A CMO Dilemma: AI Promise vs. Business Reality

Learn About a CMO Dilemma: AI Promise vs. Business Reality.

AI has quickly become the centerpiece of modern marketing innovation. Every CMO is under pressure to “do something with AI”—automate campaigns, predict customer behavior, or scale personalization.

Yet most AI programs stall after the proof-of-concept phase.

When the excitement fades, a familiar question echoes in the boardroom:

“This AI thing sounds impressive… but where’s the return?”

It’s not that AI lacks value—it’s that most CMOs don’t translate technical performance into financial outcomes.

The result? Brilliant pilots that die before scaling, frustrated executives, and missed growth opportunities.

Why the Traditional ROI Model Is Killing Sales

Marketers have long relied on metrics like clicks, impressions, and engagement. But in the AI era, those numbers are meaningless to a CFO.

Traditional ROI models fail for three big reasons:

- They measure activity, not acceleration.

Reporting on performance metrics doesn’t show how AI actually moves the business forward. - They isolate marketing from enterprise economics.

Engagement means nothing if it doesn’t connect to profit, cost savings, or growth. - They don’t justify investment.

The board doesn’t care about a 15% increase in model accuracy—they want to see the impact on margins.

When marketers cling to outdated metrics, they undermine their ability to prove that AI is more than a shiny tool—it’s a strategic growth engine.

From Experimentation to Execution: The New AI Mandate

It’s time to shift from testing AI’s potential to proving its profitability.

The winning question is no longer “Can this work?” but “What is it worth?”

That’s the difference between a proof-of-concept and a profit center.

Proof-of-concept measures output.

Profit centers measure impact.

To get there, marketing leaders must build frameworks that tie AI performance directly to business outcomes—revenue growth, cost reduction, and competitive advantage.

The Three Pillars of AI ROI

A new ROI framework for AI marketing must go beyond clicks and conversions. It should reflect how AI creates enterprise-level value across three pillars:

1. Revenue Efficiency: Turning Intelligence into Income

AI enhances top-line growth by optimizing every stage of the marketing and sales funnel.

Key applications:

- Predictive analytics shortens sales cycles and improves lead-to-sale ratios.

- Personalization engines increase average order value and lifetime value.

- Automated campaign orchestration boosts output without expanding headcount.

Example:

“AI improved lead scoring accuracy by 30%” becomes “AI cut wasted sales time and added $3.8M in pipeline revenue.”

Revenue efficiency metrics speak the C-suite’s language—velocity, conversion, and profitability—not model precision.

2. Cost Efficiency: Doing More with Less (and Proving It)

AI-driven automation creates measurable cost savings across marketing operations.

Examples:

- Media optimization reduces customer acquisition costs.

- Natural language generation tools cut content production hours in half.

- Chatbots and self-service tools lower customer service costs.

Executives care about bottom-line savings. Frame your results accordingly:

“AI reduced content production time by 2,000 hours, saving $600,000 annually.”

When you quantify operational efficiency, AI becomes a profit enabler—not a budget line.

Stop getting your AI budget cut: Move beyond “efficiency” to provable P&L impact.

Core Concept: Visually contrast the failed “efficiency-only” pitch (which collapses into a Strategic Value Black Hole) with a 4D Value Framework that ties AI to revenue, pipeline, enterprise value, and risk reduction.

The Strategic Value Black Hole

Cost-only logic collapses your business case. Efficiency ≠ investment thesis.

A 5% boost in “Lead Scoring Accuracy” = $12M in Qualified Pipeline.

Tie model accuracy to increased Sales-Accepted Leads and win-rate lift.

A 10% lift in “Cross-Sell Conversion” from AI = $45M in New Revenue.

Translate conversion lift into additional orders, margins, and P&L impact.

A 20% increase in “Customer Lifetime Value (CLV)” from AI-personalization = $100M in Enterprise Value.

Convert CLV gains into discounted cash flows the CFO recognizes.

AI-driven compliance in ad-targeting = $8M in Fines Avoided.

Model compliance avoidance as preserved operating income.

3. Innovation Capital: Quantifying Agility and Advantage

AI’s speed of learning and adaptability create a third source of ROI—innovation capital.

It’s the ability to:

- Test campaigns in days, not weeks.

- Generate insights that inform strategy faster.

- Launch data-driven initiatives ahead of competitors.

This agility isn’t fluff—it’s measurable through reductions in time-to-market, increases in idea-to-execution velocity, or incremental share gains.

The companies that experiment fastest grow fastest.

Translating AI Value: From Data Points to Dollars

AI metrics often sound like a foreign language in the boardroom. The key is translation.

You must connect every technical achievement to a financial outcome.

| AI Output | Business KPI | Financial Impact |

| Model accuracy up 20% | Lead-to-sale ratio | More closed deals |

| Campaign automation | Labor efficiency | Reduced SG&A costs |

| Predictive targeting | Conversion lift | Incremental revenue |

| Chatbot deployment | Retention rate | Higher CLV |

When you can bridge that gap, AI stops being an experiment and starts being a profit strategy.

The Art of Financial Storytelling

CMOs are storytellers—but in the AI age, they must become financial storytellers.

Here’s how to tell a story that convinces the C-suite:

1. Use “Before and After” Framing

Compare baseline metrics to post-AI results.

“Before AI, it took six days to qualify a lead. After AI, it takes two. That’s 30% faster revenue realization.”

2. Quantify Compounding Value

Show how results grow over time.

“A 1% increase in retention through AI personalization adds $2M in lifetime value annually.”

3. Anchor to Enterprise Goals

Connect AI success directly to the company’s top objectives—margin growth, productivity, or market share.

When the financial story matches the board’s priorities, AI gets the green light.

Case Example: Turning Proof into Profit

A global B2B software firm launched an AI pilot to improve lead scoring.

At first, the marketing team presented metrics like “model accuracy” and “data cleanliness.”

The CFO wasn’t impressed.

So, the CMO reframed the narrative:

- The model improved lead-to-opportunity conversion by 17%.

- That reduced the sales cycle by two weeks.

- The result? $3.2 million in new revenue per quarter—with no extra headcount.

That’s when the CFO leaned in.

Lesson: Technical success doesn’t sell. Financial impact does.

Building a C-Suite-Ready AI ROI Framework

To win executive buy-in, you need a structure that turns marketing data into a business case.

Here’s the roadmap:

Step 1: Define Success Through Business Outcomes

Start with enterprise goals—profitability, growth, or efficiency—and map AI use cases directly to them.

If the corporate goal is “increase profit by 10%,” the AI goal becomes “reduce marketing CAC by 15% via predictive spend optimization.”

Every AI initiative should have a business-aligned success statement.

Step 2: Establish Benchmarks and Baselines

You can’t prove ROI without a “before” picture.

Document performance before AI implementation and measure changes after deployment.

This builds credibility and prevents the dreaded “black box” perception of AI.

Step 3: Measure Both Hard and Soft ROI

Hard ROI: direct financial gains—cost savings, revenue growth.

Soft ROI: strategic value—speed, innovation, data maturity.

For example:

- “AI cut ad waste by 22%, saving $400K quarterly.” (hard ROI)

- “AI reduced campaign iteration time by 50%, increasing market agility.” (soft ROI)

Together, they form a complete value story.

Step 4: Model the Multiplier Effect

AI returns compound over time.

Once trained, models and automations keep improving—amplifying ROI with every cycle.

“A 5% gain in predictive accuracy this quarter will yield $8M in additional revenue over two years.”

This future-facing view positions AI as a long-term asset rather than a short-term expense.

Step 5: Visualize ROI for the Boardroom

Executives don’t want dashboards—they want direction.

Use financial storytelling visuals:

- ROI bridges showing contribution to profit.

- Before-and-after charts quantifying efficiency gains.

- Forecast curves illustrating scaling impact.

Speak visually in a language the CFO already uses—ROI, payback period, margin improvement.

From Marketing Initiative to Enterprise Strategy

AI success isn’t just a marketing victory—it’s an organizational transformation.

When CMOs connect AI insights across departments, they elevate marketing from a cost center to a growth center.

Cross-functional integration examples:

- Sales: Prioritize high-likelihood leads using AI signals.

- Finance: Forecast revenue using AI-driven patterns.

- Operations: Streamline workflows with intelligent automation.

This alignment creates an enterprise AI ecosystem—where every function benefits from shared intelligence.

The most forward-thinking CMOs make AI everyone’s investment, not just marketing’s experiment.

The Future CMO: Data-Driven, Financially Fluent, AI-Literate

The next generation of CMOs will look less like traditional marketers and more like Chief Growth Architects—blending analytics, strategy, and financial acumen.

Three skills define the modern AI CMO:

- Analytical Fluency – Understand enough about data models to explain them simply and strategically.

- Financial Literacy – Connect every AI investment to financial metrics that matter.

- Change Leadership – Inspire teams to adopt AI while managing cultural and operational shifts.

These CMOs will be able to walk into a board meeting and say with confidence:

“AI didn’t just improve engagement—it increased EBITDA.”

That’s the new standard for marketing leadership.

The End of “Marketing as Usual”

Marketing has always been about influencing perception. AI adds the power to influence precision.

The most effective CMOs today are merging art and algorithm—intuition with intelligence.

But without the right ROI framework, even the best AI initiative risks being dismissed as “just another pilot.”

The organizations that win are the ones that measure differently, communicate strategically, and execute decisively.

AI doesn’t just prove what’s possible—it proves what’s profitable.

A Cautionary Truth for CMOs

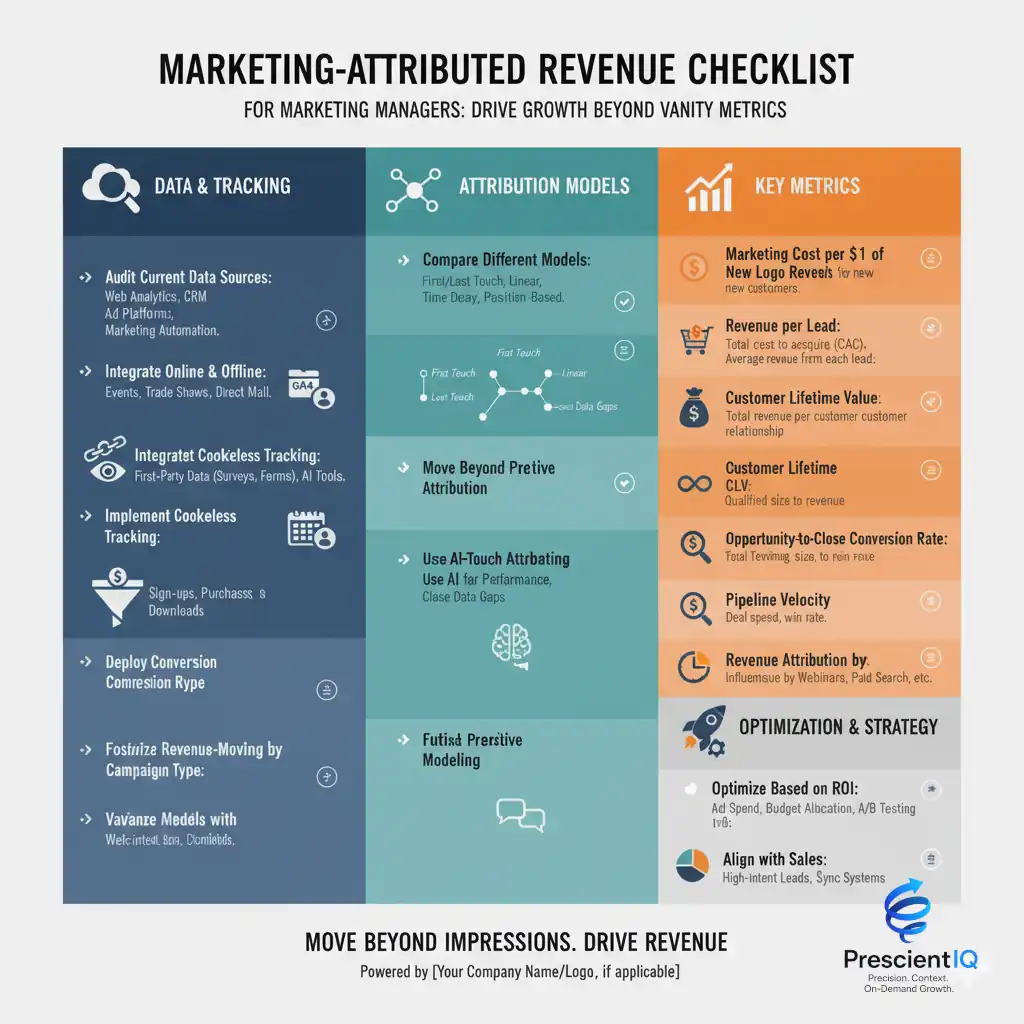

CMOs who continue to report vanity metrics—clicks, views, impressions—are writing their own obsolescence.

Your competitors aren’t bragging about engagement.

They’re quantifying how AI increased profit per customer, improved efficiency, and accelerated growth.

In this new era, the most powerful metric is trust—the board’s trust in your ability to connect innovation to impact.

Redefine Success Before It’s Too Late

AI is no longer optional. It’s foundational.

But only the CMOs who translate technology into financial performance will own the future of growth.

Here’s your playbook:

- Stop chasing activity metrics.

Focus on revenue, cost, and innovation ROI. - Speak in financial terms.

The CFO’s language is your new superpower. - Elevate AI from pilot to profit center.

Show impact, not just intelligence.

The CMOs who embrace this shift will lead the charge toward a more intelligent, measurable, and profitable era of marketing.

Everyone else will be left behind—stuck explaining accuracy scores while competitors explain margin growth.

Final Word

AI has redefined what marketing leadership means.

The modern CMO isn’t just responsible for brand storytelling—they’re responsible for enterprise value creation.

Those who can connect AI’s predictive power to financial performance won’t just survive the shift—they’ll define it.

Because in the age of intelligent business, the real question isn’t “Can AI prove it works?” It’s “Can you prove it pays?”

The AI ROI Confidence Gap

Enterprises invest billions in AI, yet only a fraction becomes measurable value. This snapshot shows where ROI vanishes—and how Simulation-as-a-Service converts uncertainty into boardroom-ready confidence.

The AI Investment Tsunami

Ambition is high—but deployment lags. Massive budgets enter fragmented pilots, straining accountability.

Only 1 in 3 projects reach deployment.The ROI Black Hole

Siloed pilots, fragmented metrics, and opaque vendor claims cause value to “leak” before it ever reaches the P&L.

Billions spent. Zero accountability.The Simulation Breakthrough

Aether converts uncertainty into evidence: secure sandbox → causal simulations → board-ready dashboards. Quantified, explainable outcomes—before you buy.

- 35%+ simulation → subscription conversion

- 9/10 executive NPS

- Standardized efficiency benchmarks