and success.

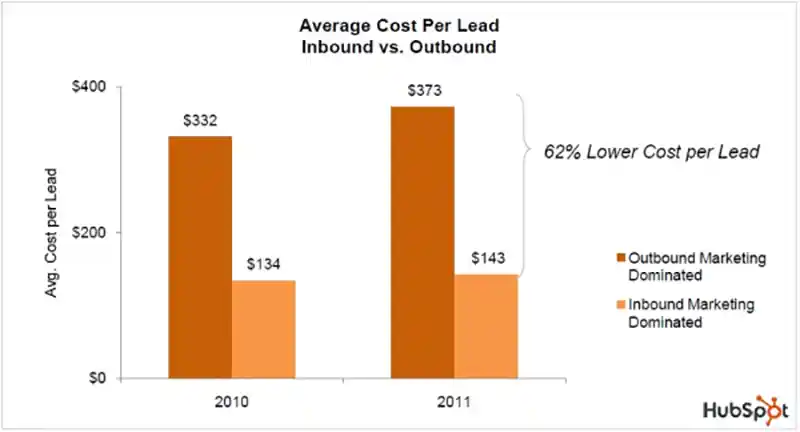

Why Marketing Automation is Vital to Marketing Cost Reduction

Marketing automation has become increasingly vital to marketing cost reduction in today’s business world. Companies can increase efficiency, improve productivity, and save money by automating certain marketing tasks.

From email campaigns to lead generation, marketing automation allows businesses to streamline their marketing efforts, freeing up time and resources for other important initiatives.

Moreover, it enables companies to create personalized customer experiences, build stronger relationships, and drive revenue growth.

With the rise of digital technologies and the plethora of data available to marketers, automation has become necessary for staying competitive in today’s fast-paced marketplace. By embracing marketing automation, businesses can reduce costs, increase their bottom line, and achieve sustainable success.

Inbound marketing examples of financial service firms using inbound marketing with results

- JPMorgan Chase & Co. is a global financial services firm that has used inbound marketing to drive growth and awareness of its brand. They have used content marketing to create helpful guides, whitepapers, and infographics on topics related to financial services. They have also created webinars and podcasts to share expertise and insights. JPMorgan Chase has built customer relationships and increased its marketplace visibility.

- Bank of America is another global financial services firm that has leveraged inbound marketing to reach and engage with its target audience. They have created industry-leading content such as articles, videos, and infographics to help customers understand the financial services they offer. Bank of America has also used social media channels like Twitter, Facebook, and LinkedIn to build customer relationships and increase brand awareness. By leveraging inbound marketing techniques, Bank of America has been able to drive customer engagement and convert leads into loyal customers.

- Wells Fargo is one of the largest banks in the United States and has used inbound marketing to gain market share. They have created useful content such as blog posts, research reports, infographics, and videos to help customers better understand their products and services. Wells Fargo has also used social media channels to engage with current and potential customers. Through its comprehensive inbound marketing efforts, Wells Fargo has been able to increase its brand awareness, drive customer engagement, and convert leads into loyal customers.

Inbound marketing is a powerful tool for financial service firms looking to reduce costs and increase revenue. By leveraging content creation and social media channels and measuring performance with analytics, businesses can create personalized experiences.

Conclusion

Financial services firms must recognize the importance of inbound marketing. Inbound marketing strategies can create more customers who produce more revenue than traditional tactics and gain you more respect as an industry leader.

Companies can increase their effectiveness while reducing costs by focusing on content, leveraging social media, and implementing efficient marketing automation.

It is essential to track your results with analytics to ensure that your inbound marketing techniques are working optimally and meeting your customers’ needs.

These strategies can help financial services firms attract high-quality, long-lasting customers and drive better ROI. Taking action now is key; start by creating an ideal customer profile to target the best quality leads.

Check out our blog for more information about how inbound marketing for financial firms works and what you need to start doing today!

General FAQs

What are the best practices for incorporating social media into my marketing mix?

When incorporating social media into your marketing mix, it’s important to set clear objectives, identify your target audience, create high-quality content, and be consistent. It’s beneficial to monitor and measure the success of each campaign so that you can adjust your strategy accordingly.

What is marketing automation, and how does it benefit my business?

Marketing automation uses software to automate tasks such as lead generation, email campaigns, and customer segmentation. It helps businesses maximize efficiency while reducing costs and allows them to create personalized customer experiences. By leveraging marketing automation, businesses can achieve better results and gain a competitive advantage in the marketplace.

How important is analytics when it comes to inbound marketing?

Analytics plays an essential role in inbound marketing. Measurement and analytics allow you to track and evaluate the success of each campaign. By consistently monitoring your results and adjusting your approach, you can ensure your inbound marketing plans are effective and achieve ROI. Analytics can provide valuable insights into customer behavior, enabling companies to create more targeted campaigns.

What is an ideal customer profile?

An ideal customer profile is a detailed description of the perfect customer for your business. It typically includes demographic information such as age, gender, location, and income level, and psychographic data like interests and lifestyle. Knowing your ideal customer profile enables businesses to create campaigns that attract the right customers and maximize ROI.