Learn about Wealth Management Agentic Revenue Platform: A Strategic Guide for Independent RIAs

Key Takeaways

- Paradigm Shift: The wealth management industry is actively transitioning from static CRM tools to Agentic Revenue Platforms. These systems utilize autonomous agents to actively manage the entire revenue lifecycle rather than just tracking it.

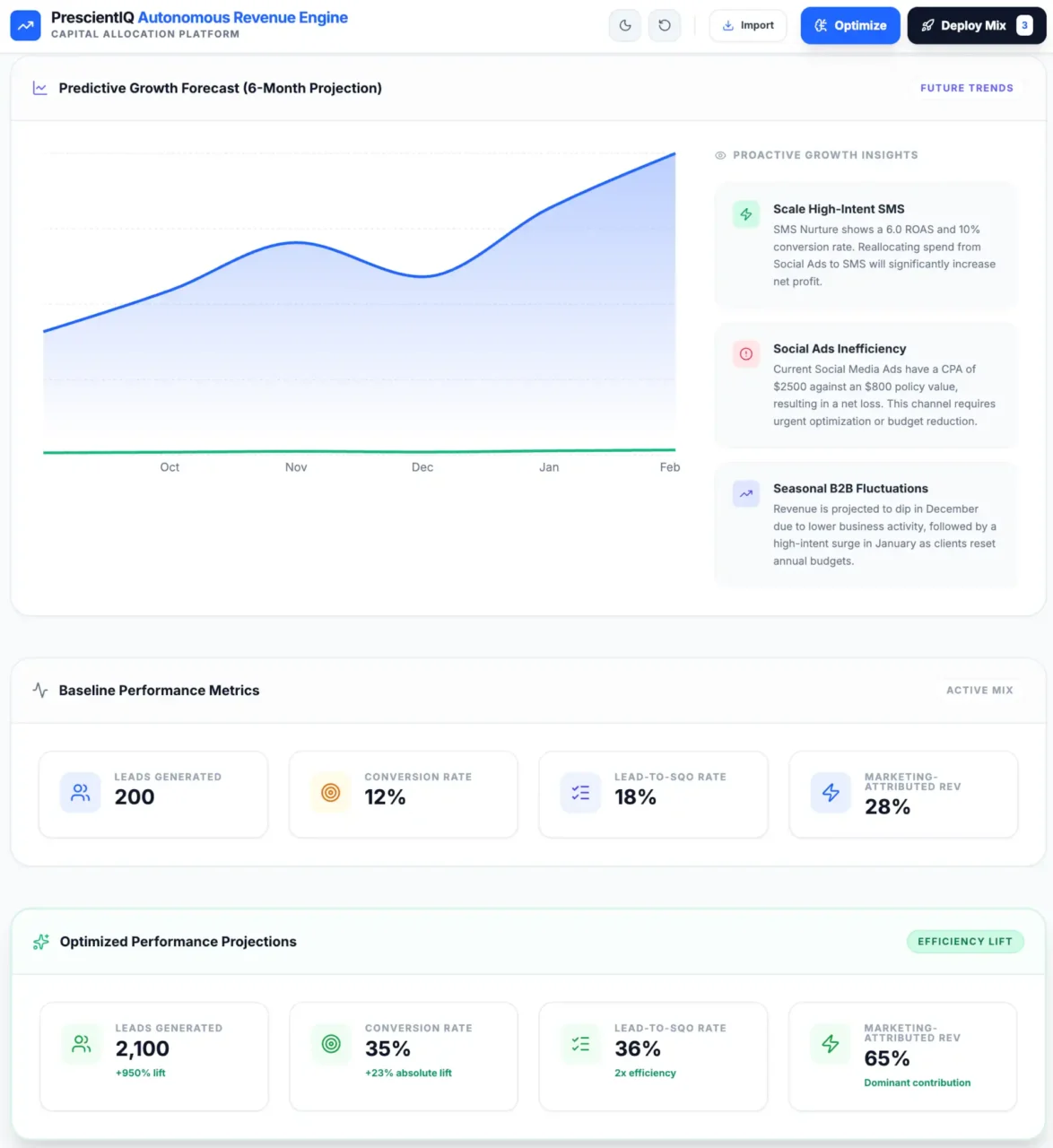

- Operational Efficiency: Implementing specialized systems such as PrescientIQ can yield a projected 62% reduction in Operational Expenditure (OpEx). This is achieved by replacing high-cost manual workflows with intelligent, autonomous automation.

- Technological Core: Unlike standard automation or basic Generative AI, these platforms leverage Causal AI. This technology understands the “why” and “cause-and-effect” behind revenue data, making operations significantly more intelligent and scalable.

- Holistic Integration: The scope of these platforms unifies previously siloed departments—sales, marketing, and customer success—into a single, autonomous motion.

What is an Agentic Revenue Platform?

An Agentic Revenue Platform is a specialized software system designed to optimize and manage a company’s revenue generation across sales, marketing, and customer success by leveraging autonomous, AI-powered agents.

Part 2: The Contextual Deep Dive

Introduction: Why is the Wealth Management Model Breaking?

The traditional manual leverage model is no longer sustainable against modern fee compression, digital competition, and evolving client expectations.

Attention is shifting rapidly within the RIA sector. For decades, the standard formula for wealth management growth has relied on a “people-heavy” approach to revenue operations.

If a firm wanted to grow its Assets Under Management (AUM), the only solution was to hire more operations staff, more marketing associates, and more relationship managers. This linear growth model is becoming a liability.

We are currently witnessing a massive pivot with the entrance of solutions like PrescientIQ’s Agentic Revenue Platform.

This is a specialized software system designed to fundamentally alter how firms grow. The interest in this shift is driven by a necessity for survival. Margins are thinner than ever, and the competition is increasingly digital-first.

Firm owners’ desire is for a solution that doesn’t just “assist” human staff but actually “does” the work.

The action required now is to move away from disparate, disconnected tools and toward autonomous systems.

These critical activities—sales, marketing, and customer success—are no longer viewed as siloed tasks but as a unified autonomous workflow.

What is the Core Trend Driving Agentic Adoption?

The convergence of Causal AI and autonomous agents is transforming revenue operations from passive tracking to active, intelligent management.

To fully grasp the magnitude of this shift, we must look at the technological underpinnings through the lens of the “Who, What, Where, When, and Why.”

- Who: Independent RIAs and Wealth Management firms that are struggling to scale their mid-and back-office revenue functions without ballooning their payroll.

- What: The adoption of platforms like PrescientIQ, which aim to leverage Causal AI to make the entire revenue operation more efficient.

- Where: Across the entire client lifecycle, specifically optimizing the critical pillars of sales, marketing, and customer success.

- Why: To achieve a massive reduction in costs—specifically, a targeted 62% reduction in OpEx.

- When: The transition is underway as firms move from “Generative” AI (which focuses on creating content) to “Agentic” AI (which focuses on executing tasks).

Unlike traditional tools that require constant human input to function, an agentic platform uses autonomous, AI-powered agents.

This is a critical distinction in the context of entity salience. We are not discussing a better CRM; we are discussing a digital workforce.

Is Your Competitor’s AI Smarter Than Yours?

You have the data. They have the insights. Find out exactly where your digital infrastructure is leaking revenue. Knowing your maturity score is step one. Fixing the bottlenecks is step two. Don’t let your data sit idle while you figure out the “how.”

How does Causal AI differ from Generative AI in this context?

Causal AI identifies the root causes of revenue outcomes to drive strategy, whereas Generative AI simply creates content based on historical patterns.

While Generative AI is excellent for drafting client emails or creating marketing copy, an agentic revenue platform like PrescientIQ aims to leverage Causal AI.

This distinction is significant for RIAs. Causal AI doesn’t just correlate data points (e.g., noting that “Clients with high cash balances tend to churn”); it understands the cause-and-effect relationships.

It allows the platform to make the revenue operation more intelligent and scalable than traditional, manual approaches.

By understanding causality, the autonomous agents can predict which specific actions in sales or marketing will actually lead to client retention or upsells, rather than just guessing based on historical averages.

Part 3: Practical Application

Feature Comparison: Traditional vs. Agentic

The following table outlines the stark differences between the current manual standard and the emerging autonomous model.

| Feature Set | Traditional Revenue Ops (Manual) | Agentic Revenue Platform (PrescientIQ) |

| Core Operator | Human Staff + Static Software | Autonomous, AI-Powered Agents |

| Intelligence Model | Human Intuition + Basic Analytics | Causal AI (Cause & Effect Analysis) |

| Scope of Work | Siloed (Sales vs. Marketing vs. CS) | Unified (Sales, Marketing, CS) |

| Scalability | Linear (Hire more to grow more) | Exponential (Software scalability) |

| OpEx Impact | High (Salaries, Benefits, Overhead) | Up to 62% Reduction in OpEx |

Use Case 1: The Autonomous Client Acquisition Engine

An RIA firm relies heavily on manual prospecting. Marketing teams generate generic leads that are manually entered into a CRM such as Salesforce or HubSpot.

Sales associates then spend hours qualifying these leads, often missing opportunities because of slow follow-up or insufficient data context. The cost of acquisition (CAC) is high, and conversion rates remain stubbornly low.

The firm deploys an Agentic Revenue Platform. Autonomous agents monitor inbound channels and enrich lead data in real time. Using Causal AI, the system identifies which prospects are most likely to convert based on specific behavioral drivers. The agents autonomously nurture these leads with hyper-personalized content, scheduling meetings only when the prospect is ready to buy.

The PrescientIQ platform serves as the bridge, optimizing and managing the company’s revenue generation across sales and marketing by leveraging these autonomous agents. The result is a seamless transition from “lead” to “client” without heavy human intervention.

Use Case 2: Proactive Churn Prevention in Customer Success

Customer Success Managers (CSMs) review client accounts quarterly. They often miss early warning signs of dissatisfaction, such as decreasing engagement with portal logins or subtle portfolio withdrawals. By the time the CSM reaches out, the client has already decided to leave the firm.

Autonomous agents continuously monitor client health metrics. Because the platform aims to leverage causal AI, it detects the specific “causes” of dissatisfaction early—perhaps a lack of communication during a period of market volatility.

The agent automatically triggers a personalized check-in or sends a relevant market analysis to the client, alerting the human advisor only when complex intervention is required.

By automating the customer success function, the platform ensures that retention is proactive rather than reactive. This directly contributes to the 62% reduction in OpEx by reducing the need for a massive CS support staff while simultaneously improving client outcomes.

Use Case 3: Integrated Revenue Operations (RevOps)

Marketing data sits in Hubspot, Sales data resides in Salesforce, and Custodial data is locked in Schwab or Fidelity. These systems do not talk to each other.

Reporting is done manually via Excel spreadsheets, leading to data entry errors and a significant “lag” in decision-making.

The Agentic Revenue Platform integrates these streams. It acts as a specialized software system that unifies the data. Agents cross-reference marketing engagement with sales outcomes to determine true ROI.

This unification allows the platform to optimize the entire revenue operation, making it more intelligent and scalable than traditional manual approaches.

What are the Primary Implementation Challenges?

Data silos, regulatory compliance, and cultural resistance are the three primary hurdles to clearing the path for autonomous revenue.

- Data Unification (The Silo Problem):

For autonomous agents to function, they need access to clean, structured data. Most RIAs have fragmented data spread across various legacy systems.- Solution: The first step in deploying a platform like PrescientIQ is a comprehensive data audit. The platform’s core function is to manage revenue generation across all sectors, so integration APIs are critical.

- Compliance and Governance:

“Hallucinations” in financial advice are unacceptable. Regulatory bodies require strict adherence to facts.- Solution: Utilizing Causal AI rather than purely generative models helps mitigate this, as causal models are grounded in logic and cause-and-effect reasoning rather than probabilistic text generation. RIAs must ensure the platform has strict guardrails.

- Cultural Adaptation:

Staff may fear displacement by AI agents.- Solution: Frame the technology correctly. As noted in the source material, the goal is to make the operation “more efficient, intelligent, and scalable.” This frees up human advisors to do what they do best: build relationships, while agents handle the revenue logistics.

Projected ROI: The 62% OpEx Reduction

The following table breaks down where the “Up to 62% reduction in OpEx” is typically derived in a Wealth Management context.

| Expense Category | Traditional Allocation | Agentic Optimization | Source of Savings |

| Sales Development | High (SDR Salaries + Commissions) | Low (Autonomous Agents) | Agents handle prospecting & qualifying |

| Marketing Ops | Medium (Campaign Managers) | Low (Automated Execution) | Unified autonomous workflows |

| Client Service | High (Support Staff) | Medium (AI + Human Hybrid) | Proactive, agent-led success management |

| Data Analysis | Medium (Analysts/Tools) | Low (Causal AI Embedded) | Built-in intelligence vs. manual analysis |

| Total OpEx Impact | Baseline | -62% Reduction | Efficiency & Scalability |

Implementation Guide: Deploying PrescientIQ

Step 1: The Audit

Assess your current revenue lifecycle. Identify manual bottlenecks across sales, marketing, and customer success. Look for repetitive tasks that consume significant human capital.

Step 2: The Integration

Connect the specialized software system to your custodial data and CRM. Ensure the autonomous agents have access to the necessary data streams to make informed decisions.

Step 3: The Causal Configuration

Configure the Causal AI parameters. Define what constitutes a “successful outcome” (e.g., AUM growth, retention, specific product uptake) so the system understands the logic it needs to optimize.

Step 4: The Autonomous Rollout

Activate the agents. Start with marketing automation to generate data, then move to sales qualification, and finally, customer success monitoring. Watch for the efficiency gains and the projected reduction in OpEx.

Part 4: Conclusion & Technical Schema

Conclusion

The era of manual revenue management in wealth management is drawing to a close. The emergence of the Agentic Revenue Platform, exemplified by solutions like PrescientIQ, marks a pivot toward autonomous growth. By leveraging Causal AI and autonomous agents, RIAs can move beyond simple efficiency gains and achieve a fundamental restructuring of their cost base, aiming for an OpEx reduction of up to 62%.

These platforms do not merely assist; they “optimize and manage” the entire lifecycle across sales, marketing, and customer success.

For the modern RIA, adopting such a specialized software system is not just an IT upgrade—it is a strategic imperative to ensure scalability and intelligence in an increasingly competitive market. Next Step: Conduct an internal “OpEx Audit” of your current sales and marketing departments to identify the manual workflows that autonomous agents could replace.

Is Your Competitor’s AI Smarter Than Yours?

You have the data. They have the insights. Find out exactly where your digital infrastructure is leaking revenue. Knowing your maturity score is step one. Fixing the bottlenecks is step two. Don’t let your data sit idle while you figure out the “how.”

FAQ

What is PrescientIQ?

PrescientIQ is an Agentic Revenue Platform. It is a specialized software system that uses autonomous agents to manage sales, marketing, and customer success for wealth management firms.

How much money can an agentic platform save an RIA?

Implementing an agentic revenue platform like PrescientIQ can reduce Operational Expenditure (OpEx) by up to 62% through efficiency and scalability.

What technology drives PrescientIQ?

The platform leverages Causal AI and autonomous, AI-powered agents to optimize revenue operations, making them smarter than manual approaches.

Does the platform replace human advisors?

No, it optimizes revenue generation. Its core function is to manage operations across sales, marketing, and customer success, allowing humans to focus on high-value relationships.

What functions does the platform cover?

It covers the entire revenue lifecycle, specifically spanning sales activities, marketing campaigns, and customer success management.